February 23, 2017

US Stock MACD Scan for Trading Close February 21, 2017

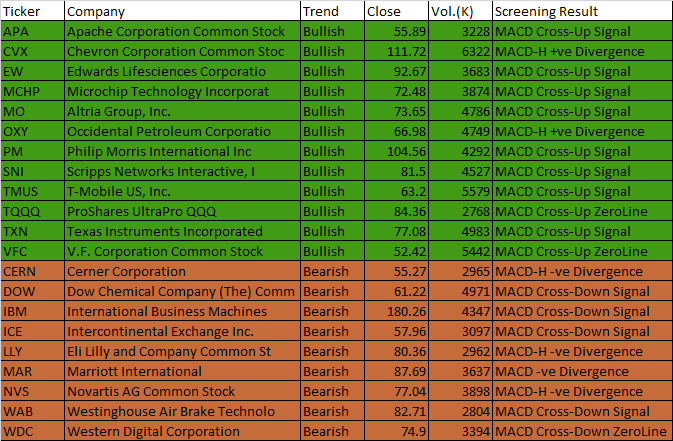

Welcome to top Moses blog site, Moses’s US Stock MACD Scan at AmiBrokerAcademy.com. February 21, 2017 one-day US stock MACD scan.

The following are one-day MACD scan on US Stocks with Amibroker using MACD Screening Script. This stock screening narrow it to stocks to value between 51 dollars to 250 dollars with at least 2,500,000 shares changed hands.

We reduce the selection criteria from 10,000,000 shares to 2,500,000 to increase the number of stocks been selected.

February 21, 2017 US Stock MACD Scan Results

| Ticker | Company | Date | Trend | Close | Vol.(K) | Screening Result |

| APA | Apache Corporation Common Stock | 21/2/2017 | Bullish | 55.89 | 3228 | MACD Cross-Up Signal |

| CVX | Chevron Corporation Common Stoc | 21/2/2017 | Bullish | 111.72 | 6322 | MACD-H +ve Divergence |

| EW | Edwards Lifesciences Corporatio | 21/2/2017 | Bullish | 92.67 | 3683 | MACD Cross-Up Signal |

| MCHP | Microchip Technology Incorporat | 21/2/2017 | Bullish | 72.48 | 3874 | MACD Cross-Up Signal |

| MO | Altria Group, Inc. | 21/2/2017 | Bullish | 73.65 | 4786 | MACD Cross-Up Signal |

| OXY | Occidental Petroleum Corporatio | 21/2/2017 | Bullish | 66.98 | 4749 | MACD-H +ve Divergence |

| PM | Philip Morris International Inc | 21/2/2017 | Bullish | 104.56 | 4292 | MACD Cross-Up Signal |

| SNI | Scripps Networks Interactive, I | 21/2/2017 | Bullish | 81.5 | 4527 | MACD Cross-Up Signal |

| TMUS | T-Mobile US, Inc. | 21/2/2017 | Bullish | 63.2 | 5579 | MACD Cross-Up Signal |

| TQQQ | ProShares UltraPro QQQ | 21/2/2017 | Bullish | 84.36 | 2768 | MACD Cross-Up ZeroLine |

| TXN | Texas Instruments Incorporated | 21/2/2017 | Bullish | 77.08 | 4983 | MACD Cross-Up Signal |

| VFC | V.F. Corporation Common Stock | 21/2/2017 | Bullish | 52.42 | 5442 | MACD Cross-Up ZeroLine |

| CERN | Cerner Corporation | 21/2/2017 | Bearish | 55.27 | 2965 | MACD-H -ve Divergence |

| DOW | Dow Chemical Company (The) Comm | 21/2/2017 | Bearish | 61.22 | 4971 | MACD Cross-Down Signal |

| IBM | International Business Machines | 21/2/2017 | Bearish | 180.26 | 4347 | MACD Cross-Down Signal |

| ICE | Intercontinental Exchange Inc. | 21/2/2017 | Bearish | 57.96 | 3097 | MACD Cross-Down Signal |

| LLY | Eli Lilly and Company Common St | 21/2/2017 | Bearish | 80.36 | 2962 | MACD-H -ve Divergence |

| MAR | Marriott International | 21/2/2017 | Bearish | 87.69 | 3637 | MACD -ve Divergence |

| NVS | Novartis AG Common Stock | 21/2/2017 | Bearish | 77.04 | 3898 | MACD-H -ve Divergence |

| WAB | Westinghouse Air Brake Technolo | 21/2/2017 | Bearish | 82.71 | 2804 | MACD Cross-Down Signal |

| WDC | Western Digital Corporation | 21/2/2017 | Bearish | 74.9 | 3394 | MACD Cross-Down ZeroLine |

These are script generated signals. They are not meant to be used for buy or sell decisions. We do not vouch for their accuracy. They are meant as demonstration of Amibroker’s functionality. Not all scan results are shown here. Readers must understand what MACD is all about before using them.

We have covered how you can use the scan in another post. If you are not sure, check it out.

Moses Stock Scan

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.