September 5, 2016

Dow Jones Industrial Average Charting

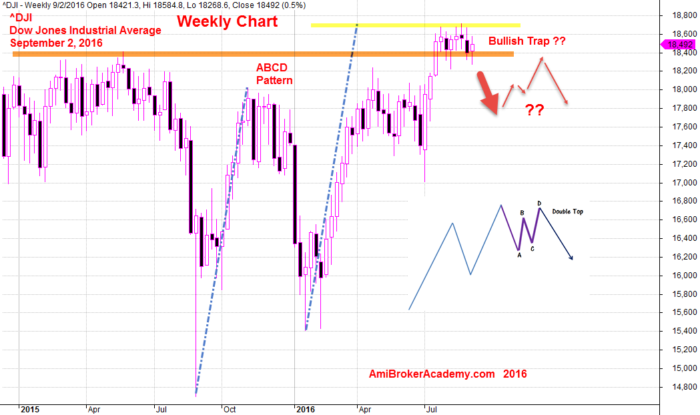

Gartley ABCD chart pattern is a good measure on the trend and the price direction. In order for the price to be able to move higher, the price has to pullback first. When it is difficult to decide, you and add an indicator to help to provide more information. See the next chart, price with MACD to find more clue.

September 2, 2016 Dow Jones Industrial Average ^DJI Weekly Chart

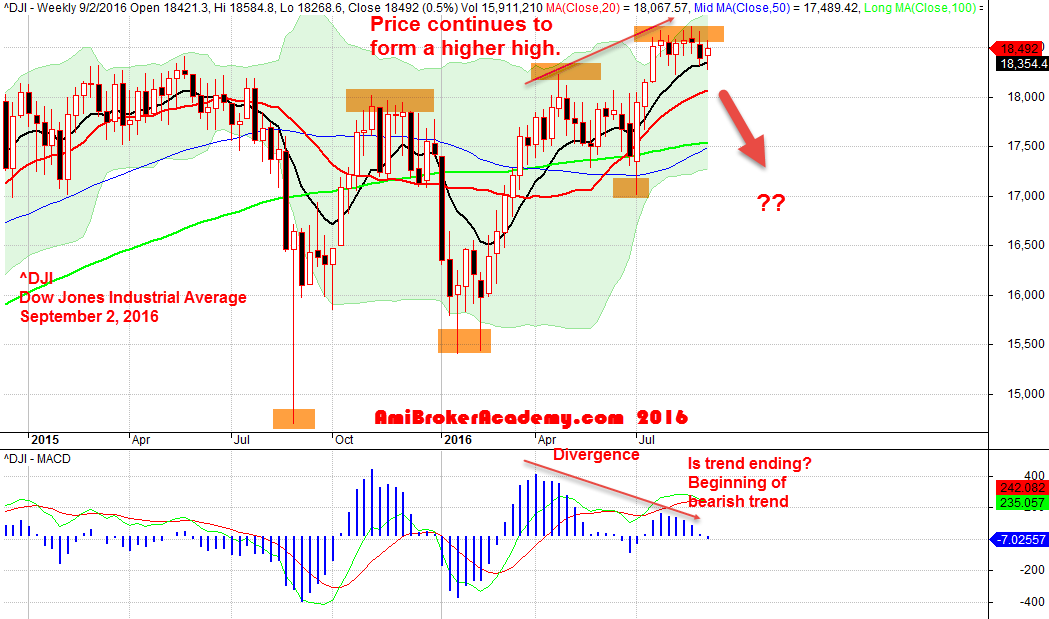

Dow Jones Industrial Average ^DJI and MACD Indicator

To add more confirmation on where the price might move, indicator or indicators are good choice. MACD is a leading indicator, the convergence or divergence signal a possibility of ending of trend.

Technical Analysis

Picture Worth a Thousand Words, MACD shows divergence, there is a possibility of price action change, the trend may be at the start of bearish trend. Trade with eye open, look out for a new valley, and lower high and lower low.

One of the past observation is when dollars, greenback is strong, the stock market is weak, But the index does not seem to be in this order. It could be the market needs more time. True or true? Will see.

September 2, 2016 Dow Jones Industrial Average Weekly with MACD indicator

AmiBrokerAcademy.com

Disclaimer: All information, data and material contained, presented, or provided on amibrokeracademy.com is for educational purposes only. It is not to be construed or intended as providing trading or legal advice. Decisions you make about your trading or investment are important to you and your family, therefore should be made in consultation with a competent financial advisor or professional. We are not financial advisor and do not claim to be. Any views expressed here-in are not necessarily those held by amibrokeracademy.com. You are responsible for your trade decision and wealth being.