Moses’s MACD Singapore Stock Scan – January 3, 2017

Welcome to Moses’s Stock Scan at AmiBrokerAcademy.com. This is January 3, 2017 the first Singapore stock MACD scan for the new year, 2017. 38 stocks that have MACD bullish signal or bearish signal. The stock market benchmark, Straits Times Index closed at 2898.97 points, another 18.21 points higher than the last closed. Can the momentum remain strong? Will see!

Technical Analysis

In total, the index is 1.03 points lower than 2900. If we take 2900 as a key level.

Check the posting on Straits Times Index daily.

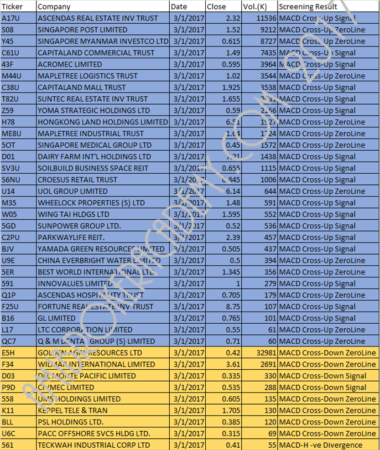

January 3, 2017 Singapore Stock One-day MACD Scan Results

Eliminated stocks below $0.3, out of 38 stocks, 29 stocks have bullish MACD signal and 9 stocks have bearish MACD signal. These are script generated results.

| Ticker | Company | Date | Close | Vol.(K) | Screening Result |

| A17U | ASCENDAS REAL ESTATE INV TRUST | 3/1/2017 | 2.32 | 11536 | MACD Cross-Up Signal |

| S08 | SINGAPORE POST LIMITED | 3/1/2017 | 1.52 | 9212 | MACD Cross-Up ZeroLine |

| Y45 | SINGAPORE MYANMAR INVESTCO LTD | 3/1/2017 | 0.615 | 8727 | MACD Cross-Up ZeroLine |

| C61U | CAPITALAND COMMERCIAL TRUST | 3/1/2017 | 1.49 | 7435 | MACD Cross-Up Signal |

| 43F | ACROMEC LIMITED | 3/1/2017 | 0.595 | 3964 | MACD Cross-Up Signal |

| M44U | MAPLETREE LOGISTICS TRUST | 3/1/2017 | 1.02 | 3544 | MACD Cross-Up ZeroLine |

| C38U | CAPITALAND MALL TRUST | 3/1/2017 | 1.925 | 3538 | MACD Cross-Up Signal |

| T82U | SUNTEC REAL ESTATE INV TRUST | 3/1/2017 | 1.655 | 2631 | MACD Cross-Up Signal |

| Z59 | YOMA STRATEGIC HOLDINGS LTD | 3/1/2017 | 0.59 | 2156 | MACD Cross-Up Signal |

| H78 | HONGKONG LAND HOLDINGS LIMITED | 3/1/2017 | 6.51 | 1927 | MACD Cross-Up ZeroLine |

| ME8U | MAPLETREE INDUSTRIAL TRUST | 3/1/2017 | 1.64 | 1724 | MACD Cross-Up ZeroLine |

| 5OT | SINGAPORE MEDICAL GROUP LTD | 3/1/2017 | 0.45 | 1572 | MACD Cross-Up ZeroLine |

| D01 | DAIRY FARM INT’L HOLDINGS LTD | 3/1/2017 | 7.21 | 1438 | MACD Cross-Up Signal |

| SV3U | SOILBUILD BUSINESS SPACE REIT | 3/1/2017 | 0.655 | 1115 | MACD Cross-Up Signal |

| S6NU | CROESUS RETAIL TRUST | 3/1/2017 | 0.845 | 1006 | MACD Cross-Up Signal |

| U14 | UOL GROUP LIMITED | 3/1/2017 | 6.14 | 644 | MACD Cross-Up ZeroLine |

| M35 | WHEELOCK PROPERTIES (S) LTD | 3/1/2017 | 1.48 | 591 | MACD Cross-Up Signal |

| W05 | WING TAI HLDGS LTD | 3/1/2017 | 1.595 | 552 | MACD Cross-Up Signal |

| 5GD | SUNPOWER GROUP LTD. | 3/1/2017 | 0.52 | 536 | MACD Cross-Up Signal |

| C2PU | PARKWAYLIFE REIT. | 3/1/2017 | 2.39 | 457 | MACD Cross-Up Signal |

| BJV | YAMADA GREEN RESOURCES LIMITED | 3/1/2017 | 0.505 | 437 | MACD Cross-Up Signal |

| U9E | CHINA EVERBRIGHT WATER LIMITED | 3/1/2017 | 0.5 | 394 | MACD Cross-Up ZeroLine |

| 5ER | BEST WORLD INTERNATIONAL LTD | 3/1/2017 | 1.345 | 356 | MACD Cross-Up ZeroLine |

| 591 | INNOVALUES LIMITED | 3/1/2017 | 1 | 279 | MACD Cross-Up Signal |

| Q1P | ASCENDAS HOSPITALITY TRUST | 3/1/2017 | 0.705 | 179 | MACD Cross-Up ZeroLine |

| F25U | FORTUNE REAL ESTATE INV TRUST | 3/1/2017 | 8.75 | 107 | MACD Cross-Up Signal |

| B16 | GL LIMITED | 3/1/2017 | 0.765 | 101 | MACD Cross-Up Signal |

| L17 | LTC CORPORATION LIMITED | 3/1/2017 | 0.55 | 61 | MACD Cross-Up ZeroLine |

| QC7 | Q & M DENTAL GROUP (S) LIMITED | 3/1/2017 | 0.71 | 60 | MACD Cross-Up ZeroLine |

| E5H | GOLDEN AGRI-RESOURCES LTD | 3/1/2017 | 0.42 | 32981 | MACD Cross-Down ZeroLine |

| F34 | WILMAR INTERNATIONAL LIMITED | 3/1/2017 | 3.61 | 2691 | MACD Cross-Down ZeroLine |

| D03 | DEL MONTE PACIFIC LIMITED | 3/1/2017 | 0.335 | 330 | MACD Cross-Down Signal |

| P9D | CIVMEC LIMITED | 3/1/2017 | 0.535 | 288 | MACD Cross-Down Signal |

| 558 | UMS HOLDINGS LIMITED | 3/1/2017 | 0.605 | 135 | MACD Cross-Down ZeroLine |

| K11 | KEPPEL TELE & TRAN | 3/1/2017 | 1.705 | 130 | MACD Cross-Down ZeroLine |

| BLL | PSL HOLDINGS LTD. | 3/1/2017 | 0.385 | 120 | MACD Cross-Down ZeroLine |

| U6C | PACC OFFSHORE SVCS HLDG LTD. | 3/1/2017 | 0.315 | 69 | MACD Cross-Down ZeroLine |

| 561 | TECKWAH INDUSTRIAL CORP LTD | 3/1/2017 | 0.41 | 55 | MACD-H -ve Divergence |

Table of January 3, 2017 One-day Singapore Stock MACD Scan Results

By Moses January 13, 2017

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.