August 10, 2017

As Said, No Right No Wrong

There is no right no wrong in trading. Especially for Elliot Waves Pattern. See example below and you will appreciate why no right no wrong. Compare the charts in this posting with the earlier posting you will better understand why no two Elliott Waves engineers to have the same conclusion.

Both postings show the Elliott Wave Pattern, but the count is different. … See chart for more. The following is bigger picture as compare to the earlier posting. Have fun learning.

Remember Ralph Nelson Elliott Discovery and Development Elliott Wave Principle in the 1930s.

Every impulse wave consists of three impulse waves and two corrective waves. And because of this no one Elliott Wave engineers can agree with each other on the wave count. Haha. This is also made trading so difficult.

There is no right no wrong in trading. You will understand this later. See the next few posting for details.

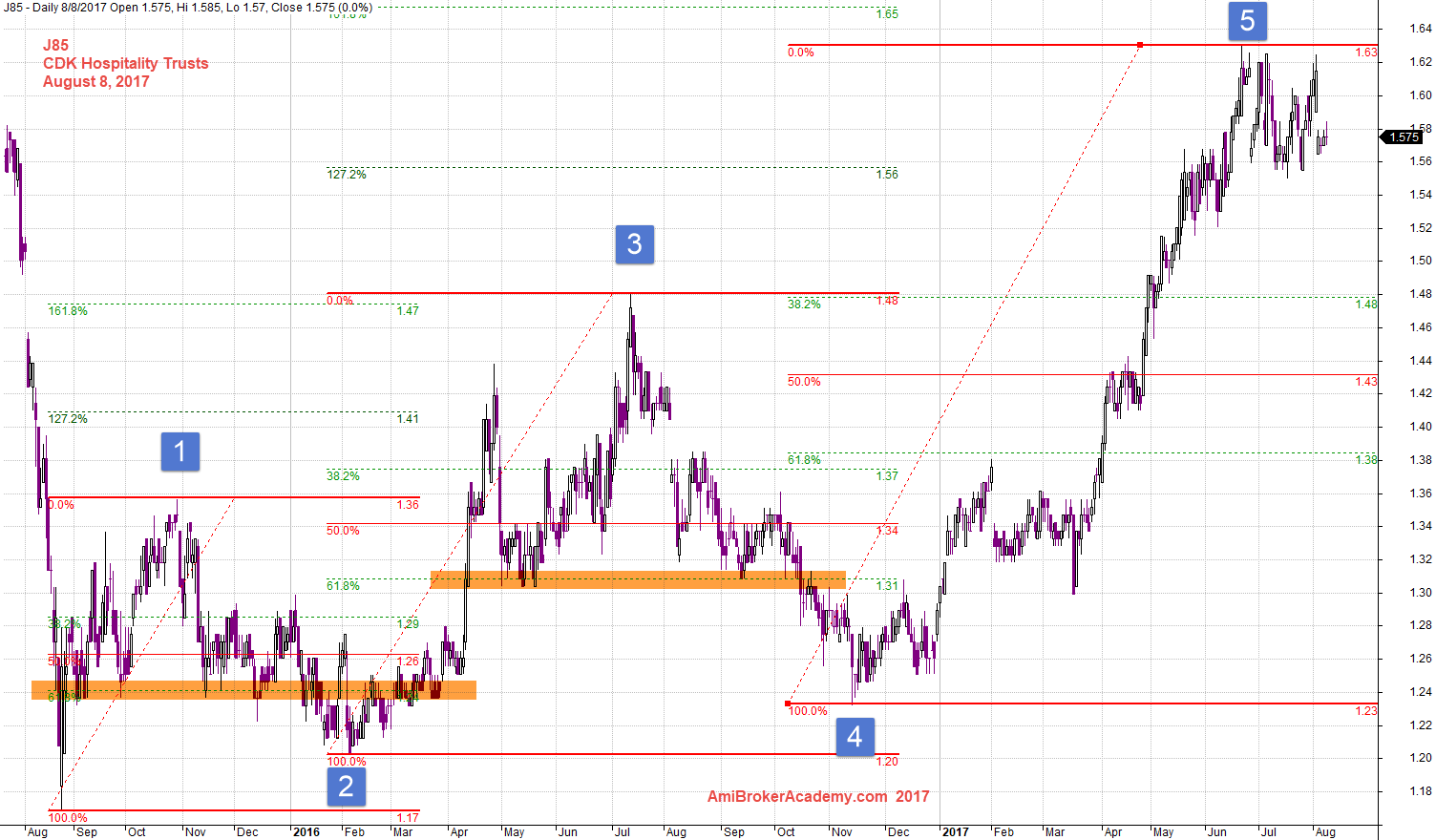

J85 CDL Hospitality Trusts and Big Elliott Wave Mapping

See chart for more, picture worth a thousand words.

We still see five waves, three impulsive waves and two corrective waves. This is what Ralph Nelson Elliott outlines the wave pattern. But this count this different from the earlier posting.

Can you see the different?

August 8, 2017 CDL Hospitality Trusts and Big Elliott Wave

J85 CDL Hospitality Trusts and Big Elliott Wave Mapping and Fibonacci Retracement Levels

See chart for more, picture worth a thousand words.

See the retracement for more.

August 8, 2017 CDL Hospitality Trusts and Big Elliott Wave and Fib Retracement Levels

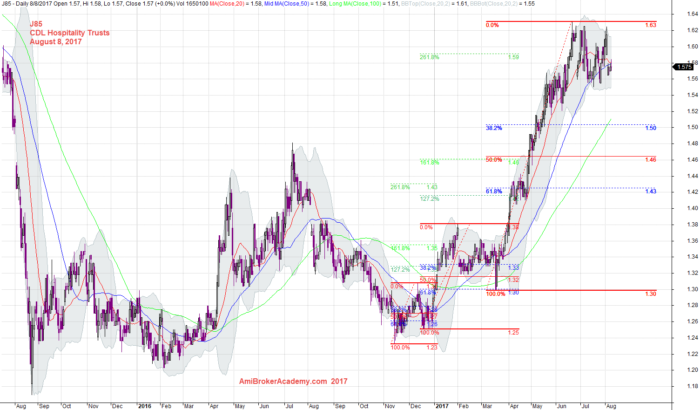

Left The Earlier Posting Inside Big Elliott Wave Mapping and Fibonacci Retracement Levels

Picture worth a thousand words.

August 8, 2017 CDL Hospitality Trusts and Two Elliott Wave and Fib Retracement

Earlier Posting, J85 CDL Hospitality Trusts and Elliott Wave | AmiBrokerAcademy.com

Pink Box Big Elliott Wave Mapping and Light Green Box Small Elliott Wave Mapping

Picture worth a thousand words.

August 8, 2017 CDL Hospitality Trusts Each Box a Elliott Wave Pattern

Thanks for visit the site here. You could also find free MACD scan here in this site too.

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.