15 April, 2018

Oscillator Moving Average Convergence Divergence

MACD is a popular trend following momentum indicator that shows the relationship of two moving averages of prices action; the MACD line and signal line.

You could reference to the MACD signals to manage your trade risk.

You Could Find Four MACD Signals:

- Crossovers – Sell Strategy, MACD crosses below the signal line. Buy Strategy, MACD rallies above the signal line. It is advisable to wait for confirmation to reduce possible whipsaw.

- Divergence – The security price action diverges from the MACD. It signals the end of the current trend.

- Cross Zero Line – MACD moves above or below zero line. Upward trend: Cross above zero line, short MA above long MA. Downward trend: Cross below zero line, short MA below long MA.

- Dramatic rise or fall – MACD rises or decline dramatically – when the shorter moving average pulls away from the longer-term moving average – Oversold or Overbought.

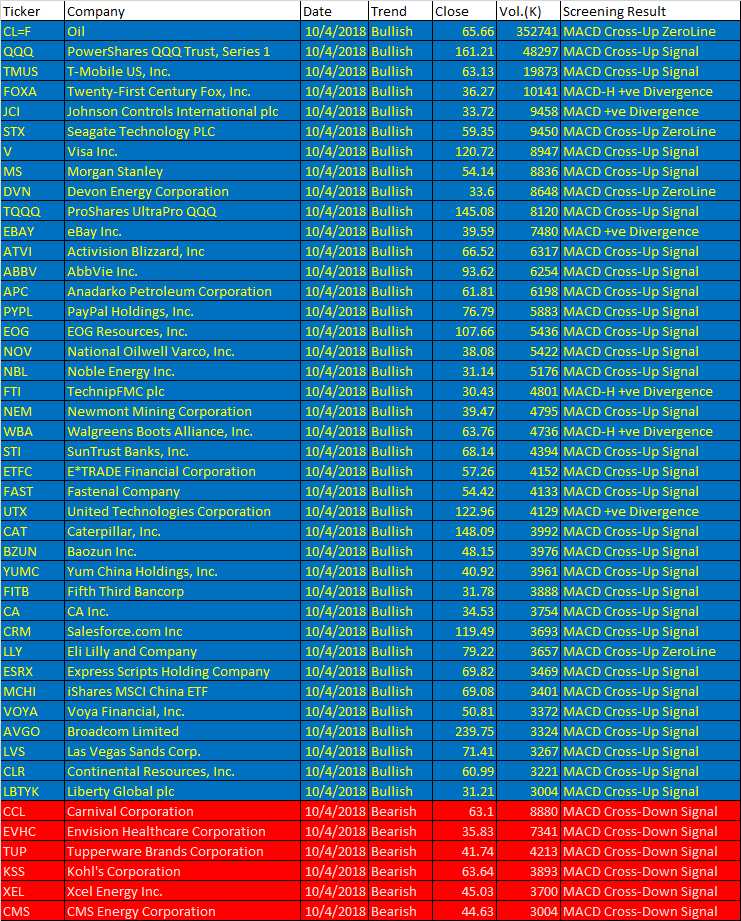

Free One-day US Stock MACD Screening Results on April 10 2018

Remember all setup can fail. This is true for all indicators. It is also true for MACD signals setup. See some of the MACD setup fail examples on this website.

April 10, 2018 US Stock One-day MACD Signals

- MACD line crosses above MACD signal – Bullish trend

- MACD line crosses above zero line – Bullish trend

- MACD Histogram +ve Divergence – Bullish trend

- MACD line crosses below MACD signal – Bearish trend

- MACD line crosses below zero line – Bearish trend

- MACD Histogram -ve Divergence – Bearish trend

| Ticker | Company | Date | Trend | Close | Vol.(K) | Screening Result |

| CL=F | Oil | 10/4/2018 | Bullish | 65.66 | 352741 | MACD Cross-Up ZeroLine |

| QQQ | PowerShares QQQ Trust, Series 1 | 10/4/2018 | Bullish | 161.21 | 48297 | MACD Cross-Up Signal |

| TMUS | T-Mobile US, Inc. | 10/4/2018 | Bullish | 63.13 | 19873 | MACD Cross-Up Signal |

| FOXA | Twenty-First Century Fox, Inc. | 10/4/2018 | Bullish | 36.27 | 10141 | MACD-H +ve Divergence |

| JCI | Johnson Controls International plc | 10/4/2018 | Bullish | 33.72 | 9458 | MACD +ve Divergence |

| STX | Seagate Technology PLC | 10/4/2018 | Bullish | 59.35 | 9450 | MACD Cross-Up ZeroLine |

| V | Visa Inc. | 10/4/2018 | Bullish | 120.72 | 8947 | MACD Cross-Up Signal |

| MS | Morgan Stanley | 10/4/2018 | Bullish | 54.14 | 8836 | MACD Cross-Up Signal |

| DVN | Devon Energy Corporation | 10/4/2018 | Bullish | 33.6 | 8648 | MACD Cross-Up ZeroLine |

| TQQQ | ProShares UltraPro QQQ | 10/4/2018 | Bullish | 145.08 | 8120 | MACD Cross-Up Signal |

| EBAY | eBay Inc. | 10/4/2018 | Bullish | 39.59 | 7480 | MACD +ve Divergence |

| ATVI | Activision Blizzard, Inc | 10/4/2018 | Bullish | 66.52 | 6317 | MACD Cross-Up Signal |

| ABBV | AbbVie Inc. | 10/4/2018 | Bullish | 93.62 | 6254 | MACD Cross-Up Signal |

| APC | Anadarko Petroleum Corporation | 10/4/2018 | Bullish | 61.81 | 6198 | MACD Cross-Up Signal |

| PYPL | PayPal Holdings, Inc. | 10/4/2018 | Bullish | 76.79 | 5883 | MACD Cross-Up Signal |

| EOG | EOG Resources, Inc. | 10/4/2018 | Bullish | 107.66 | 5436 | MACD Cross-Up Signal |

| NOV | National Oilwell Varco, Inc. | 10/4/2018 | Bullish | 38.08 | 5422 | MACD Cross-Up Signal |

| NBL | Noble Energy Inc. | 10/4/2018 | Bullish | 31.14 | 5176 | MACD Cross-Up Signal |

| FTI | TechnipFMC plc | 10/4/2018 | Bullish | 30.43 | 4801 | MACD-H +ve Divergence |

| NEM | Newmont Mining Corporation | 10/4/2018 | Bullish | 39.47 | 4795 | MACD Cross-Up Signal |

| WBA | Walgreens Boots Alliance, Inc. | 10/4/2018 | Bullish | 63.76 | 4736 | MACD-H +ve Divergence |

| STI | SunTrust Banks, Inc. | 10/4/2018 | Bullish | 68.14 | 4394 | MACD Cross-Up Signal |

| ETFC | E*TRADE Financial Corporation | 10/4/2018 | Bullish | 57.26 | 4152 | MACD Cross-Up Signal |

| FAST | Fastenal Company | 10/4/2018 | Bullish | 54.42 | 4133 | MACD Cross-Up Signal |

| UTX | United Technologies Corporation | 10/4/2018 | Bullish | 122.96 | 4129 | MACD +ve Divergence |

| CAT | Caterpillar, Inc. | 10/4/2018 | Bullish | 148.09 | 3992 | MACD Cross-Up Signal |

| BZUN | Baozun Inc. | 10/4/2018 | Bullish | 48.15 | 3976 | MACD Cross-Up Signal |

| YUMC | Yum China Holdings, Inc. | 10/4/2018 | Bullish | 40.92 | 3961 | MACD Cross-Up Signal |

| FITB | Fifth Third Bancorp | 10/4/2018 | Bullish | 31.78 | 3888 | MACD Cross-Up Signal |

| CA | CA Inc. | 10/4/2018 | Bullish | 34.53 | 3754 | MACD Cross-Up Signal |

| CRM | Salesforce.com Inc | 10/4/2018 | Bullish | 119.49 | 3693 | MACD Cross-Up Signal |

| LLY | Eli Lilly and Company | 10/4/2018 | Bullish | 79.22 | 3657 | MACD Cross-Up ZeroLine |

| ESRX | Express Scripts Holding Company | 10/4/2018 | Bullish | 69.82 | 3469 | MACD Cross-Up Signal |

| MCHI | iShares MSCI China ETF | 10/4/2018 | Bullish | 69.08 | 3401 | MACD Cross-Up Signal |

| VOYA | Voya Financial, Inc. | 10/4/2018 | Bullish | 50.81 | 3372 | MACD Cross-Up Signal |

| AVGO | Broadcom Limited | 10/4/2018 | Bullish | 239.75 | 3324 | MACD Cross-Up Signal |

| LVS | Las Vegas Sands Corp. | 10/4/2018 | Bullish | 71.41 | 3267 | MACD Cross-Up Signal |

| CLR | Continental Resources, Inc. | 10/4/2018 | Bullish | 60.99 | 3221 | MACD Cross-Up Signal |

| LBTYK | Liberty Global plc | 10/4/2018 | Bullish | 31.21 | 3004 | MACD Cross-Up Signal |

| CCL | Carnival Corporation | 10/4/2018 | Bearish | 63.1 | 8880 | MACD Cross-Down Signal |

| EVHC | Envision Healthcare Corporation | 10/4/2018 | Bearish | 35.83 | 7341 | MACD Cross-Down Signal |

| TUP | Tupperware Brands Corporation | 10/4/2018 | Bearish | 41.74 | 4213 | MACD Cross-Down Signal |

| KSS | Kohl’s Corporation | 10/4/2018 | Bearish | 63.64 | 3893 | MACD Cross-Down Signal |

| XEL | Xcel Energy Inc. | 10/4/2018 | Bearish | 45.03 | 3700 | MACD Cross-Down Signal |

| CMS | CMS Energy Corporation | 10/4/2018 | Bearish | 44.63 | 3004 | MACD Cross-Down Signal |

Have fun!Users must understand what MACD is all about before using the results.

Moses US Stock Scan

AmiBroker Academy.com

Disclaimer:

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.