October 19, 2018

Thanks for visiting the site.

‘October Effect’

October effect is a theory that stocks tend to decline during the month of October.

Moses Stock Stories

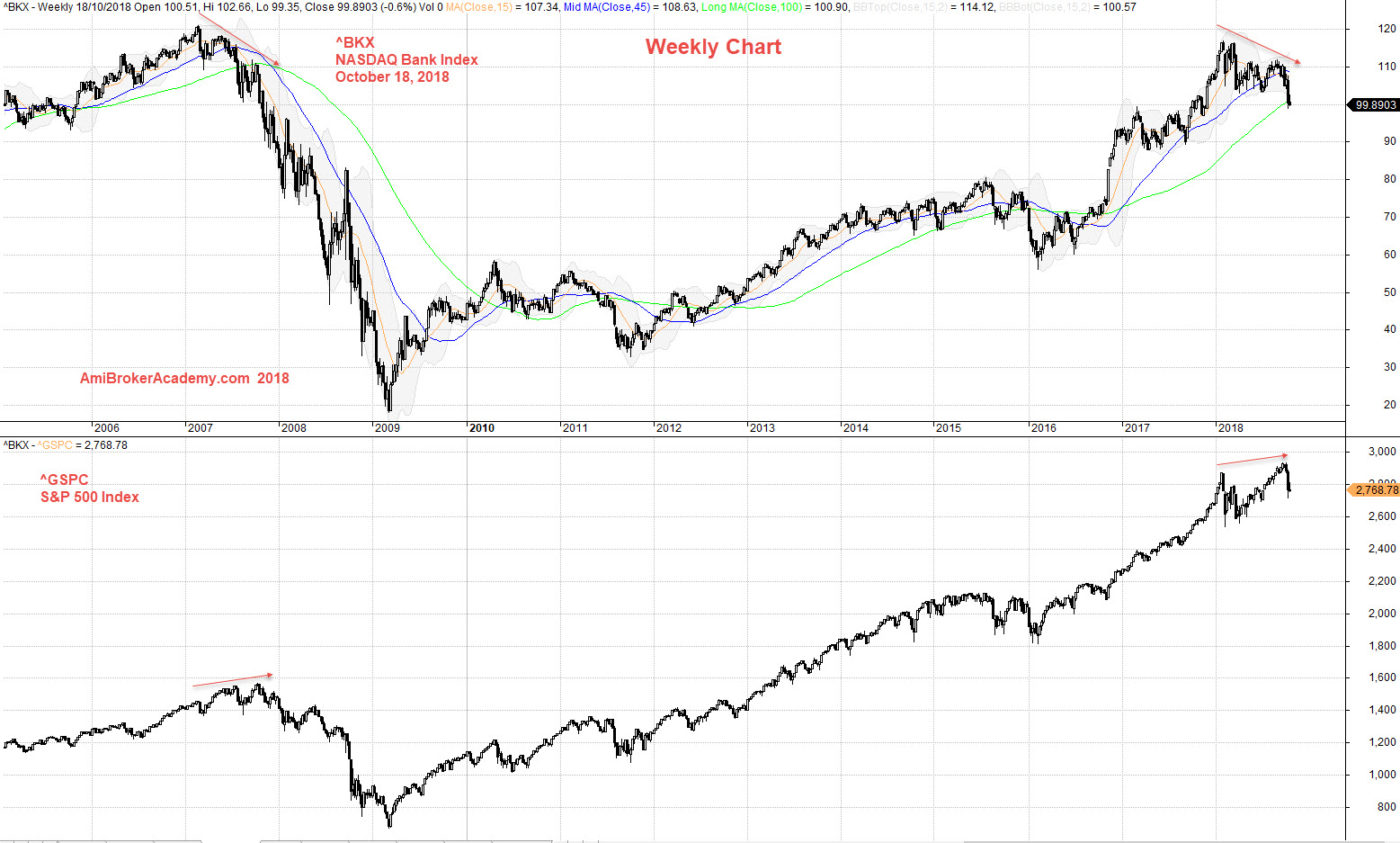

^BKX NASDAQ Bank Index and S&P 500 Index Correlation Charting

Study NASDAQ Bank index and S&P 500 Index, see price action picture worth a thousand words. See the marking on both chart, at year 2007 and 2018. Bank Index declined but S&P 500 Index rally at year 2007, again at year 2018, Bank Index again shows decline, but S&P 500 Index again rally.

Bank Index seems to have “October Effect”, the price action has declined.

Trade with your eyes open.

Manage Your Risk!

October 18, 2018 NASDAQ Bank Index and S&P 500 Index Correlation

If you can see the whole chart, “press Ctrl and -” to zoom out to see the entire chart.

Why Study the two indices such as S&P 500 Index and NASDAQ Bank Index?

Do you know why we study the correlation of the two indexes? Looking back at the patterns at that time. From the pattern, now 2018 seems to have the same or similar trend. This gives a strong indication that there may be a similar pattern going to happen at 2018. As it has not seen since 2008. That is why we study the historical correlation. Or put it in another way, technical analysis guys are always looking for pattern that could repeat again, and again. But trade with eyes open. Manage your risk, all setup can fail.

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.