3 November, 2018

Thanks for visiting the site.

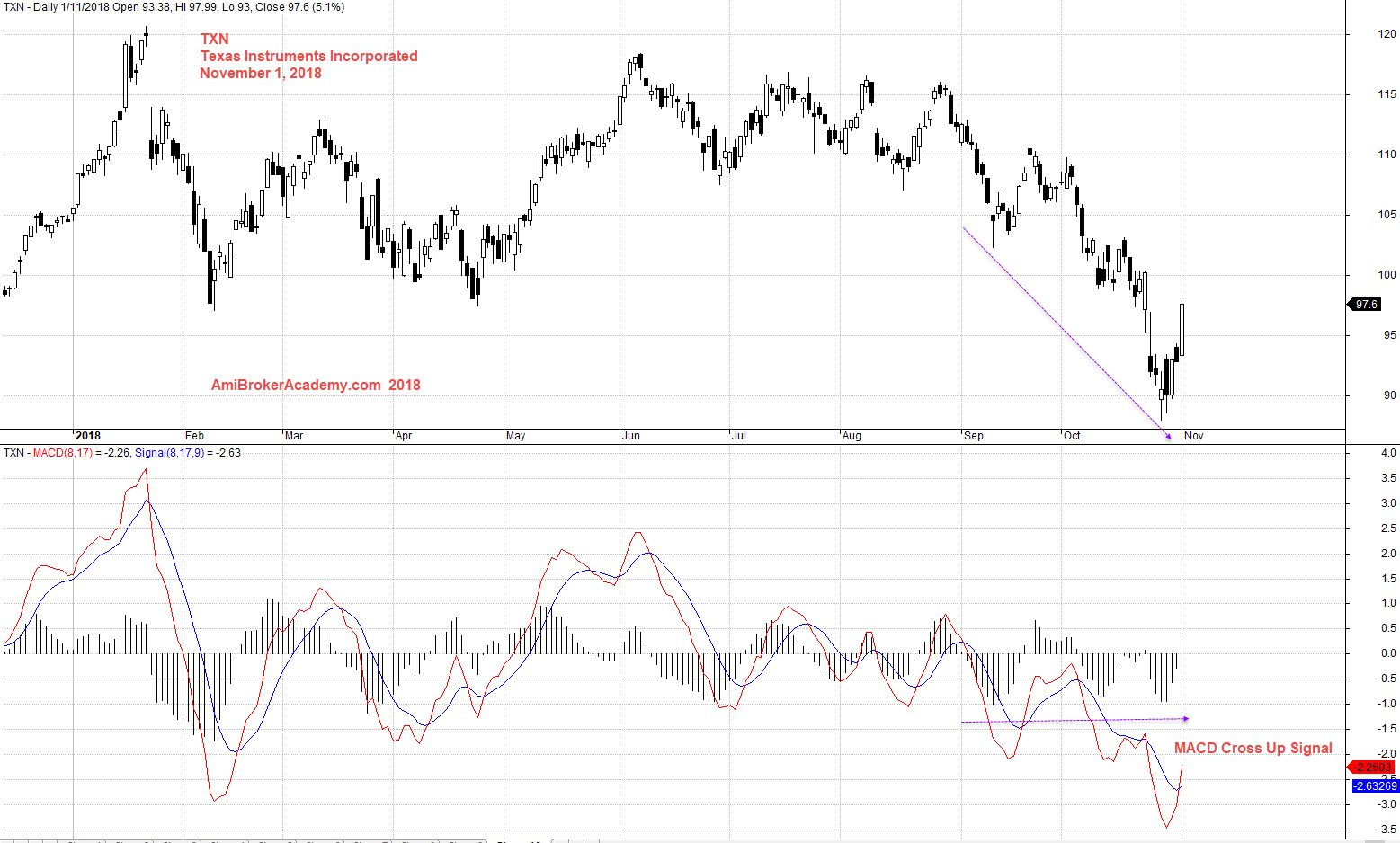

TXN Texas Instruments Incorporated Daily Charting

Buy Support Sell Resistance

Buy Low Sell High

Study chart of Texas Instruments Incorporated Daily stock chart. Study the chart from 2010. When apply buy hold strategy.

See chart, the price action from low to high. The price action from below 30 dollars to high at 120 dollars. If you apply BHS, buy hold strategy, you will be very happy.

If you are observing enough, you will find this chart have more resistance then support. So, if you trade this stock be more aware of the resistance. But, remember all setup can fail.

Remember trade with eyes open.

There are H M Gartley 222 pattern. See chart.

Think think got more things.

Manage your risk.

November 1, 2018 Texas Instruments Incorporated Buy Hold Strategy

if you can see the full chart, “press Ctrl and -” to zoom out and see the entire chart.

Zoom in, add MACD. See chart.

November 1, 2018 Texas Instruments Incorporated and MACD

Moses US Stock Chart Analysis

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.