June 12, 2017

Did you ring a bell last Friday on NASDAQ Index fall? Hindenburg Omen Indicator might be working. All indicators are lacking, the important is what is your strategy, your trading plan. Sell high?! Be mindful.

Volatility Index Analysis

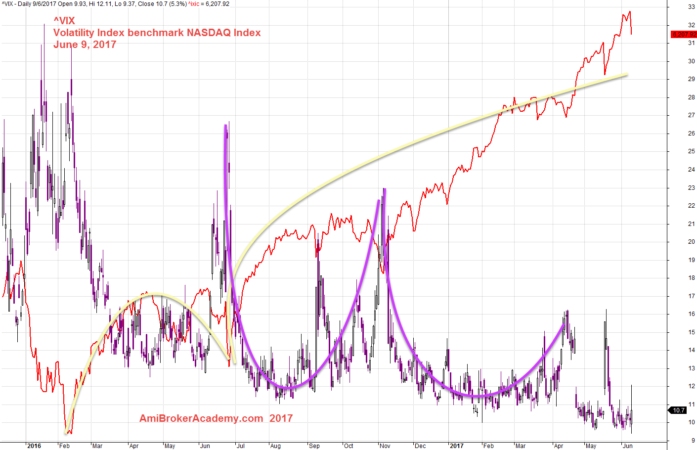

Volatility is an indicator for Fear and Greed. Picture worth a thousand words. See the benchmark between NASDAQ and Volatility Index. It took ever months for the VIX to drop from the high to low and go back up again. But it only took half of the time to form a double top. Now the VIX has even gone lower. What is the market sentiment.

June 9, 2017 Volatility Index and NASDAQ Index

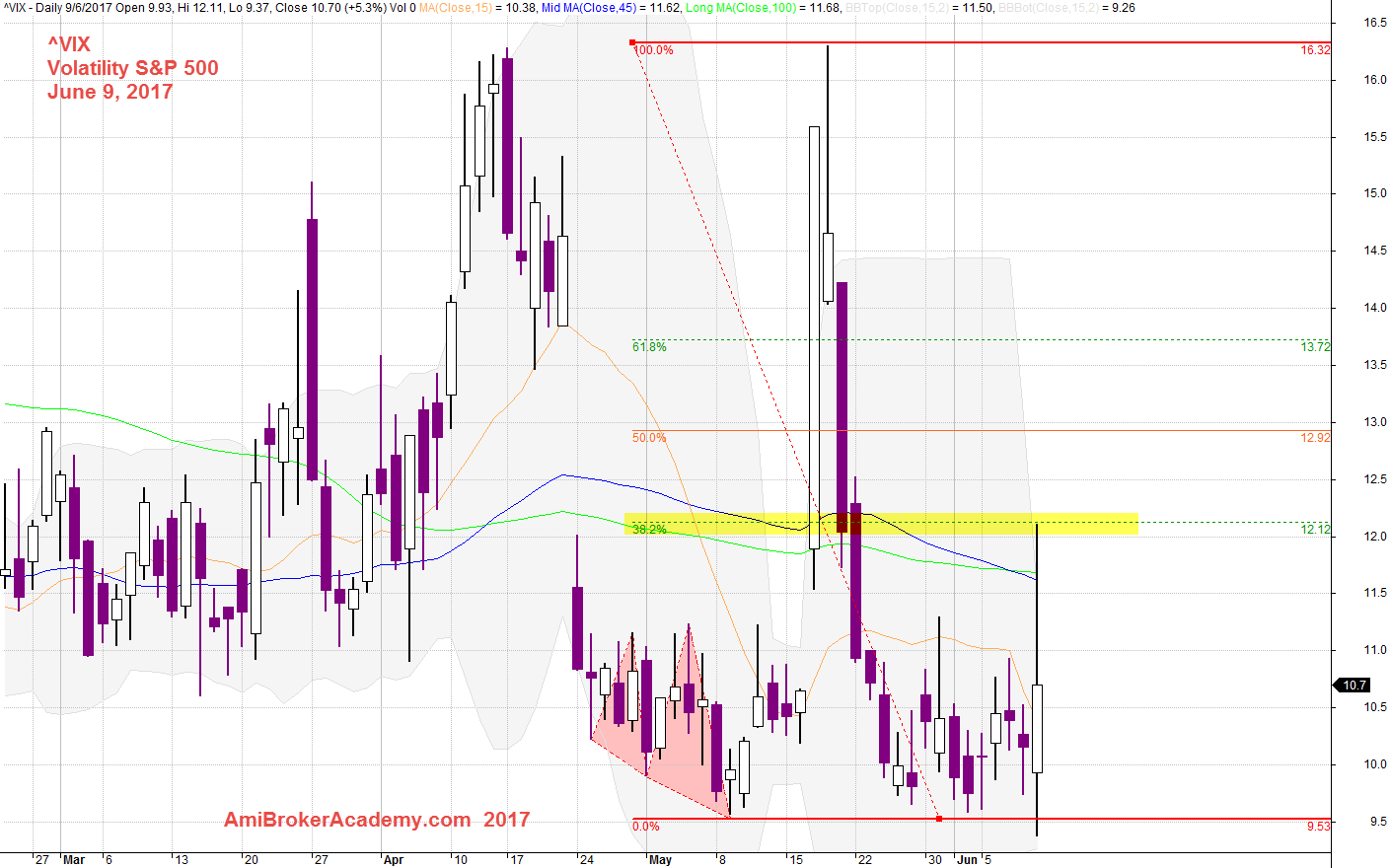

Volatility Index Analysis

The volatility index after rallying has now backed down to retest the previous low. The major bottom should be in place. The current momentum suggesting that volatility index is starting to increase the pace. This is one index you might want to watch very closely.

June 9, 2017 Voliatility Index and Fibonacci Levels

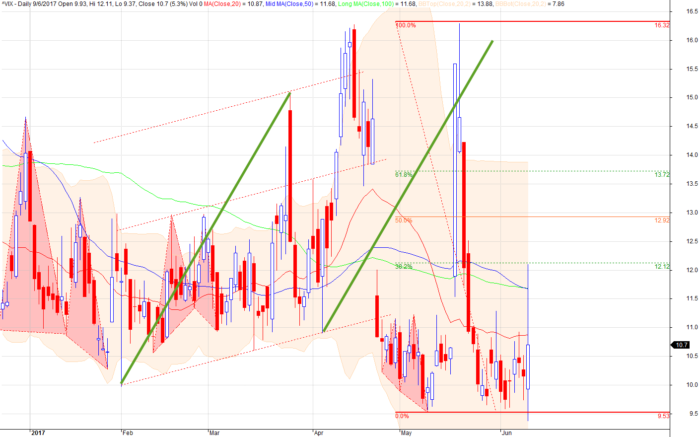

Volatility Index Analysis and ABCD Chart Pattern

Picture worth a thousand words. You can always find ABCD Chart pattern, the market is always move in a zigzag manner.

June 9, 2017 Volatility and ABCD Chart Pattern

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.