5 March 2019

Thanks for visiting the site.

Free U.S. Stock MACD Screener

What is MACD?

MACD stands for Moving Average Convergence Divergence, common setting is (12,26,9)

MACD indicator is a trend trading system that makes up of 2 lines. The MACD Line (fast line) and MACD Signal Line (slow line).

1) When the MACD Line crosses over the MACD Signal Line the trend is bullish. When the MACD Line crosses below the MACD Signal the trend is bearish.

2) When the MACD Line crosses above zero line the trend is bullish. When the MACD line crosses below zero line the trend is bearish.

What is AmiBroker AFL?

AmiBroker AFL stands for AmiBroker Formula Language.

AmiBroker equips with a powerful formula language allowing you to write trading system rules, define your own indicators and custom commentaries, such as the MACD Screener Script here.

Read more on the following link, https://www.amibroker.com/guide/AFL.html.

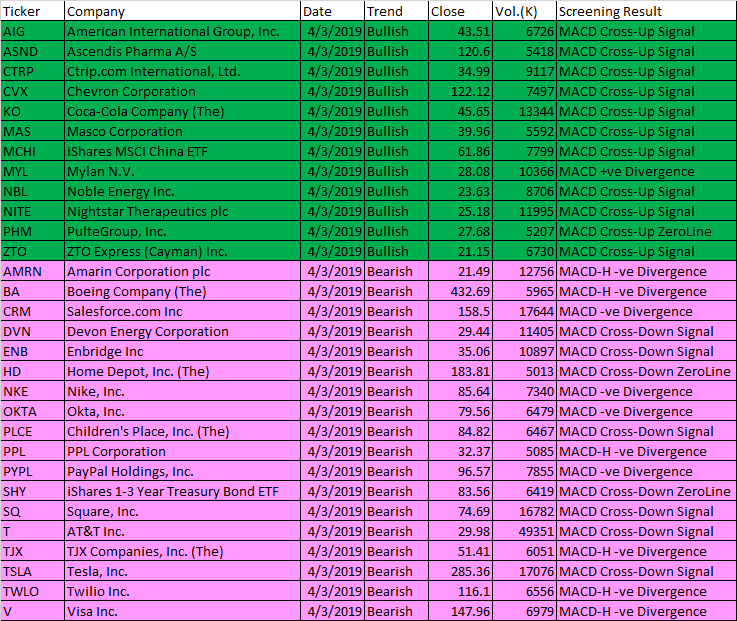

March 4, 2019 AFL Script Generated One-day U.S. Stock MACD Signals

The following are script generated One-day U.S. Stock Market MACD signals using the Powerful AmiBroker’s AFL.

The MACD Setting used is (8,17,9)

| Ticker | Company | Date | Trend | Close | Vol.(K) | Screening Result |

| AIG | American International Group, Inc. | 4/3/2019 | Bullish | 43.51 | 6726 | MACD Cross-Up Signal |

| ASND | Ascendis Pharma A/S | 4/3/2019 | Bullish | 120.6 | 5418 | MACD Cross-Up Signal |

| CTRP | Ctrip.com International, Ltd. | 4/3/2019 | Bullish | 34.99 | 9117 | MACD Cross-Up Signal |

| CVX | Chevron Corporation | 4/3/2019 | Bullish | 122.12 | 7497 | MACD Cross-Up Signal |

| KO | Coca-Cola Company (The) | 4/3/2019 | Bullish | 45.65 | 13344 | MACD Cross-Up Signal |

| MAS | Masco Corporation | 4/3/2019 | Bullish | 39.96 | 5592 | MACD Cross-Up Signal |

| MCHI | iShares MSCI China ETF | 4/3/2019 | Bullish | 61.86 | 7799 | MACD Cross-Up Signal |

| MYL | Mylan N.V. | 4/3/2019 | Bullish | 28.08 | 10366 | MACD +ve Divergence |

| NBL | Noble Energy Inc. | 4/3/2019 | Bullish | 23.63 | 8706 | MACD Cross-Up Signal |

| NITE | Nightstar Therapeutics plc | 4/3/2019 | Bullish | 25.18 | 11995 | MACD Cross-Up Signal |

| PHM | PulteGroup, Inc. | 4/3/2019 | Bullish | 27.68 | 5207 | MACD Cross-Up ZeroLine |

| ZTO | ZTO Express (Cayman) Inc. | 4/3/2019 | Bullish | 21.15 | 6730 | MACD Cross-Up Signal |

| AMRN | Amarin Corporation plc | 4/3/2019 | Bearish | 21.49 | 12756 | MACD-H -ve Divergence |

| BA | Boeing Company (The) | 4/3/2019 | Bearish | 432.69 | 5965 | MACD-H -ve Divergence |

| CRM | Salesforce.com Inc | 4/3/2019 | Bearish | 158.5 | 17644 | MACD -ve Divergence |

| DVN | Devon Energy Corporation | 4/3/2019 | Bearish | 29.44 | 11405 | MACD Cross-Down Signal |

| ENB | Enbridge Inc | 4/3/2019 | Bearish | 35.06 | 10897 | MACD Cross-Down Signal |

| HD | Home Depot, Inc. (The) | 4/3/2019 | Bearish | 183.81 | 5013 | MACD Cross-Down ZeroLine |

| NKE | Nike, Inc. | 4/3/2019 | Bearish | 85.64 | 7340 | MACD -ve Divergence |

| OKTA | Okta, Inc. | 4/3/2019 | Bearish | 79.56 | 6479 | MACD -ve Divergence |

| PLCE | Children’s Place, Inc. (The) | 4/3/2019 | Bearish | 84.82 | 6467 | MACD Cross-Down Signal |

| PPL | PPL Corporation | 4/3/2019 | Bearish | 32.37 | 5085 | MACD-H -ve Divergence |

| PYPL | PayPal Holdings, Inc. | 4/3/2019 | Bearish | 96.57 | 7855 | MACD -ve Divergence |

| SHY | iShares 1-3 Year Treasury Bond ETF | 4/3/2019 | Bearish | 83.56 | 6419 | MACD Cross-Down ZeroLine |

| SQ | Square, Inc. | 4/3/2019 | Bearish | 74.69 | 16782 | MACD Cross-Down Signal |

| T | AT&T Inc. | 4/3/2019 | Bearish | 29.98 | 49351 | MACD Cross-Down Signal |

| TJX | TJX Companies, Inc. (The) | 4/3/2019 | Bearish | 51.41 | 6051 | MACD-H -ve Divergence |

| TSLA | Tesla, Inc. | 4/3/2019 | Bearish | 285.36 | 17076 | MACD Cross-Down Signal |

| TWLO | Twilio Inc. | 4/3/2019 | Bearish | 116.1 | 6556 | MACD-H -ve Divergence |

| V | Visa Inc. | 4/3/2019 | Bearish | 147.96 | 6979 | MACD-H -ve Divergence |

Moses U.S. Stock MACD Scan

AmiBroker Academy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.

2 March, 2019

Welcome to AmiBrokerAcademy.com. We provide US stock analysis for academy learning.

Think!

AT&T Inc Stock Charting

Study AT&T Inc stock chart.

As we said to use additional indicator such as MACD to confirm the bear trend.

See chart, we see the positive divergence. Mean possible trend change. So, the bear trend may change.

Remember, the setup will be true until when it fail.

So, for such case. You have to double careful to monitor the trade and cut lost fast. Or reduce your trade size.

You are responsible for your trade plan and your execution.

Trade with your eyes open.

Moses Stock Observation

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.