19 May, 2018

Thank you for visiting the site. Hope you like the content.

NASDAQ Bank Index and MACD

See chart, picture worth a thousand words. Moving Average, MA is a great tool for technical analysis, it provides a great visual effect. How? Simple, when the price action below MA, short term MA such as 20 period, days of hours, you can be quite sure that the price action is bearish. Or when you see the short term MA, is slopping down, it is also meant bearish. Open your eyes and observe. Have fun!

Price Action and Moving Averages:

NASDAQ Bank Index ^BKX has closed above its Short Term 20 Period Moving Average.

Short term moving average is currently below mid-term, and below long term moving average. Here, 50 MA is mid term, 100 MA is long term.

Therefore, the price action and its moving averages is neutral in short-term, and bearish in mid and long term.

May 17, 2018 NASDAQ Bank Index and Moving Averages

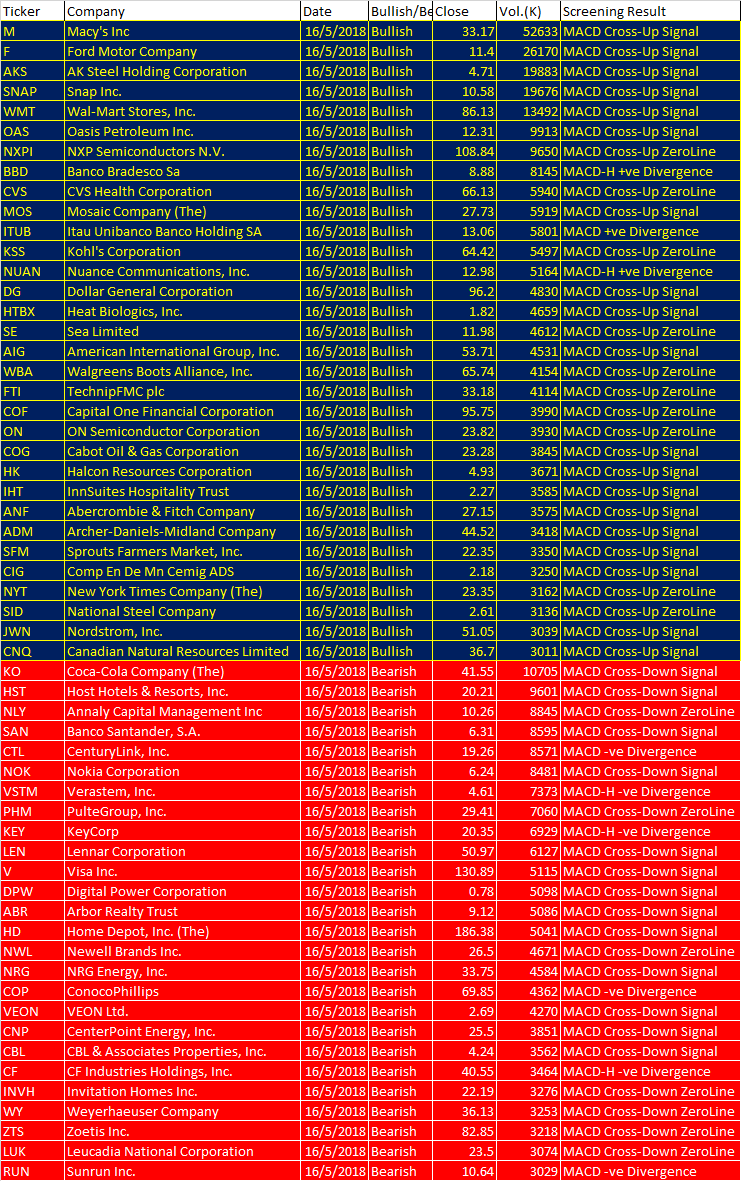

Free MACD Scan One-day US Stock MACD Screening Results on May 16 2018

Remember all setup can fail. This is true for all indicators. It is also true for MACD signals setup. See some of the MACD setup fail examples on this website.

These are the six types of MACD Signals:

- MACD line crosses above MACD signal – Bullish trend

- MACD line crosses above zero line – Bullish trend

- MACD Histogram +ve Divergence – Bullish trend

- MACD line crosses below MACD signal – Bearish trend

- MACD line crosses below zero line – Bearish trend

- MACD Histogram -ve Divergence – Bearish trend

| Ticker | Company | Date | Bullish/Bearish | Close | Vol.(K) | Screening Result |

| M | Macy’s Inc | 16/5/2018 | Bullish | 33.17 | 52633 | MACD Cross-Up Signal |

| F | Ford Motor Company | 16/5/2018 | Bullish | 11.4 | 26170 | MACD Cross-Up Signal |

| AKS | AK Steel Holding Corporation | 16/5/2018 | Bullish | 4.71 | 19883 | MACD Cross-Up Signal |

| SNAP | Snap Inc. | 16/5/2018 | Bullish | 10.58 | 19676 | MACD Cross-Up Signal |

| WMT | Wal-Mart Stores, Inc. | 16/5/2018 | Bullish | 86.13 | 13492 | MACD Cross-Up Signal |

| OAS | Oasis Petroleum Inc. | 16/5/2018 | Bullish | 12.31 | 9913 | MACD Cross-Up Signal |

| NXPI | NXP Semiconductors N.V. | 16/5/2018 | Bullish | 108.84 | 9650 | MACD Cross-Up ZeroLine |

| BBD | Banco Bradesco Sa | 16/5/2018 | Bullish | 8.88 | 8145 | MACD-H +ve Divergence |

| CVS | CVS Health Corporation | 16/5/2018 | Bullish | 66.13 | 5940 | MACD Cross-Up ZeroLine |

| MOS | Mosaic Company (The) | 16/5/2018 | Bullish | 27.73 | 5919 | MACD Cross-Up Signal |

| ITUB | Itau Unibanco Banco Holding SA | 16/5/2018 | Bullish | 13.06 | 5801 | MACD +ve Divergence |

| KSS | Kohl’s Corporation | 16/5/2018 | Bullish | 64.42 | 5497 | MACD Cross-Up ZeroLine |

| NUAN | Nuance Communications, Inc. | 16/5/2018 | Bullish | 12.98 | 5164 | MACD-H +ve Divergence |

| DG | Dollar General Corporation | 16/5/2018 | Bullish | 96.2 | 4830 | MACD Cross-Up Signal |

| HTBX | Heat Biologics, Inc. | 16/5/2018 | Bullish | 1.82 | 4659 | MACD Cross-Up Signal |

| SE | Sea Limited | 16/5/2018 | Bullish | 11.98 | 4612 | MACD Cross-Up ZeroLine |

| AIG | American International Group, Inc. | 16/5/2018 | Bullish | 53.71 | 4531 | MACD Cross-Up Signal |

| WBA | Walgreens Boots Alliance, Inc. | 16/5/2018 | Bullish | 65.74 | 4154 | MACD Cross-Up ZeroLine |

| FTI | TechnipFMC plc | 16/5/2018 | Bullish | 33.18 | 4114 | MACD Cross-Up ZeroLine |

| COF | Capital One Financial Corporation | 16/5/2018 | Bullish | 95.75 | 3990 | MACD Cross-Up ZeroLine |

| ON | ON Semiconductor Corporation | 16/5/2018 | Bullish | 23.82 | 3930 | MACD Cross-Up ZeroLine |

| COG | Cabot Oil & Gas Corporation | 16/5/2018 | Bullish | 23.28 | 3845 | MACD Cross-Up Signal |

| HK | Halcon Resources Corporation | 16/5/2018 | Bullish | 4.93 | 3671 | MACD Cross-Up Signal |

| IHT | InnSuites Hospitality Trust | 16/5/2018 | Bullish | 2.27 | 3585 | MACD Cross-Up Signal |

| ANF | Abercrombie & Fitch Company | 16/5/2018 | Bullish | 27.15 | 3575 | MACD Cross-Up Signal |

| ADM | Archer-Daniels-Midland Company | 16/5/2018 | Bullish | 44.52 | 3418 | MACD Cross-Up Signal |

| SFM | Sprouts Farmers Market, Inc. | 16/5/2018 | Bullish | 22.35 | 3350 | MACD Cross-Up Signal |

| CIG | Comp En De Mn Cemig ADS | 16/5/2018 | Bullish | 2.18 | 3250 | MACD Cross-Up Signal |

| NYT | New York Times Company (The) | 16/5/2018 | Bullish | 23.35 | 3162 | MACD Cross-Up ZeroLine |

| SID | National Steel Company | 16/5/2018 | Bullish | 2.61 | 3136 | MACD Cross-Up ZeroLine |

| JWN | Nordstrom, Inc. | 16/5/2018 | Bullish | 51.05 | 3039 | MACD Cross-Up Signal |

| CNQ | Canadian Natural Resources Limited | 16/5/2018 | Bullish | 36.7 | 3011 | MACD Cross-Up Signal |

| KO | Coca-Cola Company (The) | 16/5/2018 | Bearish | 41.55 | 10705 | MACD Cross-Down Signal |

| HST | Host Hotels & Resorts, Inc. | 16/5/2018 | Bearish | 20.21 | 9601 | MACD Cross-Down Signal |

| NLY | Annaly Capital Management Inc | 16/5/2018 | Bearish | 10.26 | 8845 | MACD Cross-Down ZeroLine |

| SAN | Banco Santander, S.A. | 16/5/2018 | Bearish | 6.31 | 8595 | MACD Cross-Down Signal |

| CTL | CenturyLink, Inc. | 16/5/2018 | Bearish | 19.26 | 8571 | MACD -ve Divergence |

| NOK | Nokia Corporation | 16/5/2018 | Bearish | 6.24 | 8481 | MACD Cross-Down Signal |

| VSTM | Verastem, Inc. | 16/5/2018 | Bearish | 4.61 | 7373 | MACD-H -ve Divergence |

| PHM | PulteGroup, Inc. | 16/5/2018 | Bearish | 29.41 | 7060 | MACD Cross-Down ZeroLine |

| KEY | KeyCorp | 16/5/2018 | Bearish | 20.35 | 6929 | MACD-H -ve Divergence |

| LEN | Lennar Corporation | 16/5/2018 | Bearish | 50.97 | 6127 | MACD Cross-Down Signal |

| V | Visa Inc. | 16/5/2018 | Bearish | 130.89 | 5115 | MACD Cross-Down Signal |

| DPW | Digital Power Corporation | 16/5/2018 | Bearish | 0.78 | 5098 | MACD Cross-Down Signal |

| ABR | Arbor Realty Trust | 16/5/2018 | Bearish | 9.12 | 5086 | MACD Cross-Down Signal |

| HD | Home Depot, Inc. (The) | 16/5/2018 | Bearish | 186.38 | 5041 | MACD Cross-Down Signal |

| NWL | Newell Brands Inc. | 16/5/2018 | Bearish | 26.5 | 4671 | MACD Cross-Down ZeroLine |

| NRG | NRG Energy, Inc. | 16/5/2018 | Bearish | 33.75 | 4584 | MACD Cross-Down Signal |

| COP | ConocoPhillips | 16/5/2018 | Bearish | 69.85 | 4362 | MACD -ve Divergence |

| VEON | VEON Ltd. | 16/5/2018 | Bearish | 2.69 | 4270 | MACD Cross-Down Signal |

| CNP | CenterPoint Energy, Inc. | 16/5/2018 | Bearish | 25.5 | 3851 | MACD Cross-Down Signal |

| CBL | CBL & Associates Properties, Inc. | 16/5/2018 | Bearish | 4.24 | 3562 | MACD Cross-Down Signal |

| CF | CF Industries Holdings, Inc. | 16/5/2018 | Bearish | 40.55 | 3464 | MACD-H -ve Divergence |

| INVH | Invitation Homes Inc. | 16/5/2018 | Bearish | 22.19 | 3276 | MACD Cross-Down ZeroLine |

| WY | Weyerhaeuser Company | 16/5/2018 | Bearish | 36.13 | 3253 | MACD Cross-Down ZeroLine |

| ZTS | Zoetis Inc. | 16/5/2018 | Bearish | 82.85 | 3218 | MACD Cross-Down ZeroLine |

| LUK | Leucadia National Corporation | 16/5/2018 | Bearish | 23.5 | 3074 | MACD Cross-Down ZeroLine |

| RUN | Sunrun Inc. | 16/5/2018 | Bearish | 10.64 | 3029 | MACD -ve Divergence |

Have fun! Reader must understand what MACD is all about before using the results.

Moses US Stock Scan

AmiBroker Academy.com

Disclaimer:

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.