4 December, 2018

Thanks for visiting the site.

Free U.S. Stock Five-day MACD Scan

Wht is AmiBroker AFL?

See the following link https://www.amibroker.com/guide/AFL.html on AmiBroker AFL.

What is MACD?

MACD stands for Moving Average Convergence Divergence, common setting is (12,26,9)

MACD indicator is a trend trading system that makes up of 2 lines. The MACD Line (fast line) and MACD Signal Line (slow line).

1) When the MACD Line crosses over the MACD Signal Line the trend is bullish. When the MACD Line crosses below the MACD Signal the trend is bearish.

2) When the MACD Line crosses above zero line the trend is bullish. When the MACD line crosses below zero line the trend is bearish.

MACD Example – iShares Russell 2000 ETF

December 3, 2018 iShares Russell 2000 ETF and MACD

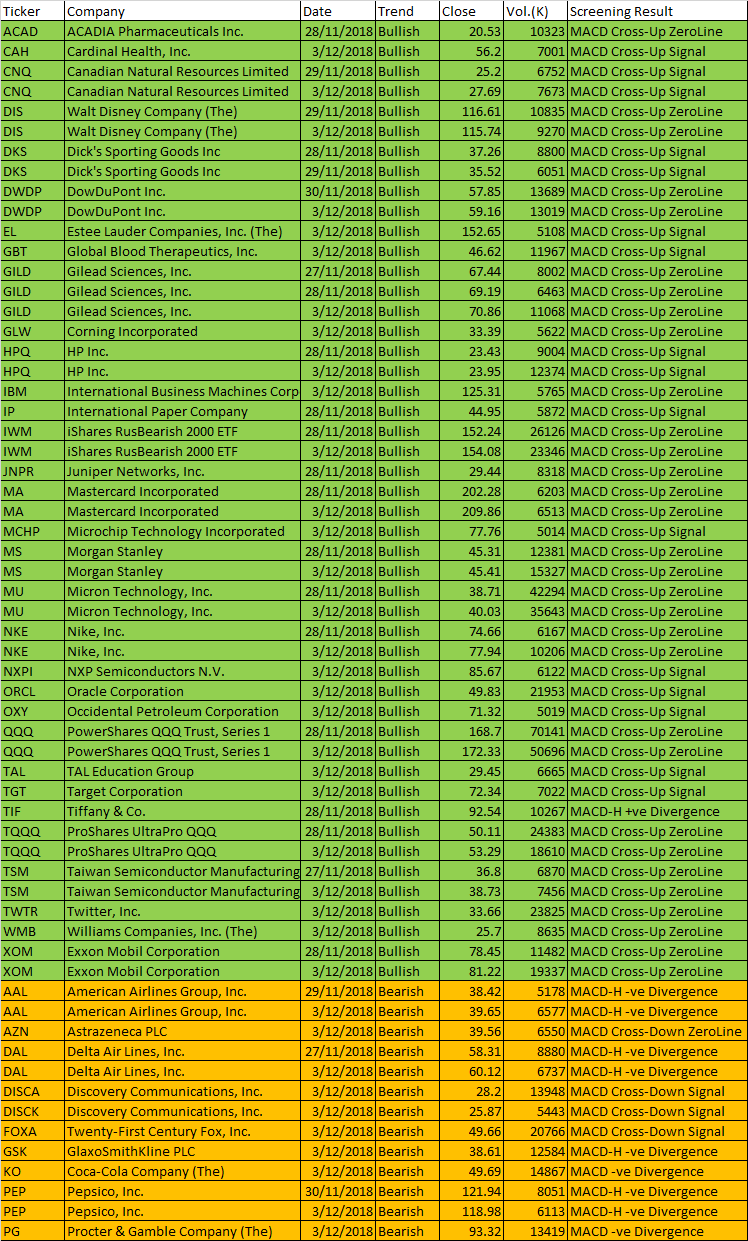

27 November to 3 December 2018 AmiBroker AFL Script Generated Five-day U.S. Stock MACD Signals

The following are script generated Five-day U.S. Stock Market MACD signals using the Powerful AmiBroker’s AFL.

The MACD Setting used is (8,17,9)

| Ticker | Company | Date | Trend | Close | Vol.(K) | Screening Result |

| ACAD | ACADIA Pharmaceuticals Inc. | 28/11/2018 | Bullish | 20.53 | 10323 | MACD Cross-Up ZeroLine |

| CAH | Cardinal Health, Inc. | 3/12/2018 | Bullish | 56.2 | 7001 | MACD Cross-Up Signal |

| CNQ | Canadian Natural Resources Limited | 29/11/2018 | Bullish | 25.2 | 6752 | MACD Cross-Up Signal |

| CNQ | Canadian Natural Resources Limited | 3/12/2018 | Bullish | 27.69 | 7673 | MACD Cross-Up Signal |

| DIS | Walt Disney Company (The) | 29/11/2018 | Bullish | 116.61 | 10835 | MACD Cross-Up ZeroLine |

| DIS | Walt Disney Company (The) | 3/12/2018 | Bullish | 115.74 | 9270 | MACD Cross-Up ZeroLine |

| DKS | Dick’s Sporting Goods Inc | 28/11/2018 | Bullish | 37.26 | 8800 | MACD Cross-Up Signal |

| DKS | Dick’s Sporting Goods Inc | 29/11/2018 | Bullish | 35.52 | 6051 | MACD Cross-Up Signal |

| DWDP | DowDuPont Inc. | 30/11/2018 | Bullish | 57.85 | 13689 | MACD Cross-Up ZeroLine |

| DWDP | DowDuPont Inc. | 3/12/2018 | Bullish | 59.16 | 13019 | MACD Cross-Up ZeroLine |

| EL | Estee Lauder Companies, Inc. (The) | 3/12/2018 | Bullish | 152.65 | 5108 | MACD Cross-Up Signal |

| GBT | Global Blood Therapeutics, Inc. | 3/12/2018 | Bullish | 46.62 | 11967 | MACD Cross-Up Signal |

| GILD | Gilead Sciences, Inc. | 27/11/2018 | Bullish | 67.44 | 8002 | MACD Cross-Up ZeroLine |

| GILD | Gilead Sciences, Inc. | 28/11/2018 | Bullish | 69.19 | 6463 | MACD Cross-Up ZeroLine |

| GILD | Gilead Sciences, Inc. | 3/12/2018 | Bullish | 70.86 | 11068 | MACD Cross-Up ZeroLine |

| GLW | Corning Incorporated | 3/12/2018 | Bullish | 33.39 | 5622 | MACD Cross-Up ZeroLine |

| HPQ | HP Inc. | 28/11/2018 | Bullish | 23.43 | 9004 | MACD Cross-Up Signal |

| HPQ | HP Inc. | 3/12/2018 | Bullish | 23.95 | 12374 | MACD Cross-Up Signal |

| IBM | International Business Machines Corporation | 3/12/2018 | Bullish | 125.31 | 5765 | MACD Cross-Up ZeroLine |

| IP | International Paper Company | 28/11/2018 | Bullish | 44.95 | 5872 | MACD Cross-Up Signal |

| IWM | iShares RusBearish 2000 ETF | 28/11/2018 | Bullish | 152.24 | 26126 | MACD Cross-Up ZeroLine |

| IWM | iShares RusBearish 2000 ETF | 3/12/2018 | Bullish | 154.08 | 23346 | MACD Cross-Up ZeroLine |

| JNPR | Juniper Networks, Inc. | 28/11/2018 | Bullish | 29.44 | 8318 | MACD Cross-Up ZeroLine |

| MA | Mastercard Incorporated | 28/11/2018 | Bullish | 202.28 | 6203 | MACD Cross-Up ZeroLine |

| MA | Mastercard Incorporated | 3/12/2018 | Bullish | 209.86 | 6513 | MACD Cross-Up ZeroLine |

| MCHP | Microchip Technology Incorporated | 3/12/2018 | Bullish | 77.76 | 5014 | MACD Cross-Up Signal |

| MS | Morgan Stanley | 28/11/2018 | Bullish | 45.31 | 12381 | MACD Cross-Up ZeroLine |

| MS | Morgan Stanley | 3/12/2018 | Bullish | 45.41 | 15327 | MACD Cross-Up ZeroLine |

| MU | Micron Technology, Inc. | 28/11/2018 | Bullish | 38.71 | 42294 | MACD Cross-Up ZeroLine |

| MU | Micron Technology, Inc. | 3/12/2018 | Bullish | 40.03 | 35643 | MACD Cross-Up ZeroLine |

| NKE | Nike, Inc. | 28/11/2018 | Bullish | 74.66 | 6167 | MACD Cross-Up ZeroLine |

| NKE | Nike, Inc. | 3/12/2018 | Bullish | 77.94 | 10206 | MACD Cross-Up ZeroLine |

| NXPI | NXP Semiconductors N.V. | 3/12/2018 | Bullish | 85.67 | 6122 | MACD Cross-Up Signal |

| ORCL | Oracle Corporation | 3/12/2018 | Bullish | 49.83 | 21953 | MACD Cross-Up Signal |

| OXY | Occidental Petroleum Corporation | 3/12/2018 | Bullish | 71.32 | 5019 | MACD Cross-Up Signal |

| QQQ | PowerShares QQQ Trust, Series 1 | 28/11/2018 | Bullish | 168.7 | 70141 | MACD Cross-Up ZeroLine |

| QQQ | PowerShares QQQ Trust, Series 1 | 3/12/2018 | Bullish | 172.33 | 50696 | MACD Cross-Up ZeroLine |

| TAL | TAL Education Group | 3/12/2018 | Bullish | 29.45 | 6665 | MACD Cross-Up Signal |

| TGT | Target Corporation | 3/12/2018 | Bullish | 72.34 | 7022 | MACD Cross-Up Signal |

| TIF | Tiffany & Co. | 28/11/2018 | Bullish | 92.54 | 10267 | MACD-H +ve Divergence |

| TQQQ | ProShares UltraPro QQQ | 28/11/2018 | Bullish | 50.11 | 24383 | MACD Cross-Up ZeroLine |

| TQQQ | ProShares UltraPro QQQ | 3/12/2018 | Bullish | 53.29 | 18610 | MACD Cross-Up ZeroLine |

| TSM | Taiwan Semiconductor Manufacturing Company Ltd. | 27/11/2018 | Bullish | 36.8 | 6870 | MACD Cross-Up ZeroLine |

| TSM | Taiwan Semiconductor Manufacturing Company Ltd. | 3/12/2018 | Bullish | 38.73 | 7456 | MACD Cross-Up ZeroLine |

| TWTR | Twitter, Inc. | 3/12/2018 | Bullish | 33.66 | 23825 | MACD Cross-Up ZeroLine |

| WMB | Williams Companies, Inc. (The) | 3/12/2018 | Bullish | 25.7 | 8635 | MACD Cross-Up ZeroLine |

| XOM | Exxon Mobil Corporation | 28/11/2018 | Bullish | 78.45 | 11482 | MACD Cross-Up ZeroLine |

| XOM | Exxon Mobil Corporation | 3/12/2018 | Bullish | 81.22 | 19337 | MACD Cross-Up ZeroLine |

| AAL | American Airlines Group, Inc. | 29/11/2018 | Bearish | 38.42 | 5178 | MACD-H -ve Divergence |

| AAL | American Airlines Group, Inc. | 3/12/2018 | Bearish | 39.65 | 6577 | MACD-H -ve Divergence |

| AZN | Astrazeneca PLC | 3/12/2018 | Bearish | 39.56 | 6550 | MACD Cross-Down ZeroLine |

| DAL | Delta Air Lines, Inc. | 27/11/2018 | Bearish | 58.31 | 8880 | MACD-H -ve Divergence |

| DAL | Delta Air Lines, Inc. | 3/12/2018 | Bearish | 60.12 | 6737 | MACD-H -ve Divergence |

| DISCA | Discovery Communications, Inc. | 3/12/2018 | Bearish | 28.2 | 13948 | MACD Cross-Down Signal |

| DISCK | Discovery Communications, Inc. | 3/12/2018 | Bearish | 25.87 | 5443 | MACD Cross-Down Signal |

| FOXA | Twenty-First Century Fox, Inc. | 3/12/2018 | Bearish | 49.66 | 20766 | MACD Cross-Down Signal |

| GSK | GlaxoSmithKline PLC | 3/12/2018 | Bearish | 38.61 | 12584 | MACD-H -ve Divergence |

| KO | Coca-Cola Company (The) | 3/12/2018 | Bearish | 49.69 | 14867 | MACD -ve Divergence |

| PEP | Pepsico, Inc. | 30/11/2018 | Bearish | 121.94 | 8051 | MACD-H -ve Divergence |

| PEP | Pepsico, Inc. | 3/12/2018 | Bearish | 118.98 | 6113 | MACD-H -ve Divergence |

| PG | Procter & Gamble Company (The) | 3/12/2018 | Bearish | 93.32 | 13419 | MACD -ve Divergence |

if you can see the full chart, “press Ctrl and -” to zoom out and see the entire chart.

November 27 to December 3, 2018 US Stock Five-day MACD Scan Signals

Moses U.S. Stock MACD Scan

AmiBroker Academy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.