January 6, 2017

Free One-day US Stock MACD Screening Signals for 4 January 2018

Remember all setup can fail. This is true for all indicators. It is also true for MACD signals setup. See some of the MACD setup fail examples on this website.

The following results are from AmiBroker AFL. AmiBroker is a powerful charting software.

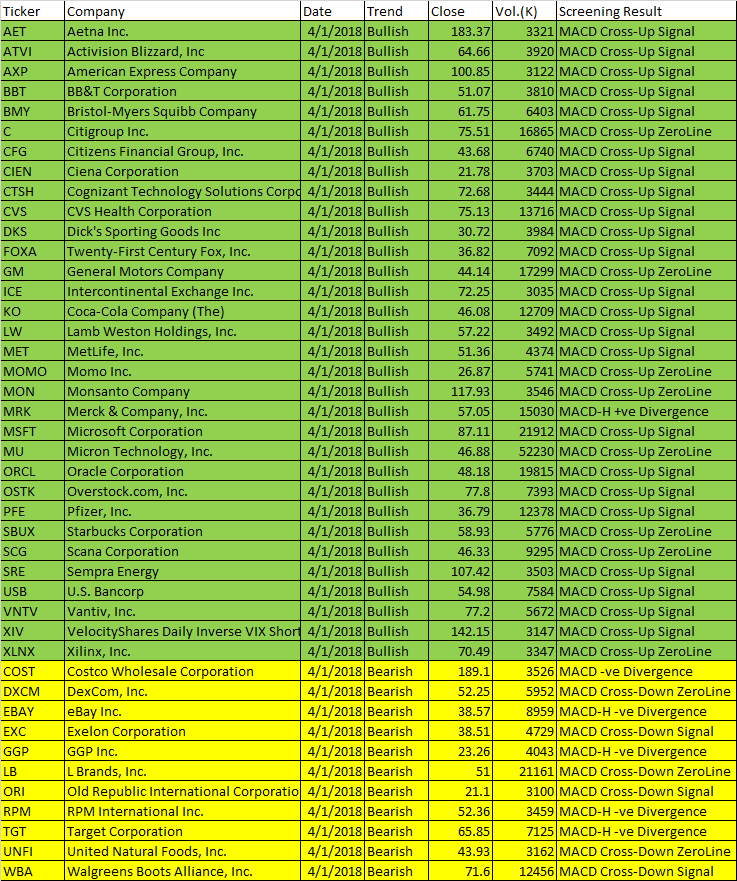

January 4, 2018 One-day US Stock MACD Scan Signals

The Following are January 4, 2018 US Stock MACD Scan Signals

The following are script generated signals using the Powerful AmiBroker AFL. AmiBroker is a powerful charting software. The results here are not meant to be used for buy or sell decisions. We do not vouch for their accuracy; depending of the author trading rules. They are meant to demonstrate the powerful Amibroker charting software functionality.

NOT all scan results are shown here.

| Ticker | Company | Date | Trend | Close | Vol.(K) | Screening Result |

| AET | Aetna Inc. | 4/1/2018 | Bullish | 183.37 | 3321 | MACD Cross-Up Signal |

| ATVI | Activision Blizzard, Inc | 4/1/2018 | Bullish | 64.66 | 3920 | MACD Cross-Up Signal |

| AXP | American Express Company | 4/1/2018 | Bullish | 100.85 | 3122 | MACD Cross-Up Signal |

| BBT | BB&T Corporation | 4/1/2018 | Bullish | 51.07 | 3810 | MACD Cross-Up Signal |

| BMY | Bristol-Myers Squibb Company | 4/1/2018 | Bullish | 61.75 | 6403 | MACD Cross-Up Signal |

| C | Citigroup Inc. | 4/1/2018 | Bullish | 75.51 | 16865 | MACD Cross-Up ZeroLine |

| CFG | Citizens Financial Group, Inc. | 4/1/2018 | Bullish | 43.68 | 6740 | MACD Cross-Up Signal |

| CIEN | Ciena Corporation | 4/1/2018 | Bullish | 21.78 | 3703 | MACD Cross-Up Signal |

| CTSH | Cognizant Technology Solutions Corporation | 4/1/2018 | Bullish | 72.68 | 3444 | MACD Cross-Up Signal |

| CVS | CVS Health Corporation | 4/1/2018 | Bullish | 75.13 | 13716 | MACD Cross-Up Signal |

| DKS | Dick’s Sporting Goods Inc | 4/1/2018 | Bullish | 30.72 | 3984 | MACD Cross-Up Signal |

| FOXA | Twenty-First Century Fox, Inc. | 4/1/2018 | Bullish | 36.82 | 7092 | MACD Cross-Up Signal |

| GM | General Motors Company | 4/1/2018 | Bullish | 44.14 | 17299 | MACD Cross-Up ZeroLine |

| ICE | Intercontinental Exchange Inc. | 4/1/2018 | Bullish | 72.25 | 3035 | MACD Cross-Up Signal |

| KO | Coca-Cola Company (The) | 4/1/2018 | Bullish | 46.08 | 12709 | MACD Cross-Up Signal |

| LW | Lamb Weston Holdings, Inc. | 4/1/2018 | Bullish | 57.22 | 3492 | MACD Cross-Up Signal |

| MET | MetLife, Inc. | 4/1/2018 | Bullish | 51.36 | 4374 | MACD Cross-Up Signal |

| MOMO | Momo Inc. | 4/1/2018 | Bullish | 26.87 | 5741 | MACD Cross-Up ZeroLine |

| MON | Monsanto Company | 4/1/2018 | Bullish | 117.93 | 3546 | MACD Cross-Up ZeroLine |

| MRK | Merck & Company, Inc. | 4/1/2018 | Bullish | 57.05 | 15030 | MACD-H +ve Divergence |

| MSFT | Microsoft Corporation | 4/1/2018 | Bullish | 87.11 | 21912 | MACD Cross-Up Signal |

| MU | Micron Technology, Inc. | 4/1/2018 | Bullish | 46.88 | 52230 | MACD Cross-Up ZeroLine |

| ORCL | Oracle Corporation | 4/1/2018 | Bullish | 48.18 | 19815 | MACD Cross-Up Signal |

| OSTK | Overstock.com, Inc. | 4/1/2018 | Bullish | 77.8 | 7393 | MACD Cross-Up Signal |

| PFE | Pfizer, Inc. | 4/1/2018 | Bullish | 36.79 | 12378 | MACD Cross-Up Signal |

| SBUX | Starbucks Corporation | 4/1/2018 | Bullish | 58.93 | 5776 | MACD Cross-Up ZeroLine |

| SCG | Scana Corporation | 4/1/2018 | Bullish | 46.33 | 9295 | MACD Cross-Up ZeroLine |

| SRE | Sempra Energy | 4/1/2018 | Bullish | 107.42 | 3503 | MACD Cross-Up Signal |

| USB | U.S. Bancorp | 4/1/2018 | Bullish | 54.98 | 7584 | MACD Cross-Up Signal |

| VNTV | Vantiv, Inc. | 4/1/2018 | Bullish | 77.2 | 5672 | MACD Cross-Up Signal |

| XIV | VelocityShares Daily Inverse VIX Short-Term ETN | 4/1/2018 | Bullish | 142.15 | 3147 | MACD Cross-Up Signal |

| XLNX | Xilinx, Inc. | 4/1/2018 | Bullish | 70.49 | 3347 | MACD Cross-Up ZeroLine |

| COST | Costco Wholesale Corporation | 4/1/2018 | Bearish | 189.1 | 3526 | MACD -ve Divergence |

| DXCM | DexCom, Inc. | 4/1/2018 | Bearish | 52.25 | 5952 | MACD Cross-Down ZeroLine |

| EBAY | eBay Inc. | 4/1/2018 | Bearish | 38.57 | 8959 | MACD-H -ve Divergence |

| EXC | Exelon Corporation | 4/1/2018 | Bearish | 38.51 | 4729 | MACD Cross-Down Signal |

| GGP | GGP Inc. | 4/1/2018 | Bearish | 23.26 | 4043 | MACD-H -ve Divergence |

| LB | L Brands, Inc. | 4/1/2018 | Bearish | 51 | 21161 | MACD Cross-Down ZeroLine |

| ORI | Old Republic International Corporation | 4/1/2018 | Bearish | 21.1 | 3100 | MACD Cross-Down Signal |

| RPM | RPM International Inc. | 4/1/2018 | Bearish | 52.36 | 3459 | MACD-H -ve Divergence |

| TGT | Target Corporation | 4/1/2018 | Bearish | 65.85 | 7125 | MACD-H -ve Divergence |

| UNFI | United Natural Foods, Inc. | 4/1/2018 | Bearish | 43.93 | 3162 | MACD Cross-Down ZeroLine |

| WBA | Walgreens Boots Alliance, Inc. | 4/1/2018 | Bearish | 71.6 | 12456 | MACD Cross-Down Signal |

Note:

Users must understand what MACD is all about before using the results.

Have fun!

Moses US Stock MACD Screening Signals

AmiBroker Academy.com

Disclaimer:

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.