January 12, 2018

Indexes Correlation See Dow and Japan Nikkei

Stock Analysis

^DJI Dow Jones Industrial Average Composite Index Year High Low from 2008

Month or Year high low is a good reference for support resistance. From the chart for the explosive move.

The boxes is a great visual tool too, see the high of each year is like a step, the steps just going higher, bullish.

January 11, 2018 Dow Jones Industrial Average Composite Index Year High Low From 2008

Powerful Chart Software – AmiBroker

The following chart is produced using AmiBroker charting software. It is a powerful chart software. You plot the stocks you are interested all in one chart, as long as you still could read them. See chart below.

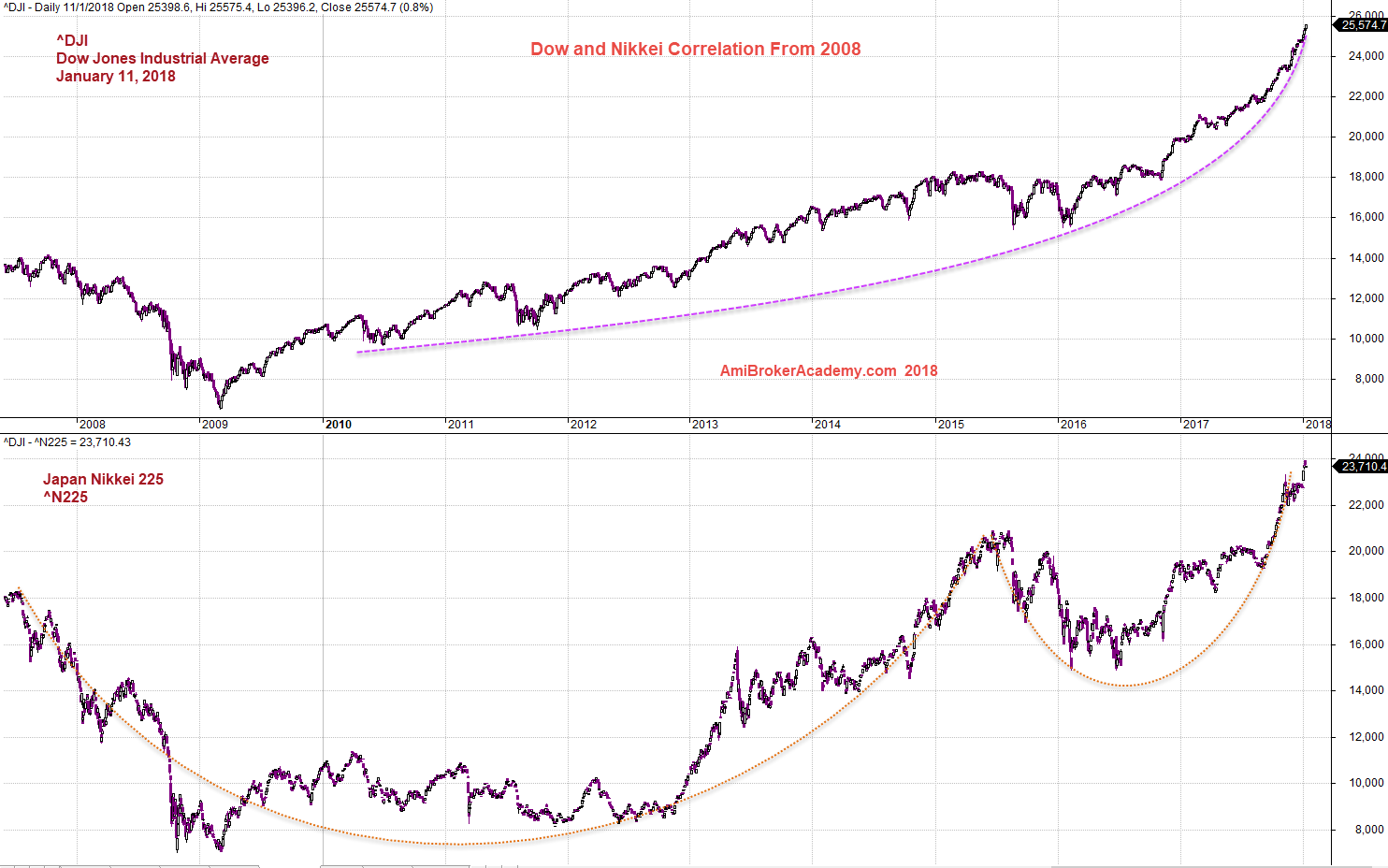

^DJI Dow Jones Industrial Average Index and Japan Nikkei Index ^N225 Correlation From 2008

Correlation is a good way to analyse the stock performance. See chart for the two indexes, Dow Jones Industrial Average and Japan Nikkei Index, N225 performance.

January 11, 2018 Dow Jones Industrial Average Index and Japan Nikkei Index, N225

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.