Welcome to AmiBrokerAcademy.com.

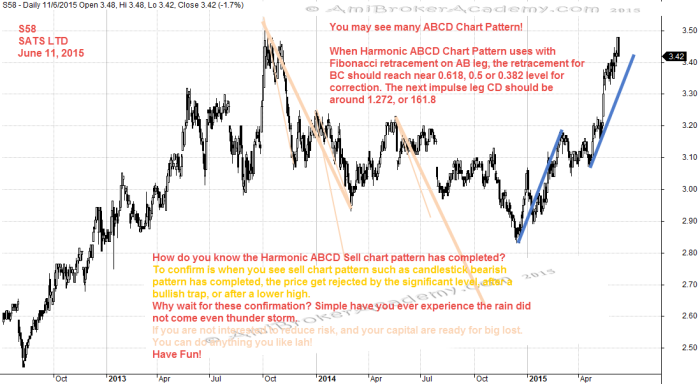

You may see many Harmonic ABCD Chart Pattern in the SATS Ltd chart pattern, but how you decide to sell or buy. To reduce you risk in loss the money. I will advice you to consider to sell when the price is near resistance, especially near significant resistance. To reduce further your risk is after near significant resistance, the price action has also completed bearish chart pattern. Next to reduce the risk further is after the price form a lower high, or the price has retested the same high, or there is potential bull trap. The more bearish bias signals will reduce your risk further.

In one of the Collins Seow monthly revision class, one of the student told Collins that in stead of sell she buy. Collins told her that no problem, and said “I assume you have many reason to buy. You only buy when you have found many reasons to buy, otherwise you just follow blindly.” Collins suggested she cut lost as soon as the market turns against her.

So, the bottom line is you only buy or sell when you have find many reason to support your trade decision and do not be a blind follower.

SATS Ltd Stock Scan

You can find many Harmonic ABCD Chart Pattern in SATS Ltd chart below. All chart pattern will only be correct when it completed. If you speculate any chart pattern, the chart pattern is always correct until it is proven wrong at the completion.

How do you trade Harmonic ABCD Chart Pattern?

How do you know the Harmonic ABCD Sell chart pattern has completed?

1) To confirm is when you see sell chart pattern such as candlestick bearish pattern has completed, the price get rejected by the significant level, after a bullish trap, or after a lower high.

Why wait for these confirmation?

Simple have you ever experience the rain did not come even thunder storm.

If you are not interested to reduce risk, and your capital are ready for big lost. You can do anything you like lah!

You can read about other Singapore Stocks analysis in this website.

Thanks for visiting the website.

Moses

DISCLAIMER

Site advice, “Stock trading is not a get rich quick scheme and it is high risk”.

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should NOT be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

The website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids.