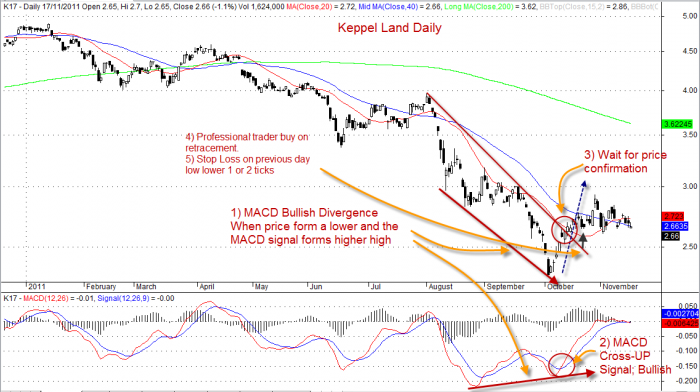

MACD Bullish Divergence is when price forms lower low and MACD signal or histogram forms a higher low. MACD Bullish Divergence provides an early warming that the price action may change direction. The price action will stop forming new lower bottom. This is only confirmed when price break the trendline or resistance.

Steps on how to trade

1) Scan for MACD singals; MACD Bullish Divergence

2) More MACD signals, in this case MACD signals cross-up

3) Wait for price confirmation, break the resistance, trendline, or moving average

4) Don’t trade breakout, professional trade retracement

5) Set stop loss the previous day low plus 1 or 2 ticks lower.

See the Keppel Land Daily chart for illustration.

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD characteristics. Amibroker can program to scan the stocks for buy and sell signals.

The MACD signal should use with price action. Readers must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here.