Moses’s Stock Conner, Straits Times Index Forming Double (Two) Double bottoms?

Straits Times Index, Singapore stock market benchmark, STI for market ended January 13, 2012

| Open | 2758.52 |

| Close | 2791.54 |

| High | 2791.54 |

| Low | 2755.86 |

| Up | 47.88 |

Singapore stock market benchmark, Straits Times Index, STI closed at 2791.54 points, one more step closer to 2800 level. STI closed 47.88 points higher than the last closed. The whole week Straits Times Index has moved 75.95 points higher.

Many would like to link this to the successful of recent bond issued in Europe. Well, who will know?

For technical analysis (TA), we look at chart and analyse past historical data on the price action or in this case index action and volume to understand the current trend and predict the next action.

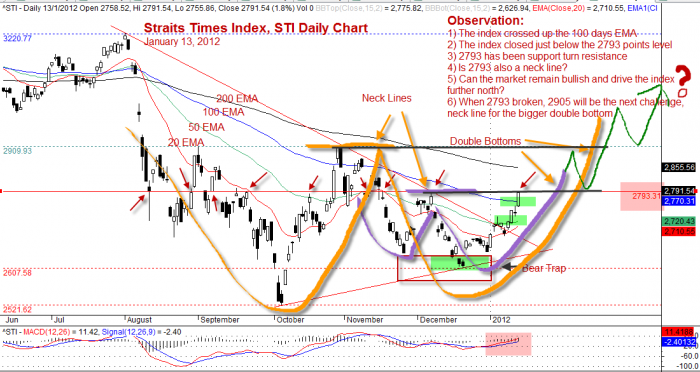

Double (Two) Double Bottoms?

We can see two double bottoms, one is near it completion and near or at the neckline. Till it really complete and break up the neckline otherwise it will still consider it fail the double bottom chart pattern.

Unless the market continue to remain bullish and strong after the completion of the first double bottom. The index will have to challenge to complete the second one which is much bigger double bottom.

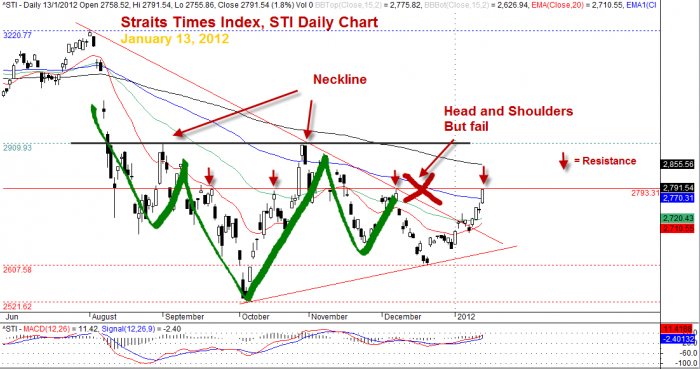

Fail Head and Shoulders

If you look back, you will see there were an inverted head and shoulders forming. The chart pattern fail due to right shoulder did not complete. In TA, the trend or pattern will remain true till it fail.

So all news aside, continue to monitor the chart to see the new development.Have fun! Happy trading.

By Moses, January 15, 2012

Notes: I will be posting a stock analysis for NOL, stock code N03.

Straits Times Index, STI Daily Chart – Double (Two) Double Bottoms?

Straits Times Index, STI Daily Chart – Fail Head and Shoulders

DSICLAIMER

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should not be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.