12 October, 2018

Thanks for visiting the site.

Free U.S. Stock MACD Scan

What is MACD?

MACD stands for Moving Average Convergence Divergence, common setting is (12,26,9)

MACD indicator is a trend trading system that makes up of 2 lines. The MACD Line (fast line) and MACD Signal Line (slow line).

1) When the MACD Line crosses over the MACD Signal Line the trend is bullish. When the MACD Line crosses below the MACD Signal the trend is bearish.

2) When the MACD Line crosses above zero line the trend is bullish. When the MACD line crosses below zero line the trend is bearish.

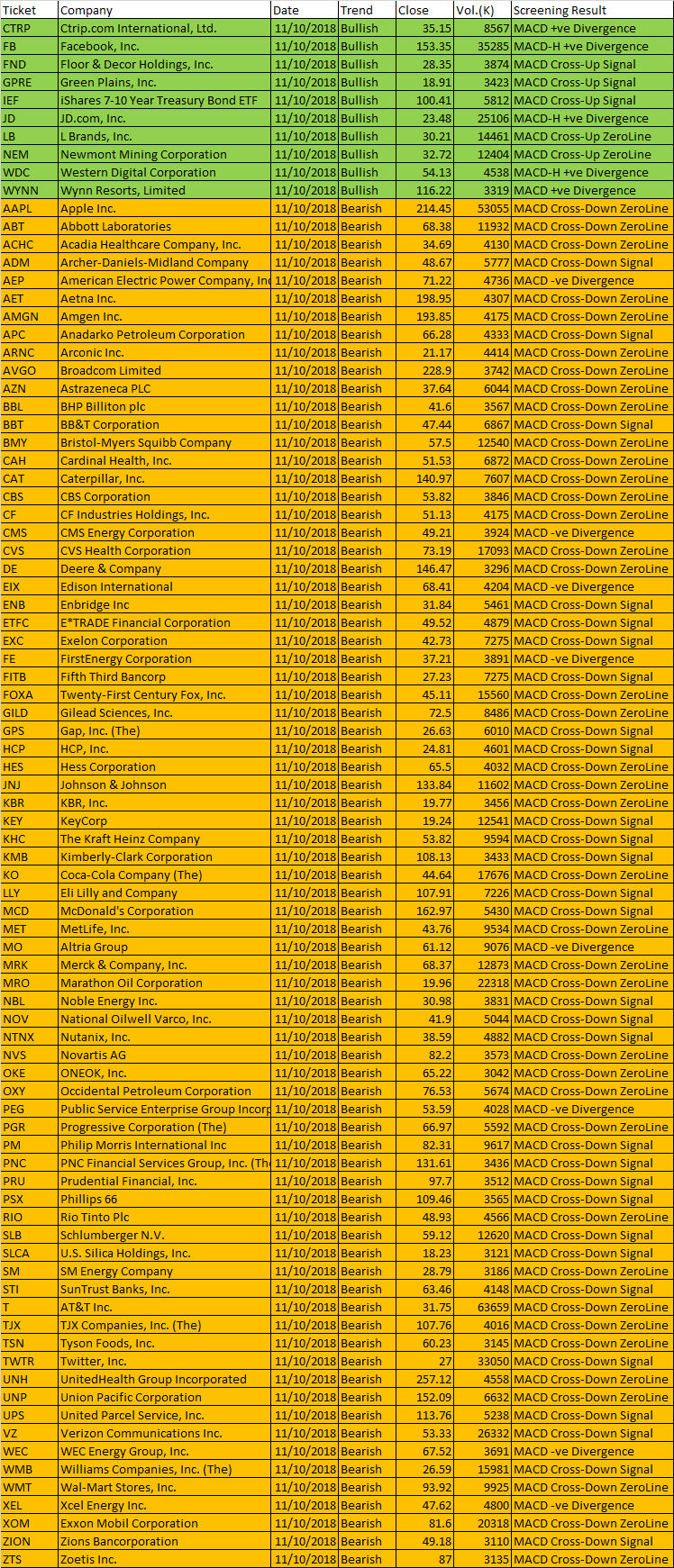

October 11 2018 – Script Generated One-day U.S. Stock MACD Signals

The following are script generated One-day U.S. Stock Market MACD signals using the Powerful AmiBroker’s AFL.

The MACD Setting used is (8,17,9)

| Ticket | Company | Date | Trend | Close | Vol.(K) | Screening Result |

| CTRP | Ctrip.com International, Ltd. | 11/10/2018 | Bullish | 35.15 | 8567 | MACD +ve Divergence |

| FB | Facebook, Inc. | 11/10/2018 | Bullish | 153.35 | 35285 | MACD-H +ve Divergence |

| FND | Floor & Decor Holdings, Inc. | 11/10/2018 | Bullish | 28.35 | 3874 | MACD Cross-Up Signal |

| GPRE | Green Plains, Inc. | 11/10/2018 | Bullish | 18.91 | 3423 | MACD Cross-Up Signal |

| IEF | iShares 7-10 Year Treasury Bond ETF | 11/10/2018 | Bullish | 100.41 | 5812 | MACD Cross-Up Signal |

| JD | JD.com, Inc. | 11/10/2018 | Bullish | 23.48 | 25106 | MACD-H +ve Divergence |

| LB | L Brands, Inc. | 11/10/2018 | Bullish | 30.21 | 14461 | MACD Cross-Up ZeroLine |

| NEM | Newmont Mining Corporation | 11/10/2018 | Bullish | 32.72 | 12404 | MACD Cross-Up ZeroLine |

| WDC | Western Digital Corporation | 11/10/2018 | Bullish | 54.13 | 4538 | MACD-H +ve Divergence |

| WYNN | Wynn Resorts, Limited | 11/10/2018 | Bullish | 116.22 | 3319 | MACD +ve Divergence |

| AAPL | Apple Inc. | 11/10/2018 | Bearish | 214.45 | 53055 | MACD Cross-Down ZeroLine |

| ABT | Abbott Laboratories | 11/10/2018 | Bearish | 68.38 | 11932 | MACD Cross-Down ZeroLine |

| ACHC | Acadia Healthcare Company, Inc. | 11/10/2018 | Bearish | 34.69 | 4130 | MACD Cross-Down ZeroLine |

| ADM | Archer-Daniels-Midland Company | 11/10/2018 | Bearish | 48.67 | 5777 | MACD Cross-Down Signal |

| AEP | American Electric Power Company, Inc. | 11/10/2018 | Bearish | 71.22 | 4736 | MACD -ve Divergence |

| AET | Aetna Inc. | 11/10/2018 | Bearish | 198.95 | 4307 | MACD Cross-Down ZeroLine |

| AMGN | Amgen Inc. | 11/10/2018 | Bearish | 193.85 | 4175 | MACD Cross-Down ZeroLine |

| APC | Anadarko Petroleum Corporation | 11/10/2018 | Bearish | 66.28 | 4333 | MACD Cross-Down Signal |

| ARNC | Arconic Inc. | 11/10/2018 | Bearish | 21.17 | 4414 | MACD Cross-Down ZeroLine |

| AVGO | Broadcom Limited | 11/10/2018 | Bearish | 228.9 | 3742 | MACD Cross-Down ZeroLine |

| AZN | Astrazeneca PLC | 11/10/2018 | Bearish | 37.64 | 6044 | MACD Cross-Down ZeroLine |

| BBL | BHP Billiton plc | 11/10/2018 | Bearish | 41.6 | 3567 | MACD Cross-Down ZeroLine |

| BBT | BB&T Corporation | 11/10/2018 | Bearish | 47.44 | 6867 | MACD Cross-Down Signal |

| BMY | Bristol-Myers Squibb Company | 11/10/2018 | Bearish | 57.5 | 12540 | MACD Cross-Down ZeroLine |

| CAH | Cardinal Health, Inc. | 11/10/2018 | Bearish | 51.53 | 6872 | MACD Cross-Down ZeroLine |

| CAT | Caterpillar, Inc. | 11/10/2018 | Bearish | 140.97 | 7607 | MACD Cross-Down ZeroLine |

| CBS | CBS Corporation | 11/10/2018 | Bearish | 53.82 | 3846 | MACD Cross-Down ZeroLine |

| CF | CF Industries Holdings, Inc. | 11/10/2018 | Bearish | 51.13 | 4175 | MACD Cross-Down ZeroLine |

| CMS | CMS Energy Corporation | 11/10/2018 | Bearish | 49.21 | 3924 | MACD -ve Divergence |

| CVS | CVS Health Corporation | 11/10/2018 | Bearish | 73.19 | 17093 | MACD Cross-Down ZeroLine |

| DE | Deere & Company | 11/10/2018 | Bearish | 146.47 | 3296 | MACD Cross-Down ZeroLine |

| EIX | Edison International | 11/10/2018 | Bearish | 68.41 | 4204 | MACD -ve Divergence |

| ENB | Enbridge Inc | 11/10/2018 | Bearish | 31.84 | 5461 | MACD Cross-Down Signal |

| ETFC | E*TRADE Financial Corporation | 11/10/2018 | Bearish | 49.52 | 4879 | MACD Cross-Down Signal |

| EXC | Exelon Corporation | 11/10/2018 | Bearish | 42.73 | 7275 | MACD Cross-Down Signal |

| FE | FirstEnergy Corporation | 11/10/2018 | Bearish | 37.21 | 3891 | MACD -ve Divergence |

| FITB | Fifth Third Bancorp | 11/10/2018 | Bearish | 27.23 | 7275 | MACD Cross-Down Signal |

| FOXA | Twenty-First Century Fox, Inc. | 11/10/2018 | Bearish | 45.11 | 15560 | MACD Cross-Down ZeroLine |

| GILD | Gilead Sciences, Inc. | 11/10/2018 | Bearish | 72.5 | 8486 | MACD Cross-Down ZeroLine |

| GPS | Gap, Inc. (The) | 11/10/2018 | Bearish | 26.63 | 6010 | MACD Cross-Down Signal |

| HCP | HCP, Inc. | 11/10/2018 | Bearish | 24.81 | 4601 | MACD Cross-Down Signal |

| HES | Hess Corporation | 11/10/2018 | Bearish | 65.5 | 4032 | MACD Cross-Down ZeroLine |

| JNJ | Johnson & Johnson | 11/10/2018 | Bearish | 133.84 | 11602 | MACD Cross-Down ZeroLine |

| KBR | KBR, Inc. | 11/10/2018 | Bearish | 19.77 | 3456 | MACD Cross-Down ZeroLine |

| KEY | KeyCorp | 11/10/2018 | Bearish | 19.24 | 12541 | MACD Cross-Down Signal |

| KHC | The Kraft Heinz Company | 11/10/2018 | Bearish | 53.82 | 9594 | MACD Cross-Down Signal |

| KMB | Kimberly-Clark Corporation | 11/10/2018 | Bearish | 108.13 | 3433 | MACD Cross-Down Signal |

| KO | Coca-Cola Company (The) | 11/10/2018 | Bearish | 44.64 | 17676 | MACD Cross-Down ZeroLine |

| LLY | Eli Lilly and Company | 11/10/2018 | Bearish | 107.91 | 7226 | MACD Cross-Down Signal |

| MCD | McDonald’s Corporation | 11/10/2018 | Bearish | 162.97 | 5430 | MACD Cross-Down Signal |

| MET | MetLife, Inc. | 11/10/2018 | Bearish | 43.76 | 9534 | MACD Cross-Down ZeroLine |

| MO | Altria Group | 11/10/2018 | Bearish | 61.12 | 9076 | MACD -ve Divergence |

| MRK | Merck & Company, Inc. | 11/10/2018 | Bearish | 68.37 | 12873 | MACD Cross-Down ZeroLine |

| MRO | Marathon Oil Corporation | 11/10/2018 | Bearish | 19.96 | 22318 | MACD Cross-Down ZeroLine |

| NBL | Noble Energy Inc. | 11/10/2018 | Bearish | 30.98 | 3831 | MACD Cross-Down Signal |

| NOV | National Oilwell Varco, Inc. | 11/10/2018 | Bearish | 41.9 | 5044 | MACD Cross-Down Signal |

| NTNX | Nutanix, Inc. | 11/10/2018 | Bearish | 38.59 | 4882 | MACD Cross-Down Signal |

| NVS | Novartis AG | 11/10/2018 | Bearish | 82.2 | 3573 | MACD Cross-Down ZeroLine |

| OKE | ONEOK, Inc. | 11/10/2018 | Bearish | 65.22 | 3042 | MACD Cross-Down ZeroLine |

| OXY | Occidental Petroleum Corporation | 11/10/2018 | Bearish | 76.53 | 5674 | MACD Cross-Down ZeroLine |

| PEG | Public Service Enterprise Group Incorporated | 11/10/2018 | Bearish | 53.59 | 4028 | MACD -ve Divergence |

| PGR | Progressive Corporation (The) | 11/10/2018 | Bearish | 66.97 | 5592 | MACD Cross-Down ZeroLine |

| PM | Philip Morris International Inc | 11/10/2018 | Bearish | 82.31 | 9617 | MACD Cross-Down Signal |

| PNC | PNC Financial Services Group, Inc. (The) | 11/10/2018 | Bearish | 131.61 | 3436 | MACD Cross-Down Signal |

| PRU | Prudential Financial, Inc. | 11/10/2018 | Bearish | 97.7 | 3512 | MACD Cross-Down Signal |

| PSX | Phillips 66 | 11/10/2018 | Bearish | 109.46 | 3565 | MACD Cross-Down Signal |

| RIO | Rio Tinto Plc | 11/10/2018 | Bearish | 48.93 | 4566 | MACD Cross-Down ZeroLine |

| SLB | Schlumberger N.V. | 11/10/2018 | Bearish | 59.12 | 12620 | MACD Cross-Down Signal |

| SLCA | U.S. Silica Holdings, Inc. | 11/10/2018 | Bearish | 18.23 | 3121 | MACD Cross-Down Signal |

| SM | SM Energy Company | 11/10/2018 | Bearish | 28.79 | 3186 | MACD Cross-Down ZeroLine |

| STI | SunTrust Banks, Inc. | 11/10/2018 | Bearish | 63.46 | 4148 | MACD Cross-Down Signal |

| T | AT&T Inc. | 11/10/2018 | Bearish | 31.75 | 63659 | MACD Cross-Down ZeroLine |

| TJX | TJX Companies, Inc. (The) | 11/10/2018 | Bearish | 107.76 | 4016 | MACD Cross-Down ZeroLine |

| TSN | Tyson Foods, Inc. | 11/10/2018 | Bearish | 60.23 | 3145 | MACD Cross-Down ZeroLine |

| TWTR | Twitter, Inc. | 11/10/2018 | Bearish | 27 | 33050 | MACD Cross-Down Signal |

| UNH | UnitedHealth Group Incorporated | 11/10/2018 | Bearish | 257.12 | 4558 | MACD Cross-Down ZeroLine |

| UNP | Union Pacific Corporation | 11/10/2018 | Bearish | 152.09 | 6632 | MACD Cross-Down ZeroLine |

| UPS | United Parcel Service, Inc. | 11/10/2018 | Bearish | 113.76 | 5238 | MACD Cross-Down Signal |

| VZ | Verizon Communications Inc. | 11/10/2018 | Bearish | 53.33 | 26332 | MACD Cross-Down Signal |

| WEC | WEC Energy Group, Inc. | 11/10/2018 | Bearish | 67.52 | 3691 | MACD -ve Divergence |

| WMB | Williams Companies, Inc. (The) | 11/10/2018 | Bearish | 26.59 | 15981 | MACD Cross-Down Signal |

| WMT | Wal-Mart Stores, Inc. | 11/10/2018 | Bearish | 93.92 | 9925 | MACD Cross-Down ZeroLine |

| XEL | Xcel Energy Inc. | 11/10/2018 | Bearish | 47.62 | 4800 | MACD -ve Divergence |

| XOM | Exxon Mobil Corporation | 11/10/2018 | Bearish | 81.6 | 20318 | MACD Cross-Down ZeroLine |

| ZION | Zions Bancorporation | 11/10/2018 | Bearish | 49.18 | 3110 | MACD Cross-Down Signal |

| ZTS | Zoetis Inc. | 11/10/2018 | Bearish | 87 | 3135 | MACD Cross-Down ZeroLine |

October 11, 2018 US Stock One-day MACD Scan Results

MACD Example – NASDAQ Bank Index

October 11 2018 NASDAQ Bank Index and MACD

If you can see the whole chart, “press Ctrl and -” to zoom out.

Moses U.S. Stock MACD Scan

AmiBroker Academy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.