13 August, 2018

Thanks for visiting the site.

Free U.S. Stock MACD Scan

What is MACD?

MACD stands for Moving Average Convergence Divergence, common setting is (12,26,9)

MACD indicator is a trend trading system that makes up of 2 lines. The MACD Line (fast line) and MACD Signal Line (slow line).

1) When the MACD Line crosses over the MACD Signal Line the trend is bullish. When the MACD Line crosses below the MACD Signal the trend is bearish.

2) When the MACD Line crosses above zero line the trend is bullish. When the MACD line crosses below zero line the trend is bearish.

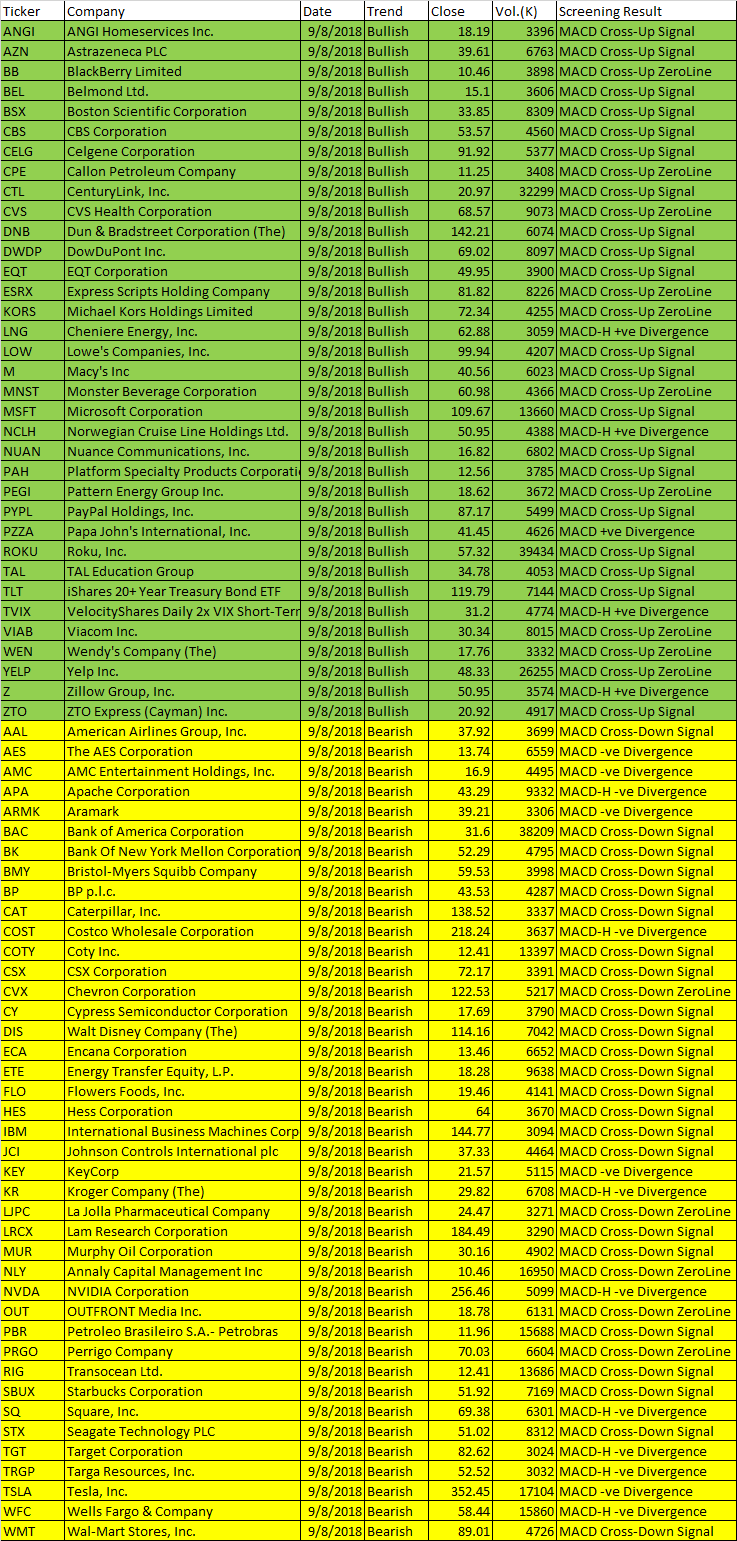

9 August, 2018 – Script Generated One-day U.S. Stock MACD Signals

The following are script generated One-day U.S. Stock Market MACD signals using the Powerful AmiBroker’s AFL.

Results of 9 August 2018 One-day U.S. Stocks MACD Scan

For stocks closed greater than 18 dollars and at least 300,000 changed hands.

The MACD Setting used is (8,17,9)

| Ticker | Company | Date | Trend | Close | Vol.(K) | Screening Result |

| ANGI | ANGI Homeservices Inc. | 9/8/2018 | Bullish | 18.19 | 3396 | MACD Cross-Up Signal |

| AZN | Astrazeneca PLC | 9/8/2018 | Bullish | 39.61 | 6763 | MACD Cross-Up Signal |

| BB | BlackBerry Limited | 9/8/2018 | Bullish | 10.46 | 3898 | MACD Cross-Up ZeroLine |

| BEL | Belmond Ltd. | 9/8/2018 | Bullish | 15.1 | 3606 | MACD Cross-Up Signal |

| BSX | Boston Scientific Corporation | 9/8/2018 | Bullish | 33.85 | 8309 | MACD Cross-Up Signal |

| CBS | CBS Corporation | 9/8/2018 | Bullish | 53.57 | 4560 | MACD Cross-Up Signal |

| CELG | Celgene Corporation | 9/8/2018 | Bullish | 91.92 | 5377 | MACD Cross-Up Signal |

| CPE | Callon Petroleum Company | 9/8/2018 | Bullish | 11.25 | 3408 | MACD Cross-Up ZeroLine |

| CTL | CenturyLink, Inc. | 9/8/2018 | Bullish | 20.97 | 32299 | MACD Cross-Up Signal |

| CVS | CVS Health Corporation | 9/8/2018 | Bullish | 68.57 | 9073 | MACD Cross-Up ZeroLine |

| DNB | Dun & Bradstreet Corporation (The) | 9/8/2018 | Bullish | 142.21 | 6074 | MACD Cross-Up Signal |

| DWDP | DowDuPont Inc. | 9/8/2018 | Bullish | 69.02 | 8097 | MACD Cross-Up Signal |

| EQT | EQT Corporation | 9/8/2018 | Bullish | 49.95 | 3900 | MACD Cross-Up Signal |

| ESRX | Express Scripts Holding Company | 9/8/2018 | Bullish | 81.82 | 8226 | MACD Cross-Up ZeroLine |

| KORS | Michael Kors Holdings Limited | 9/8/2018 | Bullish | 72.34 | 4255 | MACD Cross-Up ZeroLine |

| LNG | Cheniere Energy, Inc. | 9/8/2018 | Bullish | 62.88 | 3059 | MACD-H +ve Divergence |

| LOW | Lowe’s Companies, Inc. | 9/8/2018 | Bullish | 99.94 | 4207 | MACD Cross-Up Signal |

| M | Macy’s Inc | 9/8/2018 | Bullish | 40.56 | 6023 | MACD Cross-Up Signal |

| MNST | Monster Beverage Corporation | 9/8/2018 | Bullish | 60.98 | 4366 | MACD Cross-Up ZeroLine |

| MSFT | Microsoft Corporation | 9/8/2018 | Bullish | 109.67 | 13660 | MACD Cross-Up Signal |

| NCLH | Norwegian Cruise Line Holdings Ltd. | 9/8/2018 | Bullish | 50.95 | 4388 | MACD-H +ve Divergence |

| NUAN | Nuance Communications, Inc. | 9/8/2018 | Bullish | 16.82 | 6802 | MACD Cross-Up Signal |

| PAH | Platform Specialty Products Corporation | 9/8/2018 | Bullish | 12.56 | 3785 | MACD Cross-Up Signal |

| PEGI | Pattern Energy Group Inc. | 9/8/2018 | Bullish | 18.62 | 3672 | MACD Cross-Up ZeroLine |

| PYPL | PayPal Holdings, Inc. | 9/8/2018 | Bullish | 87.17 | 5499 | MACD Cross-Up Signal |

| PZZA | Papa John’s International, Inc. | 9/8/2018 | Bullish | 41.45 | 4626 | MACD +ve Divergence |

| ROKU | Roku, Inc. | 9/8/2018 | Bullish | 57.32 | 39434 | MACD Cross-Up Signal |

| TAL | TAL Education Group | 9/8/2018 | Bullish | 34.78 | 4053 | MACD Cross-Up Signal |

| TLT | iShares 20+ Year Treasury Bond ETF | 9/8/2018 | Bullish | 119.79 | 7144 | MACD Cross-Up Signal |

| TVIX | VelocityShares Daily 2x VIX Short-Term ETN | 9/8/2018 | Bullish | 31.2 | 4774 | MACD-H +ve Divergence |

| VIAB | Viacom Inc. | 9/8/2018 | Bullish | 30.34 | 8015 | MACD Cross-Up ZeroLine |

| WEN | Wendy’s Company (The) | 9/8/2018 | Bullish | 17.76 | 3332 | MACD Cross-Up ZeroLine |

| YELP | Yelp Inc. | 9/8/2018 | Bullish | 48.33 | 26255 | MACD Cross-Up ZeroLine |

| Z | Zillow Group, Inc. | 9/8/2018 | Bullish | 50.95 | 3574 | MACD-H +ve Divergence |

| ZTO | ZTO Express (Cayman) Inc. | 9/8/2018 | Bullish | 20.92 | 4917 | MACD Cross-Up Signal |

| AAL | American Airlines Group, Inc. | 9/8/2018 | Bearish | 37.92 | 3699 | MACD Cross-Down Signal |

| AES | The AES Corporation | 9/8/2018 | Bearish | 13.74 | 6559 | MACD -ve Divergence |

| AMC | AMC Entertainment Holdings, Inc. | 9/8/2018 | Bearish | 16.9 | 4495 | MACD -ve Divergence |

| APA | Apache Corporation | 9/8/2018 | Bearish | 43.29 | 9332 | MACD-H -ve Divergence |

| ARMK | Aramark | 9/8/2018 | Bearish | 39.21 | 3306 | MACD -ve Divergence |

| BAC | Bank of America Corporation | 9/8/2018 | Bearish | 31.6 | 38209 | MACD Cross-Down Signal |

| BK | Bank Of New York Mellon Corporation (The) | 9/8/2018 | Bearish | 52.29 | 4795 | MACD Cross-Down Signal |

| BMY | Bristol-Myers Squibb Company | 9/8/2018 | Bearish | 59.53 | 3998 | MACD Cross-Down Signal |

| BP | BP p.l.c. | 9/8/2018 | Bearish | 43.53 | 4287 | MACD Cross-Down Signal |

| CAT | Caterpillar, Inc. | 9/8/2018 | Bearish | 138.52 | 3337 | MACD Cross-Down Signal |

| COST | Costco Wholesale Corporation | 9/8/2018 | Bearish | 218.24 | 3637 | MACD-H -ve Divergence |

| COTY | Coty Inc. | 9/8/2018 | Bearish | 12.41 | 13397 | MACD Cross-Down Signal |

| CSX | CSX Corporation | 9/8/2018 | Bearish | 72.17 | 3391 | MACD Cross-Down Signal |

| CVX | Chevron Corporation | 9/8/2018 | Bearish | 122.53 | 5217 | MACD Cross-Down ZeroLine |

| CY | Cypress Semiconductor Corporation | 9/8/2018 | Bearish | 17.69 | 3790 | MACD Cross-Down Signal |

| DIS | Walt Disney Company (The) | 9/8/2018 | Bearish | 114.16 | 7042 | MACD Cross-Down Signal |

| ECA | Encana Corporation | 9/8/2018 | Bearish | 13.46 | 6652 | MACD Cross-Down Signal |

| ETE | Energy Transfer Equity, L.P. | 9/8/2018 | Bearish | 18.28 | 9638 | MACD Cross-Down Signal |

| FLO | Flowers Foods, Inc. | 9/8/2018 | Bearish | 19.46 | 4141 | MACD Cross-Down Signal |

| HES | Hess Corporation | 9/8/2018 | Bearish | 64 | 3670 | MACD Cross-Down Signal |

| IBM | International Business Machines Corporation | 9/8/2018 | Bearish | 144.77 | 3094 | MACD Cross-Down Signal |

| JCI | Johnson Controls International plc | 9/8/2018 | Bearish | 37.33 | 4464 | MACD Cross-Down Signal |

| KEY | KeyCorp | 9/8/2018 | Bearish | 21.57 | 5115 | MACD -ve Divergence |

| KR | Kroger Company (The) | 9/8/2018 | Bearish | 29.82 | 6708 | MACD-H -ve Divergence |

| LJPC | La Jolla Pharmaceutical Company | 9/8/2018 | Bearish | 24.47 | 3271 | MACD Cross-Down ZeroLine |

| LRCX | Lam Research Corporation | 9/8/2018 | Bearish | 184.49 | 3290 | MACD Cross-Down Signal |

| MUR | Murphy Oil Corporation | 9/8/2018 | Bearish | 30.16 | 4902 | MACD Cross-Down Signal |

| NLY | Annaly Capital Management Inc | 9/8/2018 | Bearish | 10.46 | 16950 | MACD Cross-Down ZeroLine |

| NVDA | NVIDIA Corporation | 9/8/2018 | Bearish | 256.46 | 5099 | MACD-H -ve Divergence |

| OUT | OUTFRONT Media Inc. | 9/8/2018 | Bearish | 18.78 | 6131 | MACD Cross-Down ZeroLine |

| PBR | Petroleo Brasileiro S.A.- Petrobras | 9/8/2018 | Bearish | 11.96 | 15688 | MACD Cross-Down Signal |

| PRGO | Perrigo Company | 9/8/2018 | Bearish | 70.03 | 6604 | MACD Cross-Down ZeroLine |

| RIG | Transocean Ltd. | 9/8/2018 | Bearish | 12.41 | 13686 | MACD Cross-Down Signal |

| SBUX | Starbucks Corporation | 9/8/2018 | Bearish | 51.92 | 7169 | MACD Cross-Down Signal |

| SQ | Square, Inc. | 9/8/2018 | Bearish | 69.38 | 6301 | MACD-H -ve Divergence |

| STX | Seagate Technology PLC | 9/8/2018 | Bearish | 51.02 | 8312 | MACD Cross-Down Signal |

| TGT | Target Corporation | 9/8/2018 | Bearish | 82.62 | 3024 | MACD-H -ve Divergence |

| TRGP | Targa Resources, Inc. | 9/8/2018 | Bearish | 52.52 | 3032 | MACD-H -ve Divergence |

| TSLA | Tesla, Inc. | 9/8/2018 | Bearish | 352.45 | 17104 | MACD -ve Divergence |

| WFC | Wells Fargo & Company | 9/8/2018 | Bearish | 58.44 | 15860 | MACD-H -ve Divergence |

| WMT | Wal-Mart Stores, Inc. | 9/8/2018 | Bearish | 89.01 | 4726 | MACD Cross-Down Signal |

Example of MACD Signal

Wal-Mart Store Inc Charting and MACD Signals

August 10, 2018 Wal-Mart Store Inc and MACD Signals

August 9, 2018 US Stock One-day MACD Screener Results

Example of MACD Signal

Tesla Inc Charting and MACD Signals

August 10, 2018 Tesla Inc and MACD Signal

Moses U.S. Stock MACD Scan

AmiBroker Academy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.