12 May, 2018

Thank you for visiting the site. Hope you like the content.

Hong Kong Hang Seng Index and Dow Jones Industrial Average Index Correlation

Picture worth a thousand words, see chart on the current market fear. Manage your risk.

May 11, 2018 Hong Kong Hang Seng Index and Dow Index Correlation

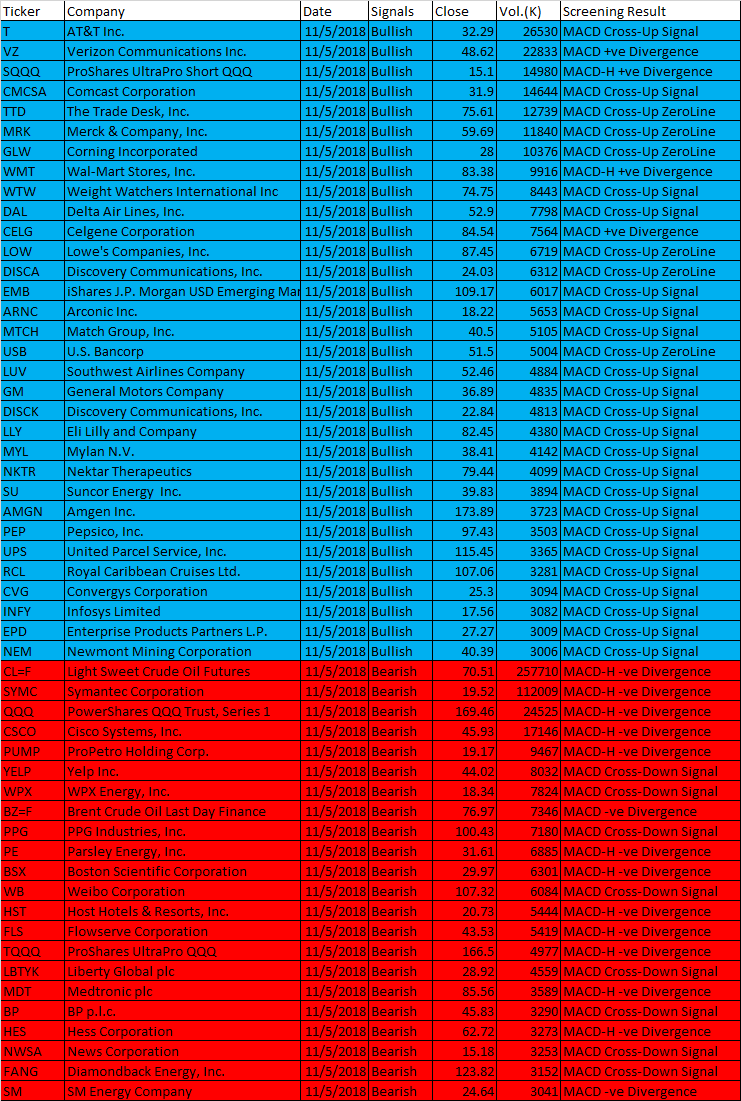

Free MACD Scan One-day US Stock MACD Screening Results on May 11 2018

Remember all setup can fail. This is true for all indicators. It is also true for MACD signals setup. See some of the MACD setup fail examples on this website.

May 11, 2018 US Stock One-day MACD Signals

These are the six types of MACD Signals:

- MACD line crosses above MACD signal – Bullish trend

- MACD line crosses above zero line – Bullish trend

- MACD Histogram +ve Divergence – Bullish trend

- MACD line crosses below MACD signal – Bearish trend

- MACD line crosses below zero line – Bearish trend

- MACD Histogram -ve Divergence – Bearish trend

| Ticker | Company | Date | Signals | Close | Vol.(K) | Screening Result |

| T | AT&T Inc. | 11/5/2018 | Bullish | 32.29 | 26530 | MACD Cross-Up Signal |

| VZ | Verizon Communications Inc. | 11/5/2018 | Bullish | 48.62 | 22833 | MACD +ve Divergence |

| SQQQ | ProShares UltraPro Short QQQ | 11/5/2018 | Bullish | 15.1 | 14980 | MACD-H +ve Divergence |

| CMCSA | Comcast Corporation | 11/5/2018 | Bullish | 31.9 | 14644 | MACD Cross-Up Signal |

| TTD | The Trade Desk, Inc. | 11/5/2018 | Bullish | 75.61 | 12739 | MACD Cross-Up ZeroLine |

| MRK | Merck & Company, Inc. | 11/5/2018 | Bullish | 59.69 | 11840 | MACD Cross-Up ZeroLine |

| GLW | Corning Incorporated | 11/5/2018 | Bullish | 28 | 10376 | MACD Cross-Up ZeroLine |

| WMT | Wal-Mart Stores, Inc. | 11/5/2018 | Bullish | 83.38 | 9916 | MACD-H +ve Divergence |

| WTW | Weight Watchers International Inc | 11/5/2018 | Bullish | 74.75 | 8443 | MACD Cross-Up Signal |

| DAL | Delta Air Lines, Inc. | 11/5/2018 | Bullish | 52.9 | 7798 | MACD Cross-Up Signal |

| CELG | Celgene Corporation | 11/5/2018 | Bullish | 84.54 | 7564 | MACD +ve Divergence |

| LOW | Lowe’s Companies, Inc. | 11/5/2018 | Bullish | 87.45 | 6719 | MACD Cross-Up ZeroLine |

| DISCA | Discovery Communications, Inc. | 11/5/2018 | Bullish | 24.03 | 6312 | MACD Cross-Up ZeroLine |

| EMB | iShares J.P. Morgan USD Emerging Markets Bond ETF | 11/5/2018 | Bullish | 109.17 | 6017 | MACD Cross-Up Signal |

| ARNC | Arconic Inc. | 11/5/2018 | Bullish | 18.22 | 5653 | MACD Cross-Up Signal |

| MTCH | Match Group, Inc. | 11/5/2018 | Bullish | 40.5 | 5105 | MACD Cross-Up Signal |

| USB | U.S. Bancorp | 11/5/2018 | Bullish | 51.5 | 5004 | MACD Cross-Up ZeroLine |

| LUV | Southwest Airlines Company | 11/5/2018 | Bullish | 52.46 | 4884 | MACD Cross-Up Signal |

| GM | General Motors Company | 11/5/2018 | Bullish | 36.89 | 4835 | MACD Cross-Up Signal |

| DISCK | Discovery Communications, Inc. | 11/5/2018 | Bullish | 22.84 | 4813 | MACD Cross-Up Signal |

| LLY | Eli Lilly and Company | 11/5/2018 | Bullish | 82.45 | 4380 | MACD Cross-Up Signal |

| MYL | Mylan N.V. | 11/5/2018 | Bullish | 38.41 | 4142 | MACD Cross-Up Signal |

| NKTR | Nektar Therapeutics | 11/5/2018 | Bullish | 79.44 | 4099 | MACD Cross-Up Signal |

| SU | Suncor Energy Inc. | 11/5/2018 | Bullish | 39.83 | 3894 | MACD Cross-Up Signal |

| AMGN | Amgen Inc. | 11/5/2018 | Bullish | 173.89 | 3723 | MACD Cross-Up Signal |

| PEP | Pepsico, Inc. | 11/5/2018 | Bullish | 97.43 | 3503 | MACD Cross-Up Signal |

| UPS | United Parcel Service, Inc. | 11/5/2018 | Bullish | 115.45 | 3365 | MACD Cross-Up Signal |

| RCL | Royal Caribbean Cruises Ltd. | 11/5/2018 | Bullish | 107.06 | 3281 | MACD Cross-Up Signal |

| CVG | Convergys Corporation | 11/5/2018 | Bullish | 25.3 | 3094 | MACD Cross-Up Signal |

| INFY | Infosys Limited | 11/5/2018 | Bullish | 17.56 | 3082 | MACD Cross-Up Signal |

| EPD | Enterprise Products Partners L.P. | 11/5/2018 | Bullish | 27.27 | 3009 | MACD Cross-Up Signal |

| NEM | Newmont Mining Corporation | 11/5/2018 | Bullish | 40.39 | 3006 | MACD Cross-Up Signal |

| CL=F | Light Sweet Crude Oil Futures | 11/5/2018 | Bearish | 70.51 | 257710 | MACD-H -ve Divergence |

| SYMC | Symantec Corporation | 11/5/2018 | Bearish | 19.52 | 112009 | MACD-H -ve Divergence |

| QQQ | PowerShares QQQ Trust, Series 1 | 11/5/2018 | Bearish | 169.46 | 24525 | MACD-H -ve Divergence |

| CSCO | Cisco Systems, Inc. | 11/5/2018 | Bearish | 45.93 | 17146 | MACD-H -ve Divergence |

| PUMP | ProPetro Holding Corp. | 11/5/2018 | Bearish | 19.17 | 9467 | MACD-H -ve Divergence |

| YELP | Yelp Inc. | 11/5/2018 | Bearish | 44.02 | 8032 | MACD Cross-Down Signal |

| WPX | WPX Energy, Inc. | 11/5/2018 | Bearish | 18.34 | 7824 | MACD Cross-Down Signal |

| BZ=F | Brent Crude Oil Last Day Finance | 11/5/2018 | Bearish | 76.97 | 7346 | MACD -ve Divergence |

| PPG | PPG Industries, Inc. | 11/5/2018 | Bearish | 100.43 | 7180 | MACD Cross-Down Signal |

| PE | Parsley Energy, Inc. | 11/5/2018 | Bearish | 31.61 | 6885 | MACD-H -ve Divergence |

| BSX | Boston Scientific Corporation | 11/5/2018 | Bearish | 29.97 | 6301 | MACD-H -ve Divergence |

| WB | Weibo Corporation | 11/5/2018 | Bearish | 107.32 | 6084 | MACD Cross-Down Signal |

| HST | Host Hotels & Resorts, Inc. | 11/5/2018 | Bearish | 20.73 | 5444 | MACD-H -ve Divergence |

| FLS | Flowserve Corporation | 11/5/2018 | Bearish | 43.53 | 5419 | MACD-H -ve Divergence |

| TQQQ | ProShares UltraPro QQQ | 11/5/2018 | Bearish | 166.5 | 4977 | MACD-H -ve Divergence |

| LBTYK | Liberty Global plc | 11/5/2018 | Bearish | 28.92 | 4559 | MACD Cross-Down Signal |

| MDT | Medtronic plc | 11/5/2018 | Bearish | 85.56 | 3589 | MACD-H -ve Divergence |

| BP | BP p.l.c. | 11/5/2018 | Bearish | 45.83 | 3290 | MACD Cross-Down Signal |

| HES | Hess Corporation | 11/5/2018 | Bearish | 62.72 | 3273 | MACD-H -ve Divergence |

| NWSA | News Corporation | 11/5/2018 | Bearish | 15.18 | 3253 | MACD Cross-Down Signal |

| FANG | Diamondback Energy, Inc. | 11/5/2018 | Bearish | 123.82 | 3152 | MACD Cross-Down Signal |

| SM | SM Energy Company | 11/5/2018 | Bearish | 24.64 | 3041 | MACD -ve Divergence |

Have fun! Reader must understand what MACD is all about before using the results.

Moses US Stock Scan

AmiBroker Academy.com

Disclaimer:

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.