1 November, 2018

Thanks for visiting the site.

We highlighted in our last posting that we use non-standard MACD setting, so we generated a faster MACD signals. In other words, our posting will give you a heads-up on up coming changes. Be aware.

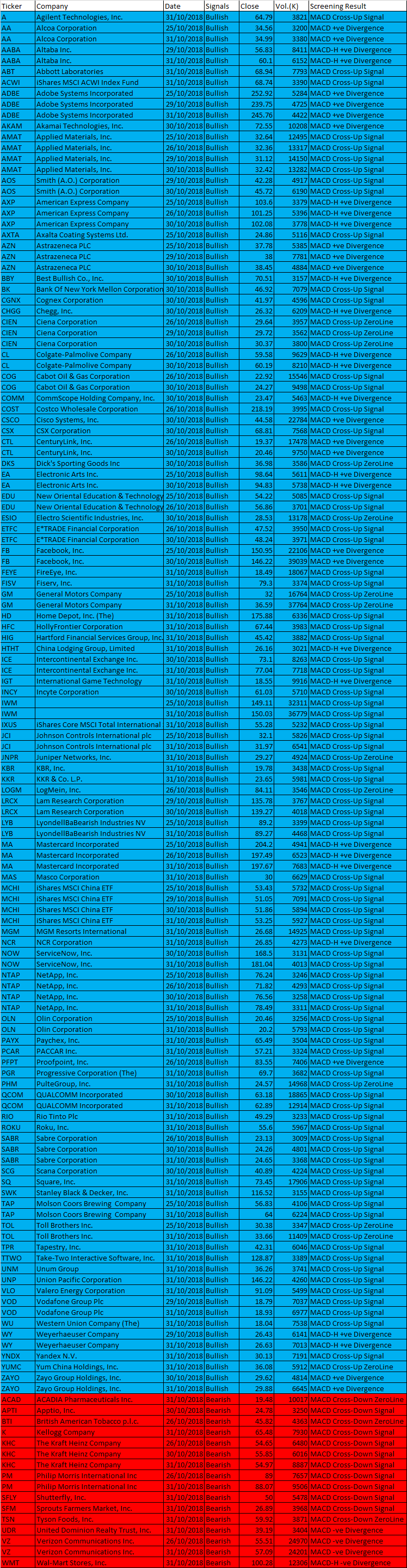

Free U.S. Stock Five-day MACD Scan

What is MACD?

MACD stands for Moving Average Convergence Divergence, common setting is (12,26,9)

MACD indicator is a trend trading system that makes up of 2 lines. The MACD Line (fast line) and MACD Signal Line (slow line).

1) When the MACD Line crosses over the MACD Signal Line the trend is bullish. When the MACD Line crosses below the MACD Signal the trend is bearish.

2) When the MACD Line crosses above zero line the trend is bullish. When the MACD line crosses below zero line the trend is bearish.

25 to 31 October, 2018 AFL Script Generated Five-day U.S. Stock MACD Signals

The following are script generated One-day U.S. Stock Market MACD signals using the Powerful AmiBroker’s AFL.

The MACD Setting used is (8,17,9)

| Ticker | Company | Date | Signals | Close | Vol.(K) | Screening Result |

| A | Agilent Technologies, Inc. | 31/10/2018 | Bullish | 64.79 | 3821 | MACD Cross-Up Signal |

| AA | Alcoa Corporation | 25/10/2018 | Bullish | 34.56 | 3200 | MACD +ve Divergence |

| AA | Alcoa Corporation | 31/10/2018 | Bullish | 34.99 | 3380 | MACD +ve Divergence |

| AABA | Altaba Inc. | 29/10/2018 | Bullish | 56.83 | 8411 | MACD-H +ve Divergence |

| AABA | Altaba Inc. | 31/10/2018 | Bullish | 60.1 | 6152 | MACD-H +ve Divergence |

| ABT | Abbott Laboratories | 31/10/2018 | Bullish | 68.94 | 7793 | MACD Cross-Up Signal |

| ACWI | iShares MSCI ACWI Index Fund | 31/10/2018 | Bullish | 68.74 | 3390 | MACD Cross-Up Signal |

| ADBE | Adobe Systems Incorporated | 25/10/2018 | Bullish | 252.92 | 5284 | MACD +ve Divergence |

| ADBE | Adobe Systems Incorporated | 29/10/2018 | Bullish | 239.75 | 4725 | MACD +ve Divergence |

| ADBE | Adobe Systems Incorporated | 31/10/2018 | Bullish | 245.76 | 4422 | MACD +ve Divergence |

| AKAM | Akamai Technologies, Inc. | 30/10/2018 | Bullish | 72.55 | 10208 | MACD +ve Divergence |

| AMAT | Applied Materials, Inc. | 25/10/2018 | Bullish | 32.64 | 12495 | MACD Cross-Up Signal |

| AMAT | Applied Materials, Inc. | 26/10/2018 | Bullish | 32.36 | 13317 | MACD Cross-Up Signal |

| AMAT | Applied Materials, Inc. | 29/10/2018 | Bullish | 31.12 | 14150 | MACD Cross-Up Signal |

| AMAT | Applied Materials, Inc. | 30/10/2018 | Bullish | 32.42 | 13282 | MACD Cross-Up Signal |

| AOS | Smith (A.O.) Corporation | 29/10/2018 | Bullish | 42.28 | 4917 | MACD Cross-Up Signal |

| AOS | Smith (A.O.) Corporation | 30/10/2018 | Bullish | 45.72 | 6190 | MACD Cross-Up Signal |

| AXP | American Express Company | 25/10/2018 | Bullish | 103.6 | 3379 | MACD-H +ve Divergence |

| AXP | American Express Company | 26/10/2018 | Bullish | 101.25 | 5396 | MACD-H +ve Divergence |

| AXP | American Express Company | 30/10/2018 | Bullish | 102.08 | 3778 | MACD-H +ve Divergence |

| AXTA | Axalta Coating Systems Ltd. | 25/10/2018 | Bullish | 24.86 | 5116 | MACD Cross-Up Signal |

| AZN | Astrazeneca PLC | 25/10/2018 | Bullish | 37.78 | 5385 | MACD +ve Divergence |

| AZN | Astrazeneca PLC | 29/10/2018 | Bullish | 38 | 7781 | MACD +ve Divergence |

| AZN | Astrazeneca PLC | 30/10/2018 | Bullish | 38.45 | 4884 | MACD +ve Divergence |

| BBY | Best Bullish Co., Inc. | 30/10/2018 | Bullish | 70.51 | 3157 | MACD-H +ve Divergence |

| BK | Bank Of New York Mellon Corporation (The) | 30/10/2018 | Bullish | 46.92 | 7079 | MACD Cross-Up Signal |

| CGNX | Cognex Corporation | 30/10/2018 | Bullish | 41.97 | 4596 | MACD Cross-Up Signal |

| CHGG | Chegg, Inc. | 30/10/2018 | Bullish | 26.32 | 6209 | MACD-H +ve Divergence |

| CIEN | Ciena Corporation | 26/10/2018 | Bullish | 29.64 | 3957 | MACD Cross-Up ZeroLine |

| CIEN | Ciena Corporation | 29/10/2018 | Bullish | 29.72 | 3562 | MACD Cross-Up ZeroLine |

| CIEN | Ciena Corporation | 30/10/2018 | Bullish | 30.37 | 3800 | MACD Cross-Up ZeroLine |

| CL | Colgate-Palmolive Company | 26/10/2018 | Bullish | 59.58 | 9629 | MACD-H +ve Divergence |

| CL | Colgate-Palmolive Company | 30/10/2018 | Bullish | 60.19 | 8210 | MACD-H +ve Divergence |

| COG | Cabot Oil & Gas Corporation | 26/10/2018 | Bullish | 22.92 | 15546 | MACD Cross-Up Signal |

| COG | Cabot Oil & Gas Corporation | 30/10/2018 | Bullish | 24.27 | 9498 | MACD Cross-Up Signal |

| COMM | CommScope Holding Company, Inc. | 30/10/2018 | Bullish | 23.47 | 5463 | MACD-H +ve Divergence |

| COST | Costco Wholesale Corporation | 26/10/2018 | Bullish | 218.19 | 3995 | MACD Cross-Up Signal |

| CSCO | Cisco Systems, Inc. | 30/10/2018 | Bullish | 44.58 | 22784 | MACD +ve Divergence |

| CSX | CSX Corporation | 30/10/2018 | Bullish | 68.81 | 7568 | MACD Cross-Up Signal |

| CTL | CenturyLink, Inc. | 26/10/2018 | Bullish | 19.37 | 17478 | MACD +ve Divergence |

| CTL | CenturyLink, Inc. | 30/10/2018 | Bullish | 20.46 | 9750 | MACD +ve Divergence |

| DKS | Dick’s Sporting Goods Inc | 30/10/2018 | Bullish | 36.98 | 3586 | MACD Cross-Up ZeroLine |

| EA | Electronic Arts Inc. | 25/10/2018 | Bullish | 98.64 | 5611 | MACD-H +ve Divergence |

| EA | Electronic Arts Inc. | 30/10/2018 | Bullish | 94.83 | 5738 | MACD-H +ve Divergence |

| EDU | New Oriental Education & Technology Group, Inc. | 25/10/2018 | Bullish | 54.22 | 5085 | MACD Cross-Up Signal |

| EDU | New Oriental Education & Technology Group, Inc. | 26/10/2018 | Bullish | 56.86 | 3701 | MACD Cross-Up Signal |

| ESIO | Electro Scientific Industries, Inc. | 30/10/2018 | Bullish | 28.53 | 13178 | MACD Cross-Up ZeroLine |

| ETFC | E*TRADE Financial Corporation | 26/10/2018 | Bullish | 47.52 | 3950 | MACD Cross-Up Signal |

| ETFC | E*TRADE Financial Corporation | 30/10/2018 | Bullish | 48.24 | 3971 | MACD Cross-Up Signal |

| FB | Facebook, Inc. | 25/10/2018 | Bullish | 150.95 | 22106 | MACD +ve Divergence |

| FB | Facebook, Inc. | 30/10/2018 | Bullish | 146.22 | 39039 | MACD +ve Divergence |

| FEYE | FireEye, Inc. | 31/10/2018 | Bullish | 18.49 | 18067 | MACD Cross-Up Signal |

| FISV | Fiserv, Inc. | 31/10/2018 | Bullish | 79.3 | 3374 | MACD Cross-Up Signal |

| GM | General Motors Company | 25/10/2018 | Bullish | 32 | 16764 | MACD Cross-Up ZeroLine |

| GM | General Motors Company | 31/10/2018 | Bullish | 36.59 | 37764 | MACD Cross-Up ZeroLine |

| HD | Home Depot, Inc. (The) | 31/10/2018 | Bullish | 175.88 | 6336 | MACD Cross-Up Signal |

| HFC | HollyFrontier Corporation | 31/10/2018 | Bullish | 67.44 | 3983 | MACD Cross-Up Signal |

| HIG | Hartford Financial Services Group, Inc. (The) | 31/10/2018 | Bullish | 45.42 | 3882 | MACD Cross-Up Signal |

| HTHT | China Lodging Group, Limited | 31/10/2018 | Bullish | 26.16 | 3021 | MACD-H +ve Divergence |

| ICE | Intercontinental Exchange Inc. | 30/10/2018 | Bullish | 73.1 | 8263 | MACD Cross-Up Signal |

| ICE | Intercontinental Exchange Inc. | 31/10/2018 | Bullish | 77.04 | 7718 | MACD Cross-Up Signal |

| IGT | International Game Technology | 31/10/2018 | Bullish | 18.55 | 9916 | MACD-H +ve Divergence |

| INCY | Incyte Corporation | 30/10/2018 | Bullish | 61.03 | 5710 | MACD Cross-Up Signal |

| IWM | 25/10/2018 | Bullish | 149.11 | 32311 | MACD Cross-Up Signal | |

| IWM | 31/10/2018 | Bullish | 150.03 | 36779 | MACD Cross-Up Signal | |

| IXUS | iShares Core MSCI Total International Stock ETF | 31/10/2018 | Bullish | 55.28 | 5232 | MACD Cross-Up Signal |

| JCI | Johnson Controls International plc | 25/10/2018 | Bullish | 32.1 | 5826 | MACD Cross-Up Signal |

| JCI | Johnson Controls International plc | 31/10/2018 | Bullish | 31.97 | 6541 | MACD Cross-Up Signal |

| JNPR | Juniper Networks, Inc. | 31/10/2018 | Bullish | 29.27 | 4924 | MACD Cross-Up ZeroLine |

| KBR | KBR, Inc. | 31/10/2018 | Bullish | 19.78 | 3438 | MACD Cross-Up Signal |

| KKR | KKR & Co. L.P. | 31/10/2018 | Bullish | 23.65 | 5981 | MACD Cross-Up Signal |

| LOGM | LogMein, Inc. | 26/10/2018 | Bullish | 84.11 | 3546 | MACD Cross-Up ZeroLine |

| LRCX | Lam Research Corporation | 29/10/2018 | Bullish | 135.78 | 3767 | MACD Cross-Up Signal |

| LRCX | Lam Research Corporation | 30/10/2018 | Bullish | 139.27 | 4018 | MACD Cross-Up Signal |

| LYB | LyondellBaBearish Industries NV | 25/10/2018 | Bullish | 89.2 | 3399 | MACD Cross-Up Signal |

| LYB | LyondellBaBearish Industries NV | 31/10/2018 | Bullish | 89.27 | 4468 | MACD Cross-Up Signal |

| MA | Mastercard Incorporated | 25/10/2018 | Bullish | 204.2 | 4941 | MACD-H +ve Divergence |

| MA | Mastercard Incorporated | 26/10/2018 | Bullish | 197.49 | 6523 | MACD-H +ve Divergence |

| MA | Mastercard Incorporated | 31/10/2018 | Bullish | 197.67 | 7683 | MACD-H +ve Divergence |

| MAS | Masco Corporation | 31/10/2018 | Bullish | 30 | 6629 | MACD Cross-Up Signal |

| MCHI | iShares MSCI China ETF | 25/10/2018 | Bullish | 53.43 | 5732 | MACD Cross-Up Signal |

| MCHI | iShares MSCI China ETF | 29/10/2018 | Bullish | 51.05 | 7091 | MACD Cross-Up Signal |

| MCHI | iShares MSCI China ETF | 30/10/2018 | Bullish | 51.86 | 5894 | MACD Cross-Up Signal |

| MCHI | iShares MSCI China ETF | 31/10/2018 | Bullish | 53.25 | 5927 | MACD Cross-Up Signal |

| MGM | MGM Resorts International | 31/10/2018 | Bullish | 26.68 | 14925 | MACD Cross-Up Signal |

| NCR | NCR Corporation | 31/10/2018 | Bullish | 26.85 | 4273 | MACD-H +ve Divergence |

| NOW | ServiceNow, Inc. | 30/10/2018 | Bullish | 168.5 | 3131 | MACD Cross-Up Signal |

| NOW | ServiceNow, Inc. | 31/10/2018 | Bullish | 181.04 | 4013 | MACD Cross-Up Signal |

| NTAP | NetApp, Inc. | 25/10/2018 | Bullish | 76.24 | 3246 | MACD Cross-Up Signal |

| NTAP | NetApp, Inc. | 26/10/2018 | Bullish | 71.82 | 4293 | MACD Cross-Up Signal |

| NTAP | NetApp, Inc. | 30/10/2018 | Bullish | 76.56 | 3258 | MACD Cross-Up Signal |

| NTAP | NetApp, Inc. | 31/10/2018 | Bullish | 78.49 | 3311 | MACD Cross-Up Signal |

| OLN | Olin Corporation | 25/10/2018 | Bullish | 20.46 | 3256 | MACD Cross-Up Signal |

| OLN | Olin Corporation | 31/10/2018 | Bullish | 20.2 | 5793 | MACD Cross-Up Signal |

| PAYX | Paychex, Inc. | 31/10/2018 | Bullish | 65.49 | 3504 | MACD Cross-Up Signal |

| PCAR | PACCAR Inc. | 31/10/2018 | Bullish | 57.21 | 3324 | MACD Cross-Up Signal |

| PFPT | Proofpoint, Inc. | 26/10/2018 | Bullish | 83.55 | 7406 | MACD +ve Divergence |

| PGR | Progressive Corporation (The) | 31/10/2018 | Bullish | 69.7 | 3682 | MACD Cross-Up Signal |

| PHM | PulteGroup, Inc. | 31/10/2018 | Bullish | 24.57 | 14968 | MACD Cross-Up ZeroLine |

| QCOM | QUALCOMM Incorporated | 30/10/2018 | Bullish | 63.18 | 18865 | MACD Cross-Up Signal |

| QCOM | QUALCOMM Incorporated | 31/10/2018 | Bullish | 62.89 | 12914 | MACD Cross-Up Signal |

| RIO | Rio Tinto Plc | 31/10/2018 | Bullish | 49.29 | 3233 | MACD Cross-Up Signal |

| ROKU | Roku, Inc. | 31/10/2018 | Bullish | 55.6 | 5967 | MACD Cross-Up Signal |

| SABR | Sabre Corporation | 26/10/2018 | Bullish | 23.13 | 3009 | MACD Cross-Up Signal |

| SABR | Sabre Corporation | 30/10/2018 | Bullish | 24.26 | 4801 | MACD Cross-Up Signal |

| SABR | Sabre Corporation | 31/10/2018 | Bullish | 24.65 | 3368 | MACD Cross-Up Signal |

| SCG | Scana Corporation | 30/10/2018 | Bullish | 40.89 | 4224 | MACD Cross-Up Signal |

| SQ | Square, Inc. | 31/10/2018 | Bullish | 73.45 | 17906 | MACD Cross-Up Signal |

| SWK | Stanley Black & Decker, Inc. | 31/10/2018 | Bullish | 116.52 | 3155 | MACD Cross-Up Signal |

| TAP | Molson Coors Brewing Company | 25/10/2018 | Bullish | 56.83 | 4106 | MACD Cross-Up Signal |

| TAP | Molson Coors Brewing Company | 31/10/2018 | Bullish | 64 | 6224 | MACD Cross-Up Signal |

| TOL | Toll Brothers Inc. | 25/10/2018 | Bullish | 30.38 | 3347 | MACD Cross-Up ZeroLine |

| TOL | Toll Brothers Inc. | 31/10/2018 | Bullish | 33.66 | 11409 | MACD Cross-Up ZeroLine |

| TPR | Tapestry, Inc. | 31/10/2018 | Bullish | 42.31 | 6046 | MACD Cross-Up Signal |

| TTWO | Take-Two Interactive Software, Inc. | 31/10/2018 | Bullish | 128.87 | 3389 | MACD Cross-Up Signal |

| UNM | Unum Group | 31/10/2018 | Bullish | 36.26 | 3741 | MACD Cross-Up Signal |

| UNP | Union Pacific Corporation | 31/10/2018 | Bullish | 146.22 | 4260 | MACD Cross-Up Signal |

| VLO | Valero Energy Corporation | 31/10/2018 | Bullish | 91.09 | 5499 | MACD Cross-Up Signal |

| VOD | Vodafone Group Plc | 29/10/2018 | Bullish | 18.79 | 7037 | MACD Cross-Up Signal |

| VOD | Vodafone Group Plc | 31/10/2018 | Bullish | 18.93 | 6977 | MACD Cross-Up Signal |

| WU | Western Union Company (The) | 31/10/2018 | Bullish | 18.04 | 7538 | MACD Cross-Up Signal |

| WY | Weyerhaeuser Company | 29/10/2018 | Bullish | 26.43 | 6141 | MACD-H +ve Divergence |

| WY | Weyerhaeuser Company | 31/10/2018 | Bullish | 26.63 | 7013 | MACD-H +ve Divergence |

| YNDX | Yandex N.V. | 31/10/2018 | Bullish | 30.13 | 7191 | MACD Cross-Up Signal |

| YUMC | Yum China Holdings, Inc. | 31/10/2018 | Bullish | 36.08 | 5912 | MACD Cross-Up ZeroLine |

| ZAYO | Zayo Group Holdings, Inc. | 30/10/2018 | Bullish | 29.62 | 4814 | MACD +ve Divergence |

| ZAYO | Zayo Group Holdings, Inc. | 31/10/2018 | Bullish | 29.88 | 6645 | MACD +ve Divergence |

| ACAD | ACADIA Pharmaceuticals Inc. | 31/10/2018 | Bearish | 19.48 | 10017 | MACD Cross-Down ZeroLine |

| APTI | Apptio, Inc. | 30/10/2018 | Bearish | 24.78 | 3250 | MACD Cross-Down Signal |

| BTI | British American Tobacco p.l.c. | 26/10/2018 | Bearish | 45.82 | 4363 | MACD Cross-Down ZeroLine |

| K | Kellogg Company | 31/10/2018 | Bearish | 65.48 | 7930 | MACD Cross-Down Signal |

| KHC | The Kraft Heinz Company | 26/10/2018 | Bearish | 54.65 | 6480 | MACD Cross-Down Signal |

| KHC | The Kraft Heinz Company | 30/10/2018 | Bearish | 55.85 | 6016 | MACD Cross-Down Signal |

| KHC | The Kraft Heinz Company | 31/10/2018 | Bearish | 54.97 | 8887 | MACD Cross-Down Signal |

| PM | Philip Morris International Inc | 26/10/2018 | Bearish | 89 | 7657 | MACD Cross-Down Signal |

| PM | Philip Morris International Inc | 31/10/2018 | Bearish | 88.07 | 9506 | MACD Cross-Down Signal |

| SFLY | Shutterfly, Inc. | 31/10/2018 | Bearish | 50 | 5478 | MACD Cross-Down Signal |

| SFM | Sprouts Farmers Market, Inc. | 31/10/2018 | Bearish | 26.89 | 3968 | MACD Cross-Down Signal |

| TSN | Tyson Foods, Inc. | 31/10/2018 | Bearish | 59.92 | 3871 | MACD Cross-Down ZeroLine |

| UDR | United Dominion Realty Trust, Inc. | 31/10/2018 | Bearish | 39.19 | 3404 | MACD -ve Divergence |

| VZ | Verizon Communications Inc. | 26/10/2018 | Bearish | 55.51 | 24970 | MACD -ve Divergence |

| VZ | Verizon Communications Inc. | 31/10/2018 | Bearish | 57.09 | 24201 | MACD -ve Divergence |

| WMT | Wal-Mart Stores, Inc. | 31/10/2018 | Bearish | 100.28 | 12306 | MACD-H -ve Divergence |

if you can see the full chart, “press Ctrl and -” to zoom out and see the entire chart.

October 25 to 31, 2018 US Stock FIve-day MACD Scan Signals

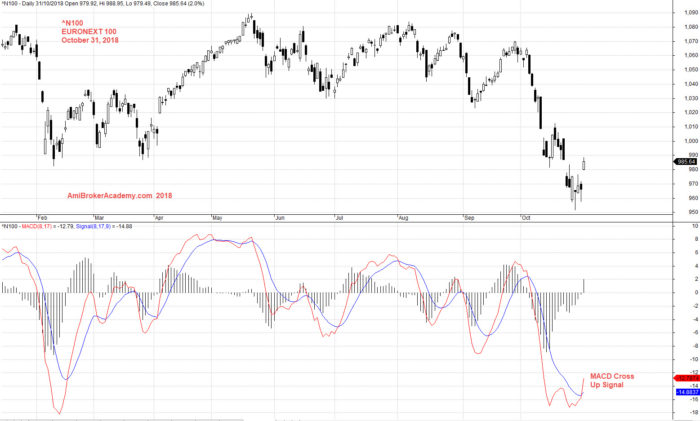

MACD Example – ^N100 EURONEXT

October 31, 2018 EURONEXT 100 and MACD

Moses U.S. Stock MACD Scan

AmiBroker Academy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.