Singapore Stock Analysis, Capitacommercial Trust, C61U

CapitaCommercial Trust (CCT), listed in Singapore Stock Exchange, SGX, stock code, C61U. It is a publicly owned real estate investment fund, the first commercial real estate investment trust (REIT) listed in SGX.

1) CapitaCommercial Trust owns 9 quality commercial buildings in the Central Singapore.

2) CCT also has 30% stake in Quill Capita Trust and 7.4% stake in Malaysia Commercial Development Fund, CapitaLand’s first and largest private real estate fund.

Quill Capital Trust is a commercial REIT listed on Bursa Malaysia Securities Berhad. Quill Capital Trust owns commercial properties in Malaysia.

With the 2012 global economy projection, the Europe zone financial situation and US economy. Plus many of the new buildings at Central Singapore expect to commercial ready. Can CCT owned properties utilization remains good and command a high price? It all depends on the supply and demand on the office availability. Is the Central Singapore over supply with too many commercial building? Besides that there has been great effort for many of the company progressively moving their operations outside of the business restrict for the last few years.

Technical Analysis

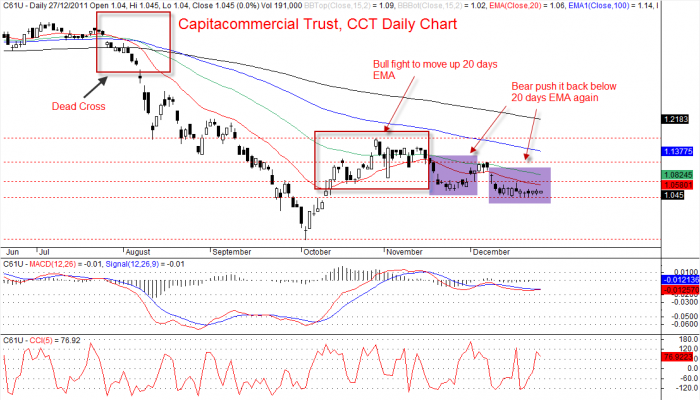

From the technical analysis, the price action has been sideways after falling since end July this year. The price tries to cross up 20 day EMA at the beginning of October, but could not sustain. The bear finally return power to push the price below 20 days EMA at the beginning of November. Now the price has been moving in narrow range for nearly fifteen days. Hope it can accumulate enough positive energy to burst out and drive away the bear.

The bull can only fight layer at a time; first 50 EMA, followed by 100 EMA and finally 200 EMA. Wait for price action confirmation before entry.

See the daily and weekly chart for the price action for CCT.

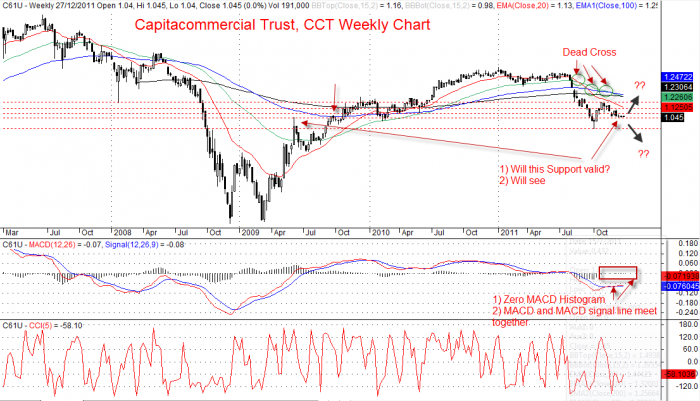

Capitacommercial Trust, C61U Weekly Chart

Capitacommercial Trust, C61U Weekly Chart

Capitacommercial Trust, C61U Daily Chart

DSICLAIMER

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should not be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.