July 2, 2017

Dow Jones Transportation and MACD Indicator

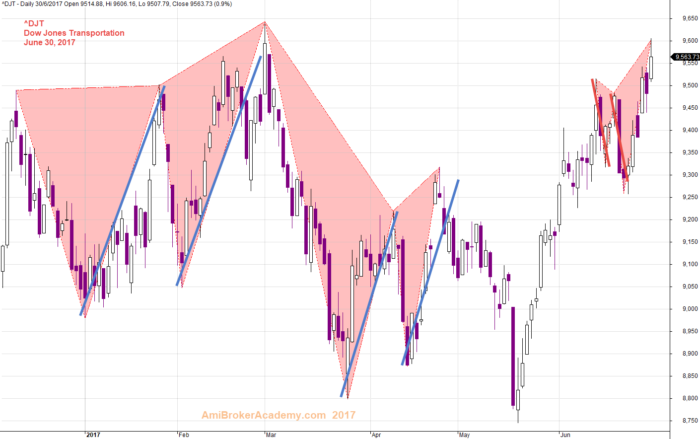

Picture worth a thousand words.

As the saying goes, professional buy retracement and this is not a good time to enter buy.

We see the trend is bullish. There is a MACD cross up signal right after the cross down signal.

June 30, 2017 Dow Jones Transportation and MACD Signals

Gartley ABCD and Dow Jones Transportation

Connect the high, low and high, we form triangle. Two triangles become a butterfly. In fact we see number of ABCD Chart pattern here.

June 30, 2017 Dow Jones Transportation and Gartley and ABCD

Risk

If you can wait, remember professional likes to wait for retracement. This will minimize the risk, as your stop loss will be smaller. So, picture worth a thousand words. In this case study, if you wait for pullback, you will have a handson gain; you can enjoy a big move in short time. Waw!

Professional Try Not to Buy and Sell Higher!

Professional trade on retracement.

What if you thought you miss and you jump in. You may be ended up you can not sleep for a days. … As you might be buy high and expecting to sell higher.

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.