March 23, 2017

Moses’ US Stock Review and MACD Stock Scan

Moses at AmiBrokerAcademy.com uses charting software AmiBorker’s AmiBroker AFL, to write an AmiBroker Formula Language program to scan through 6,300 stocks that stored in the data base for US Stocks, listed in AMEX, NASDAQ, and NYSE to find stocks have Moving Average Convergence Divergence (MACD) bullish and bearish signals.

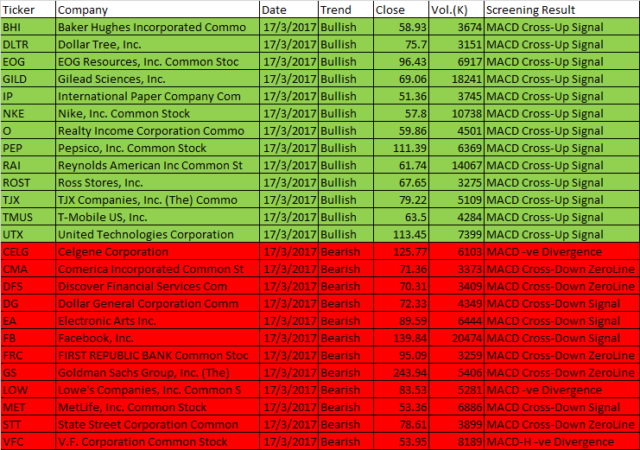

March 17, 2017 Moses Free US Stock MACD Scan Results

Free stock market scan results, Moses’ Stock Corner. Moses provides a list of US stocks that have the following MACD signals.

- MACD line crosses above MACD signal – Bullish trend

- MACD line crosses above zero line – Bullish trend

- MACD Histogram +ve Divergence – Bullish trend

- MACD line crosses below MACD signal – Bearish trend

- MACD line crosses below zero line – Bearish trend

- MACD Histogram -ve Divergence – Bearish trend

- Volume traded greater 3,000,000 shares

Total 6300 stocks and only 25 MACD bullish and bearish signals with more than 3,000,000 shares. This stock screening narrow it to stocks to value between 51 dollars to 250 dollars.

Out of total of six stocks that have MACD signals, only three bull signal and three bear signal. This is from the scan of 6,229 stocks on our database.

| Ticker | Company | Date | Trend | Close | Vol.(K) | Screening Result |

| BHI | Baker Hughes Incorporated Commo | 17/3/2017 | Bullish | 58.93 | 3674 | MACD Cross-Up Signal |

| DLTR | Dollar Tree, Inc. | 17/3/2017 | Bullish | 75.7 | 3151 | MACD Cross-Up Signal |

| EOG | EOG Resources, Inc. Common Stoc | 17/3/2017 | Bullish | 96.43 | 6917 | MACD Cross-Up Signal |

| GILD | Gilead Sciences, Inc. | 17/3/2017 | Bullish | 69.06 | 18241 | MACD Cross-Up Signal |

| IP | International Paper Company Com | 17/3/2017 | Bullish | 51.36 | 3745 | MACD Cross-Up Signal |

| NKE | Nike, Inc. Common Stock | 17/3/2017 | Bullish | 57.8 | 10738 | MACD Cross-Up Signal |

| O | Realty Income Corporation Commo | 17/3/2017 | Bullish | 59.86 | 4501 | MACD Cross-Up Signal |

| PEP | Pepsico, Inc. Common Stock | 17/3/2017 | Bullish | 111.39 | 6369 | MACD Cross-Up Signal |

| RAI | Reynolds American Inc Common St | 17/3/2017 | Bullish | 61.74 | 14067 | MACD Cross-Up Signal |

| ROST | Ross Stores, Inc. | 17/3/2017 | Bullish | 67.65 | 3275 | MACD Cross-Up Signal |

| TJX | TJX Companies, Inc. (The) Commo | 17/3/2017 | Bullish | 79.22 | 5109 | MACD Cross-Up Signal |

| TMUS | T-Mobile US, Inc. | 17/3/2017 | Bullish | 63.5 | 4284 | MACD Cross-Up Signal |

| UTX | United Technologies Corporation | 17/3/2017 | Bullish | 113.45 | 7399 | MACD Cross-Up Signal |

| CELG | Celgene Corporation | 17/3/2017 | Bearish | 125.77 | 6103 | MACD -ve Divergence |

| CMA | Comerica Incorporated Common St | 17/3/2017 | Bearish | 71.36 | 3373 | MACD Cross-Down ZeroLine |

| DFS | Discover Financial Services Com | 17/3/2017 | Bearish | 70.31 | 3409 | MACD Cross-Down ZeroLine |

| DG | Dollar General Corporation Comm | 17/3/2017 | Bearish | 72.33 | 4349 | MACD Cross-Down Signal |

| EA | Electronic Arts Inc. | 17/3/2017 | Bearish | 89.59 | 6444 | MACD Cross-Down Signal |

| FB | Facebook, Inc. | 17/3/2017 | Bearish | 139.84 | 20474 | MACD Cross-Down Signal |

| FRC | FIRST REPUBLIC BANK Common Stoc | 17/3/2017 | Bearish | 95.09 | 3259 | MACD Cross-Down ZeroLine |

| GS | Goldman Sachs Group, Inc. (The) | 17/3/2017 | Bearish | 243.94 | 5406 | MACD Cross-Down ZeroLine |

| LOW | Lowe’s Companies, Inc. Common S | 17/3/2017 | Bearish | 83.53 | 5281 | MACD -ve Divergence |

| MET | MetLife, Inc. Common Stock | 17/3/2017 | Bearish | 53.36 | 6886 | MACD Cross-Down Signal |

| STT | State Street Corporation Common | 17/3/2017 | Bearish | 78.61 | 3899 | MACD Cross-Down ZeroLine |

| VFC | V.F. Corporation Common Stock | 17/3/2017 | Bearish | 53.95 | 8189 | MACD-H -ve Divergence |

March 17, 2017 USStock MACD Scan

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.