March 5, 2017

Moses Stock Trading Blog Site – AmiBrokerAcademy.com

Thank you for visiting the amibrokeracademy.com blog site. No one doing analysis like what you read here.

Welcome to Moses’s US Stock Analysis @ AmiBrokerAcademy.com.

We asked in our last posting are you a Scalper, Swing trader or Investor?

Which one you belong to, there is no right no wrong. And again, these are just terms that the market try to define the type of trading profile you belong too. Be it scalper or investor, so what as long as you make money.

So, just trade what you like.

If you want to know what we said, see the last posting here. We make many posting a day as time, last posting is just a expression. It many not means the previous one. Have fun!

Anticipating a Bull Trend Continuation

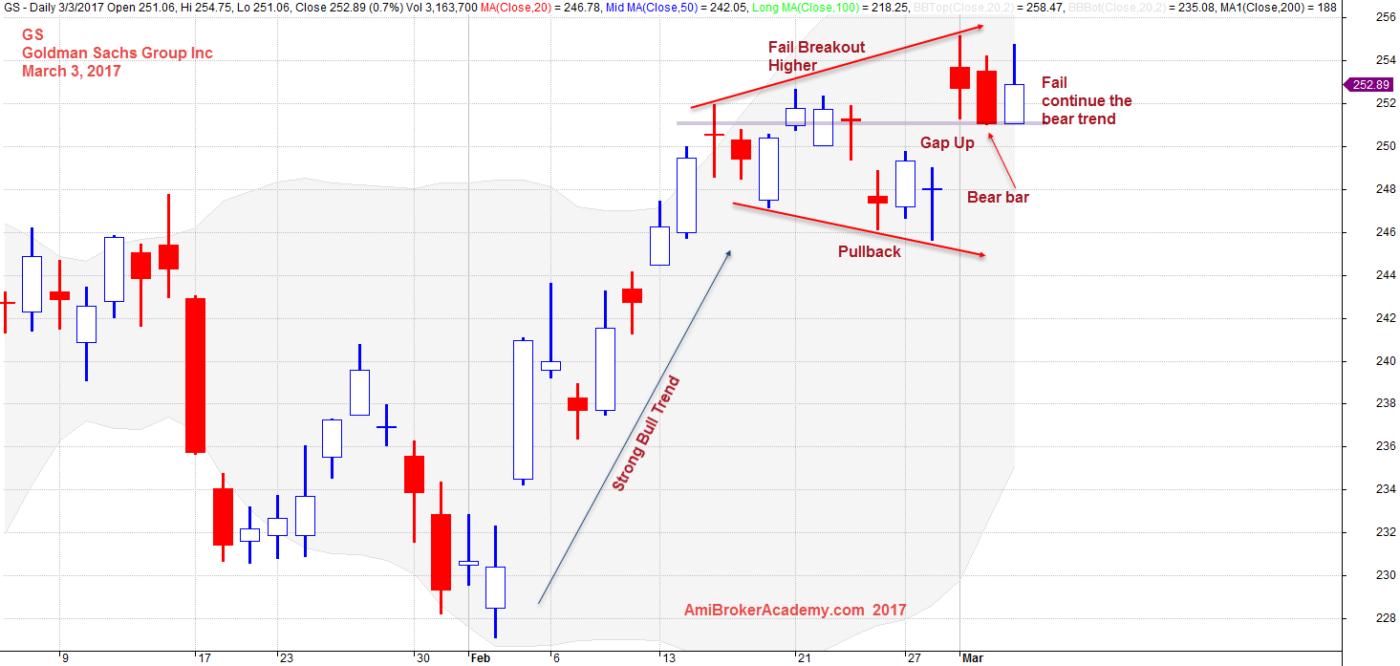

GS Goldman Sachs Group Inc Stock Update on March 3, 2017

From the chart, you can see there is a two leg down and a rejection; the trend revere up. Starting February this year, the bull has a great ride up. But does not last long, at the mid of the month the bar start to go exhausted and and become irregular. Some up some down, and two bull continuation fail after pullback. The pullback become larger one after another. So how?

Asides from the fundamental, a strong up move after the range from mid January 2017. It follows a price pull back. We see a inside bar after the pullback low. The bull inside bar signal a trend continuation. Not as strong bull trend as the first leg up, but still a bull trend with one bear bar. After the large bull the trend exhausted; range bar, doji. Both the bull and bear are tire. Both decide to take a break.The trend starts to go sideways, in the flag. It is a bull flag, of course it can fail. We have three touch points on top and three below.

The bull is still strong, quite strong. See the last bar. Just refuse to go bear. But in a deeper sense, the long tails are no go sign, especially it is equal length as the body. This is bull win first and bear step in later. Although it is not a doji candle, but it is really a range bar. Bull get drive back down half way, all the bull effort are gone. The scalper was betting in buying one tick higher was right after the bear bar. But soon become nasty, when the day ended half way only. More bull will take profit, and bear continue to sell. …

The said sideways may continue, and the range will open up further. The level drawn is very important at this point, if the price hold and bounce up and move north. Then the whole story change, the plan has to rewrite. Otherwise, it is alright to stand aside and let the bull and bear settle their fight.

Now, as said on the chart, to reduce your risk, wait a bull bar (bull bar close, in this case is the EOD bar) and buy one tick higher. Or just risk buying one tick above the current bull high.

Remember, we are only sharing the experience and for the education purpose. We do not provide buy or sell signal, please seek your trade adviser for their expert advice. You are responsible for your own action. Trading is personal, even you have enter the trade at the exact same manner, you may not make money. Trading is not a get rich fast business like many have advertise. It needs a lot of hard work and good money and risk management. Have fun! Happy learning.

March 8, 2017 Goldman Sachs Group Daily

If you can not see the whole chart, scales down you browser.

Moses US Stock Analysis

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.