March 20, 2015

Reading Chart Bar by Bar

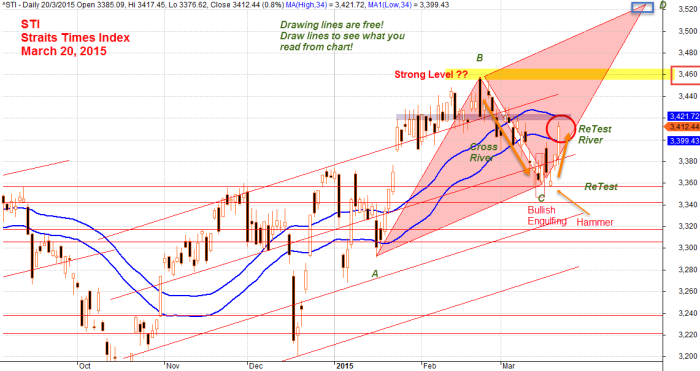

The last bar (on March 19) was a bullish candlestick; open gap up and close higher. We see the candlestick left with no tail. This is the continuation of the previous bullish candlestick, hammer. So, gap up, closed with no tail; very bullsih. When you look back for one more candlestick, it is a bearish candlestick, the three candlestick has formed a morning star candlestick pattern. These add up very very bullish.

With the strong level, and the morning star candlestick pattern, the result of a bullish day is expected.

But do not get too hung up on what you read here. It is always easy when you look back. Therefore, practice is very important. Practice, practice, practice make perfect. Have fun!

However, this can’t not make you a living. You still have to look into the big picture. See the posting on Big Picture.

March 20, 2015 Straits Times Index

STI start the day low by open gaps down at 3385.09 points, first deep down and left a long tail. STI finally drive north and ended quite high at 3412.44 points. STI has moved up 26.28, 0.78 percent higher.

From a fundamental point of view, the excuse made is stocks rally due to Fed (United States Central Bank) holds back on raising interest rate.

Lesson

Low interest rate on borrowing encourages borrowing, hope to stimulate economy grow.

High interest rate on borrowing discourage borrowing, hope to slow down the grow.

Thanks for visiting this extra ordinary site, AmiBrokerAcademy.com.

Watch this space here, some great stock will be analyse here. See you more.

Moses

DISCLAIMER

Stock trading is not a get rich quick scheme and it is high risk.

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should NOT be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids.

Trading is personal. You are responsible for your own trading decision.

The comment is the author personal experience. There is no intent for your believe and follow.