August 19, 2014

Pressure’s On But Keep Focus – MACD False Signals, Moses’ Stock Column

Welcome to Moses’ Stock Column at AmiBrokerAcademy.com. Thank you for visiting the site. One of the reasons you are here because you want to know who moves your stock.

Lesson

Pressure’s On But Keep Focus– MACD False Signals

Forecasting algorithm can fail, like weather forecast on typhoon or thunderstorm do not happen are common. Same goes to indicators, such as MACD can generate false signals too.

A false MACD positive signal, a bullish crossover followed by a sudden decline in a stock price. Or a false MACD negative signal can happen to fail during a bearish situation and resulting in bullish too, where there was no bullish crossover but the stock accelerated upwards.

To counter the problem, the strategy is to apply filter. Example on the MACD signal crossovers to ensure that price action continues to hold up. An example of a price action filter would be to buy if the MACD line breaks above the signal line and remains above. Just like any filtering strategy, this only reduces the probability of false signals but equally this resulting you will miss the profitable trade too.

So the pressure is on, but keeps focus. It is better to reduce risk, than expose to loses. It is wise to wait for confirmation before taking any trade. Technical analysis uses a variety of approaches to filter out as many false signals as possible and confirm the true ones.

In MACD, a MACD crossover signals indicate that the direction of the acceleration is changing. When MACD line crossing zero level suggests that the average velocity is changing direction.

Stay focus, trade reasonable and manage your risk.So don’t play play. Do your home work and trade responsibly.

Moses’ Free MACD Scan

This site provides you the free MACD scan for Singapore stocks.

This is August 11, 2014, Monday of the nine hundreds plus Singapore stocks that have the following MACD signals, which have trading volume greater than 500,000 shares.

Total 59 stocks have MACD bullish and bearish signals, 40 stocks have bullish MACD signals, and 19 stocks have bearish MACD signals.

Only 30 stocks are traded more than 500,000 shares. 20 stocks have bullish MACD signals, and 10 stocks have bearish MACD signals. Wow! The bulls have left the town.

- MACD line crosses above MACD signal – Bullish trend

- MACD line crosses above zero line – Bullish trend

- MACD Histogram +ve Divergence – Bullish trend

- MACD line crosses below MACD signal – Bearish trend

- MACD line crosses below zero line – Bearish trend

- MACD Histogram -ve Divergence – Bearish trend

- Volume traded greater 500,000 shares

| Ticker | Company | Signals | Close | Vol.(K) | Screening Result |

| C68 | MIRACH ENERGY LIMITED | Bullish | 0.195 | 98840 | MACD Cross-Up Signal |

| 5UN | SINCAP GROUP LIMITED | Bullish | 0.125 | 29834 | MACD Cross-Up Signal |

| N4E | NAM CHEONG LIMITED | Bullish | 0.495 | 23945 | MACD Cross-Up Signal |

| EG0 | JES INTERNATIONAL HOLDINGS LTD | Bullish | 0.063 | 13952 | MACD-H +ve Divergence |

| 542 | GIKEN SAKATA (S) LIMITED | Bullish | 0.35 | 8453 | MACD Cross-Up Signal |

| J16 | GSH CORPORATION LIMITED | Bullish | 0.077 | 8247 | MACD Cross-Up Signal |

| RE4 | GEO ENERGY RESOURCES LIMITED | Bullish | 0.27 | 3975 | MACD-H +ve Divergence |

| 5CQ | TECHNICS OIL & GAS LIMITED | Bullish | 0.835 | 2526 | MACD Cross-Up Signal |

| Z59 | YOMA STRATEGIC HOLDINGS LTD | Bullish | 0.67 | 2127 | MACD +ve Divergence |

| 5UO | SYSMA HOLDINGS LIMITED | Bullish | 0.255 | 1990 | MACD Cross-Up ZeroLine |

| MS7 | VARD HOLDINGS LIMITED | Bullish | 1.005 | 1720 | MACD-H +ve Divergence |

| 526 | HG METAL MANUFACTURING LTD | Bullish | 0.076 | 1415 | MACD +ve Divergence |

| H78 | HONGKONG LAND HOLDINGS LIMITED | Bullish | 6.89 | 1085 | MACD Cross-Up Signal |

| C14 | CWT LIMITED | Bullish | 1.71 | 1011 | MACD Cross-Up Signal |

| AK3 | SWIBER HOLDINGS LIMITED | Bullish | 0.49 | 889 | MACD-H +ve Divergence |

| S63 | SINGAPORE TECH ENGINEERING LTD | Bullish | 3.8 | 866 | MACD Cross-Up Signal |

| A7RU | CITYSPRING INFRASTRUCT TRUST | Bullish | 0.51 | 747 | MACD Cross-Up Signal |

| J7X | TIGER AIRWAYS HOLDINGS LIMITED | Bullish | 0.41 | 712 | MACD-H +ve Divergence |

| MF6 | MUN SIONG ENGINEERING LIMITED | Bullish | 0.122 | 680 | MACD Cross-Up ZeroLine |

| KI3 | HU AN CABLE HOLDINGS LTD. | Bullish | 0.068 | 528 | MACD-H +ve Divergence |

| Y92 | THAI BEVERAGE PUBLIC CO LTD | Bearish | 0.63 | 17578 | MACD -ve Divergence |

| S10 | SUPER GROUP LTD.. | Bearish | 1.445 | 3982 | MACD Cross-Down ZeroLine |

| CH8 | CHINA SUNSINE CHEM HLDGS LTD. | Bearish | 0.32 | 3130 | MACD Cross-Down Signal |

| F34 | WILMAR INTERNATIONAL LIMITED | Bearish | 3.22 | 2097 | MACD Cross-Down ZeroLine |

| E3B | WEE HUR HOLDINGS LTD. | Bearish | 0.39 | 1706 | MACD Cross-Down ZeroLine |

| SK7 | OUE HOSPITALITY TRUST | Bearish | 0.895 | 1404 | MACD Cross-Down ZeroLine |

| T39 | SINGAPORE PRESS HLDGS LTD | Bearish | 4.13 | 1398 | MACD Cross-Down Signal |

| N03 | NEPTUNE ORIENT LINES LIMITED | Bearish | 0.94 | 1135 | MACD Cross-Down Signal |

| B1ZU | RICKMERS MARITIME | Bearish | 0.295 | 1011 | MACD Cross-Down Signal |

| KJ5 | BBR HOLDINGS (S) LTD | Bearish | 0.29 | 803 | MACD -ve Divergence |

Straits Times Index

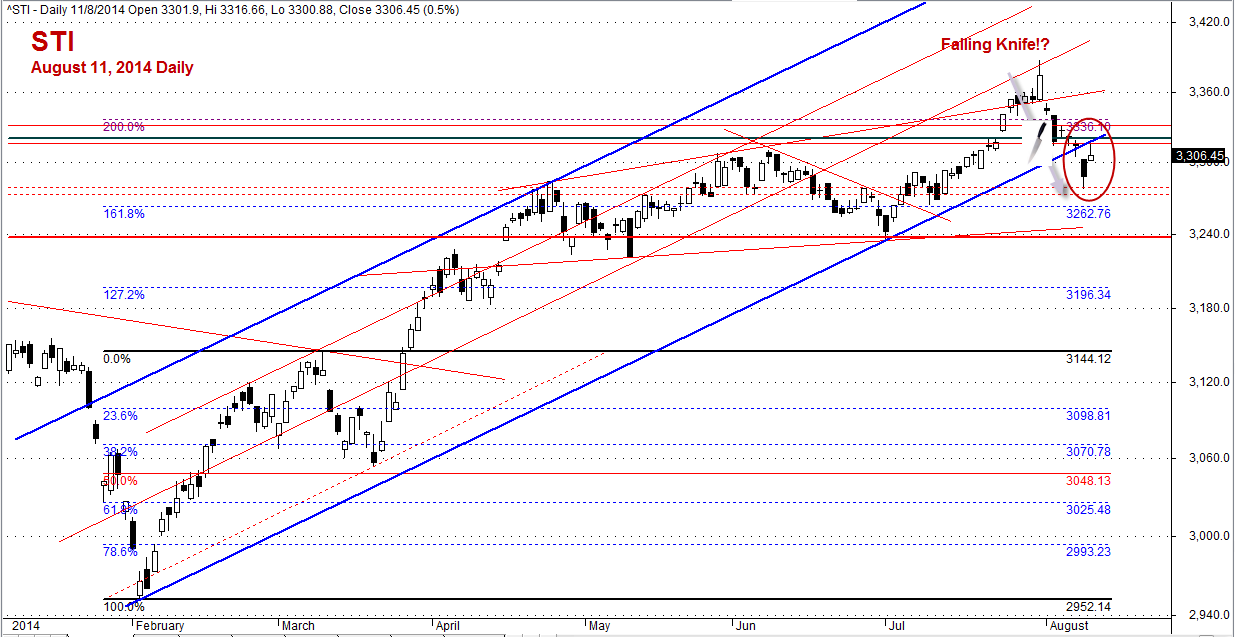

August 11, 2014, Monday Straits Times Index, STI gaps up and closes at 3306.45 points. STI is up 17.56 points from the last Friday closed at 3288.89 points.

Can the 3280 level a strong level to hold the falling knife? Will this the pivot in changing the direction? Will see.

Catching a falling knife is an act of trying to predict where a price action or index will stop decline and start reversal.

Thanks for visiting the site, AmiBrokerAcademy.com.

Moses

DISCLAIMER

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should NOT be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids.

Trading is personal. You are responsible for your own trading decision.