December 29, 2014

Indicator

Traditionally stock market has been viewed as an indicator of the economy. When a large decreases in stock prices are reflective of a recession is near, and a large increases in stock prices suggest a economic growth is near.

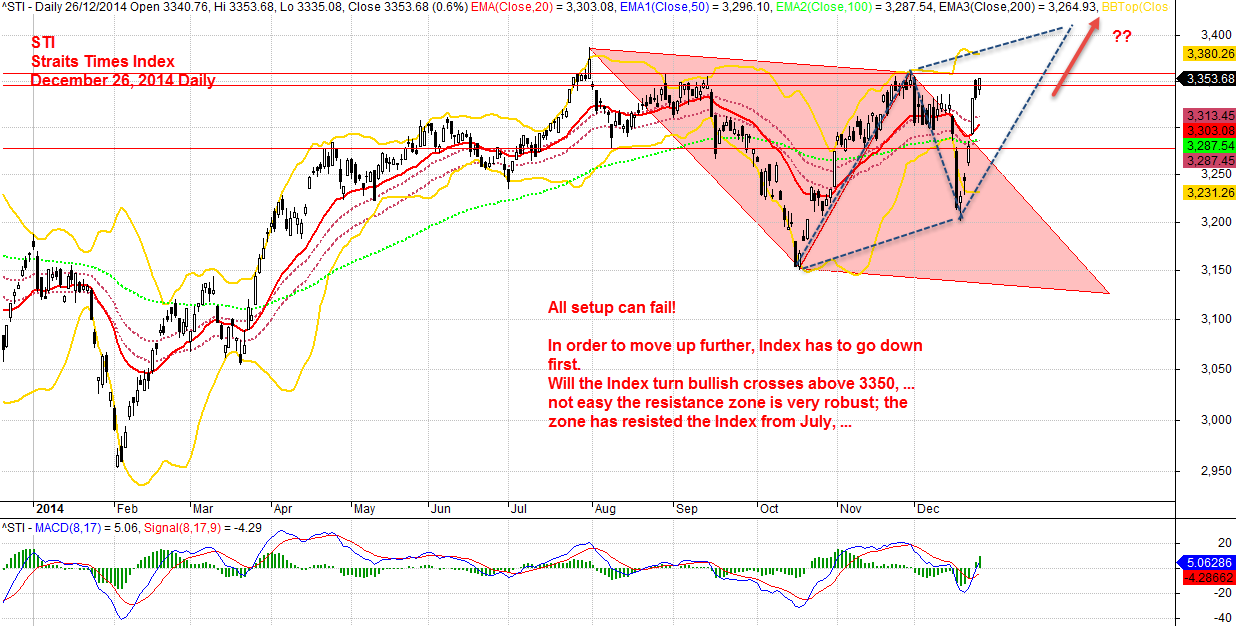

However, all setup can fail.

Now, the oil price decline has also forced the market to go into market deflation. Is this a recession? In Singapore, Channel NewsAsia has reported Singapore Experiences Deflation for First Time in 5 Years.

It seems relevant to further research this topic. May be this is the economy professionals’ job to prove which is which.

What is the implication when what if the price is fall slower than the market? See the articles on Slow Fall in Pump Prices Irks Consumers.

Straits Times Index, STI

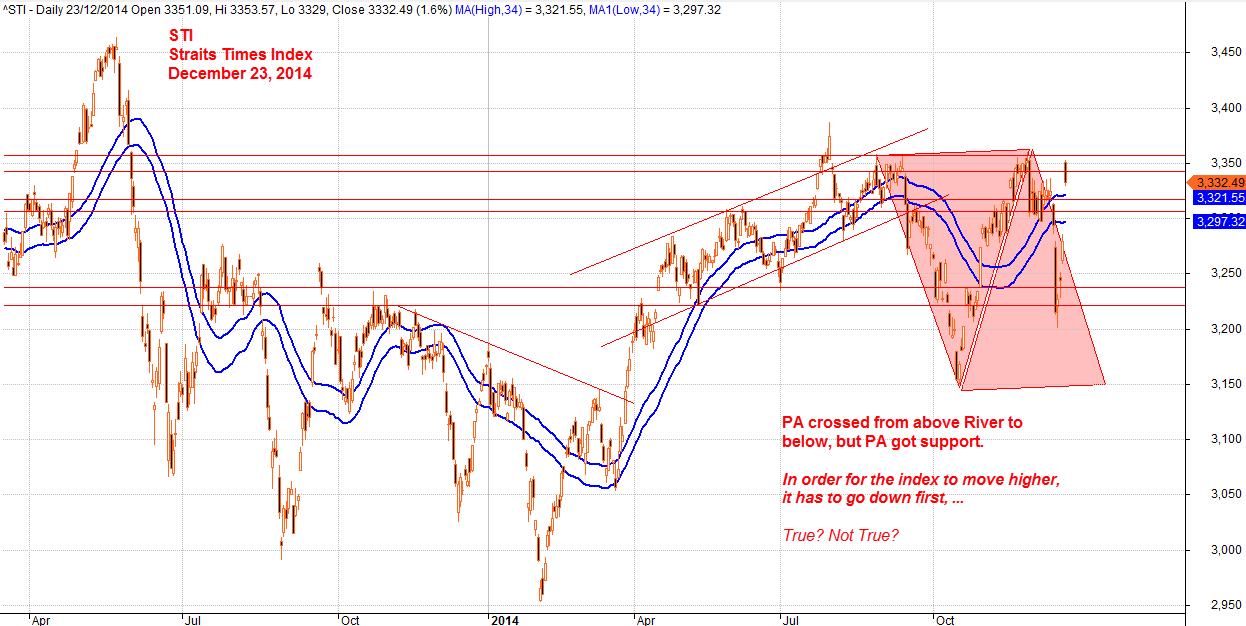

Singapore economy indicator, Straits Times Index, STI has been struggle since July this year to travel north. The zone has been giving the index a hard time. Who will except the economy is not as rosy as everyone would like it to be. Now, with the property is down, the index is struggling, and so on. Now, added a new element, the oil price has to come down.

The market will become very challenging; everyone has expected there is a inflation. Transportation is expected to go up, stamp fee has just went up, another phase of public transport fee is pending for increase. … Will any recalculate the new revenue for 2015; to revise down. Will see.

Again, this the the economic professionals to make a call.

This is a Star year for them.

Let examine the STI, December 23, 2014 Daily.

Let see the STI after Christmas, December 26, 2014 Daily.

Can 3350 to 3360 zone hold the index from traveling north?

Thanks for visiting the site, AmiBrokerAcademy.com.

Moses

DISCLAIMER

Stock trading is not a get rich quick scheme and it is high risk.

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should NOT be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids.

Trading is personal. You are responsible for your own trading decision.

The comment is the author personal experience. There is no intent for your believe and follow.