June 17, 2018

Thank you for visiting the site. Hope you like the content.

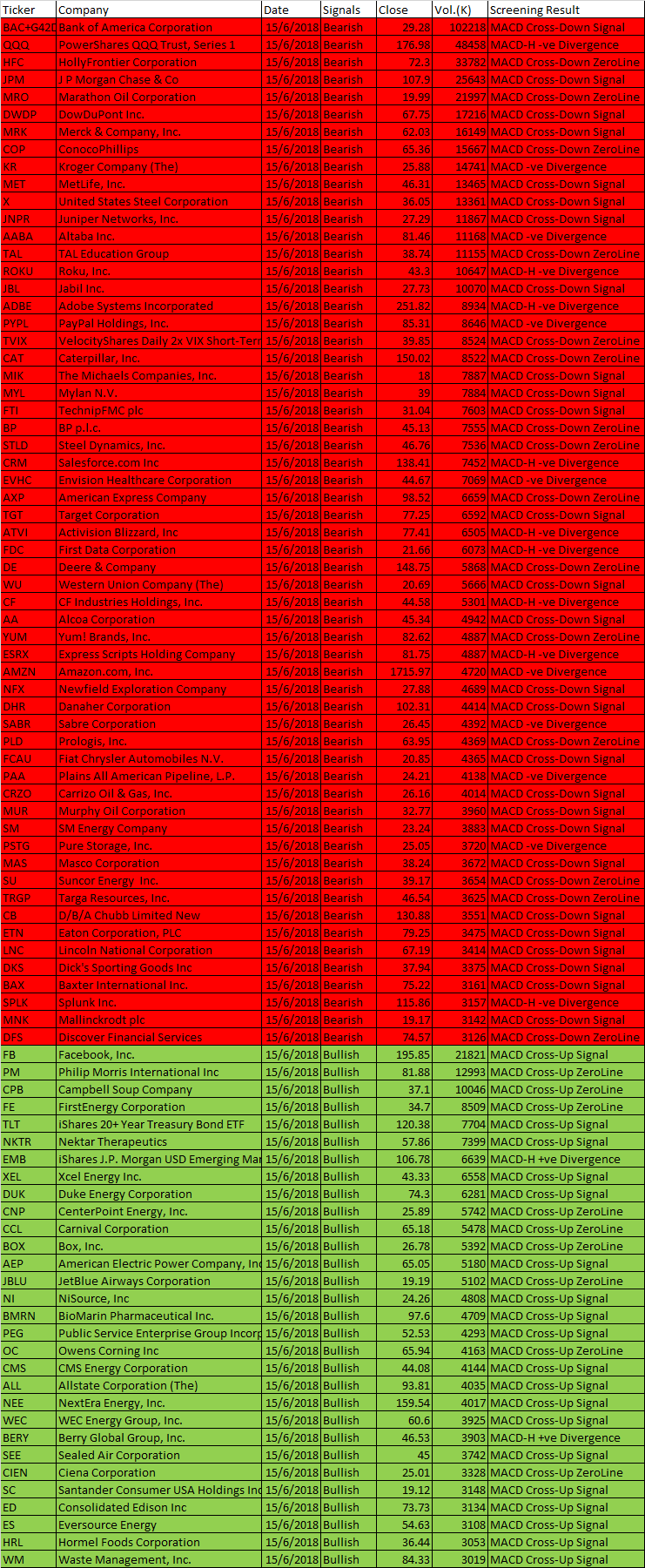

Free MACD Scan One-day US Stock MACD Screening Results on June 15 2018

Remember all setup can fail. This is true for all indicators. It is also true for MACD signals setup.

But, even the setup can fail. Without the MACD scan results, how to find a stock might moves in the near eight thousand stocks market. The MACD signals at least reduce the among the stocks you need to study and make your trade plan.

Manage your risk.

These are the six types of MACD Signals:

- MACD line crosses above MACD signal – Bullish trend

- MACD line crosses above zero line – Bullish trend

- MACD Histogram +ve Divergence – Bullish trend

- MACD line crosses below MACD signal – Bearish trend

- MACD line crosses below zero line – Bearish trend

- MACD Histogram -ve Divergence – Bearish tren

June 15, 2018 US Stock One-day MACD Signals

You must understand what MACD is all about before using the results.

| Ticker | Company | Date | Signals | Close | Vol.(K) | Screening Result |

| FB | Facebook, Inc. | 15/6/2018 | Bullish | 195.85 | 21821 | MACD Cross-Up Signal |

| PM | Philip Morris International Inc | 15/6/2018 | Bullish | 81.88 | 12993 | MACD Cross-Up ZeroLine |

| CPB | Campbell Soup Company | 15/6/2018 | Bullish | 37.1 | 10046 | MACD Cross-Up ZeroLine |

| FE | FirstEnergy Corporation | 15/6/2018 | Bullish | 34.7 | 8509 | MACD Cross-Up ZeroLine |

| TLT | iShares 20+ Year Treasury Bond ETF | 15/6/2018 | Bullish | 120.38 | 7704 | MACD Cross-Up Signal |

| NKTR | Nektar Therapeutics | 15/6/2018 | Bullish | 57.86 | 7399 | MACD Cross-Up Signal |

| EMB | iShares J.P. Morgan USD Emerging Markets Bond ETF | 15/6/2018 | Bullish | 106.78 | 6639 | MACD-H +ve Divergence |

| XEL | Xcel Energy Inc. | 15/6/2018 | Bullish | 43.33 | 6558 | MACD Cross-Up Signal |

| DUK | Duke Energy Corporation | 15/6/2018 | Bullish | 74.3 | 6281 | MACD Cross-Up Signal |

| CNP | CenterPoint Energy, Inc. | 15/6/2018 | Bullish | 25.89 | 5742 | MACD Cross-Up ZeroLine |

| CCL | Carnival Corporation | 15/6/2018 | Bullish | 65.18 | 5478 | MACD Cross-Up ZeroLine |

| BOX | Box, Inc. | 15/6/2018 | Bullish | 26.78 | 5392 | MACD Cross-Up ZeroLine |

| AEP | American Electric Power Company, Inc. | 15/6/2018 | Bullish | 65.05 | 5180 | MACD Cross-Up Signal |

| JBLU | JetBlue Airways Corporation | 15/6/2018 | Bullish | 19.19 | 5102 | MACD Cross-Up ZeroLine |

| NI | NiSource, Inc | 15/6/2018 | Bullish | 24.26 | 4808 | MACD Cross-Up Signal |

| BMRN | BioMarin Pharmaceutical Inc. | 15/6/2018 | Bullish | 97.6 | 4709 | MACD Cross-Up Signal |

| PEG | Public Service Enterprise Group Incorporated | 15/6/2018 | Bullish | 52.53 | 4293 | MACD Cross-Up Signal |

| OC | Owens Corning Inc | 15/6/2018 | Bullish | 65.94 | 4163 | MACD Cross-Up ZeroLine |

| CMS | CMS Energy Corporation | 15/6/2018 | Bullish | 44.08 | 4144 | MACD Cross-Up Signal |

| ALL | Allstate Corporation (The) | 15/6/2018 | Bullish | 93.81 | 4035 | MACD Cross-Up Signal |

| NEE | NextEra Energy, Inc. | 15/6/2018 | Bullish | 159.54 | 4017 | MACD Cross-Up Signal |

| WEC | WEC Energy Group, Inc. | 15/6/2018 | Bullish | 60.6 | 3925 | MACD Cross-Up Signal |

| BERY | Berry Global Group, Inc. | 15/6/2018 | Bullish | 46.53 | 3903 | MACD-H +ve Divergence |

| SEE | Sealed Air Corporation | 15/6/2018 | Bullish | 45 | 3742 | MACD Cross-Up Signal |

| CIEN | Ciena Corporation | 15/6/2018 | Bullish | 25.01 | 3328 | MACD Cross-Up ZeroLine |

| SC | Santander Consumer USA Holdings Inc. | 15/6/2018 | Bullish | 19.12 | 3148 | MACD Cross-Up Signal |

| ED | Consolidated Edison Inc | 15/6/2018 | Bullish | 73.73 | 3134 | MACD Cross-Up Signal |

| ES | Eversource Energy | 15/6/2018 | Bullish | 54.63 | 3108 | MACD Cross-Up Signal |

| HRL | Hormel Foods Corporation | 15/6/2018 | Bullish | 36.44 | 3053 | MACD Cross-Up Signal |

| WM | Waste Management, Inc. | 15/6/2018 | Bullish | 84.33 | 3019 | MACD Cross-Up Signal |

| BAC+G42DA2:G44 | Bank of America Corporation | 15/6/2018 | Bearish | 29.28 | 102218 | MACD Cross-Down Signal |

| QQQ | PowerShares QQQ Trust, Series 1 | 15/6/2018 | Bearish | 176.98 | 48458 | MACD-H -ve Divergence |

| HFC | HollyFrontier Corporation | 15/6/2018 | Bearish | 72.3 | 33782 | MACD Cross-Down ZeroLine |

| JPM | J P Morgan Chase & Co | 15/6/2018 | Bearish | 107.9 | 25643 | MACD Cross-Down Signal |

| MRO | Marathon Oil Corporation | 15/6/2018 | Bearish | 19.99 | 21997 | MACD Cross-Down ZeroLine |

| DWDP | DowDuPont Inc. | 15/6/2018 | Bearish | 67.75 | 17216 | MACD Cross-Down Signal |

| MRK | Merck & Company, Inc. | 15/6/2018 | Bearish | 62.03 | 16149 | MACD Cross-Down Signal |

| COP | ConocoPhillips | 15/6/2018 | Bearish | 65.36 | 15667 | MACD Cross-Down ZeroLine |

| KR | Kroger Company (The) | 15/6/2018 | Bearish | 25.88 | 14741 | MACD -ve Divergence |

| MET | MetLife, Inc. | 15/6/2018 | Bearish | 46.31 | 13465 | MACD Cross-Down Signal |

| X | United States Steel Corporation | 15/6/2018 | Bearish | 36.05 | 13361 | MACD Cross-Down Signal |

| JNPR | Juniper Networks, Inc. | 15/6/2018 | Bearish | 27.29 | 11867 | MACD Cross-Down Signal |

| AABA | Altaba Inc. | 15/6/2018 | Bearish | 81.46 | 11168 | MACD -ve Divergence |

| TAL | TAL Education Group | 15/6/2018 | Bearish | 38.74 | 11155 | MACD Cross-Down ZeroLine |

| ROKU | Roku, Inc. | 15/6/2018 | Bearish | 43.3 | 10647 | MACD-H -ve Divergence |

| JBL | Jabil Inc. | 15/6/2018 | Bearish | 27.73 | 10070 | MACD Cross-Down Signal |

| ADBE | Adobe Systems Incorporated | 15/6/2018 | Bearish | 251.82 | 8934 | MACD-H -ve Divergence |

| PYPL | PayPal Holdings, Inc. | 15/6/2018 | Bearish | 85.31 | 8646 | MACD -ve Divergence |

| TVIX | VelocityShares Daily 2x VIX Short-Term ETN | 15/6/2018 | Bearish | 39.85 | 8524 | MACD Cross-Down ZeroLine |

| CAT | Caterpillar, Inc. | 15/6/2018 | Bearish | 150.02 | 8522 | MACD Cross-Down ZeroLine |

| MIK | The Michaels Companies, Inc. | 15/6/2018 | Bearish | 18 | 7887 | MACD Cross-Down Signal |

| MYL | Mylan N.V. | 15/6/2018 | Bearish | 39 | 7884 | MACD Cross-Down Signal |

| FTI | TechnipFMC plc | 15/6/2018 | Bearish | 31.04 | 7603 | MACD Cross-Down Signal |

| BP | BP p.l.c. | 15/6/2018 | Bearish | 45.13 | 7555 | MACD Cross-Down ZeroLine |

| STLD | Steel Dynamics, Inc. | 15/6/2018 | Bearish | 46.76 | 7536 | MACD Cross-Down ZeroLine |

| CRM | Salesforce.com Inc | 15/6/2018 | Bearish | 138.41 | 7452 | MACD-H -ve Divergence |

| EVHC | Envision Healthcare Corporation | 15/6/2018 | Bearish | 44.67 | 7069 | MACD -ve Divergence |

| AXP | American Express Company | 15/6/2018 | Bearish | 98.52 | 6659 | MACD Cross-Down ZeroLine |

| TGT | Target Corporation | 15/6/2018 | Bearish | 77.25 | 6592 | MACD Cross-Down Signal |

| ATVI | Activision Blizzard, Inc | 15/6/2018 | Bearish | 77.41 | 6505 | MACD-H -ve Divergence |

| FDC | First Data Corporation | 15/6/2018 | Bearish | 21.66 | 6073 | MACD-H -ve Divergence |

| DE | Deere & Company | 15/6/2018 | Bearish | 148.75 | 5868 | MACD Cross-Down ZeroLine |

| WU | Western Union Company (The) | 15/6/2018 | Bearish | 20.69 | 5666 | MACD Cross-Down Signal |

| CF | CF Industries Holdings, Inc. | 15/6/2018 | Bearish | 44.58 | 5301 | MACD-H -ve Divergence |

| AA | Alcoa Corporation | 15/6/2018 | Bearish | 45.34 | 4942 | MACD Cross-Down Signal |

| YUM | Yum! Brands, Inc. | 15/6/2018 | Bearish | 82.62 | 4887 | MACD Cross-Down ZeroLine |

| ESRX | Express Scripts Holding Company | 15/6/2018 | Bearish | 81.75 | 4887 | MACD-H -ve Divergence |

| AMZN | Amazon.com, Inc. | 15/6/2018 | Bearish | 1715.97 | 4720 | MACD -ve Divergence |

| NFX | Newfield Exploration Company | 15/6/2018 | Bearish | 27.88 | 4689 | MACD Cross-Down Signal |

| DHR | Danaher Corporation | 15/6/2018 | Bearish | 102.31 | 4414 | MACD Cross-Down Signal |

| SABR | Sabre Corporation | 15/6/2018 | Bearish | 26.45 | 4392 | MACD -ve Divergence |

| PLD | Prologis, Inc. | 15/6/2018 | Bearish | 63.95 | 4369 | MACD Cross-Down ZeroLine |

| FCAU | Fiat Chrysler Automobiles N.V. | 15/6/2018 | Bearish | 20.85 | 4365 | MACD Cross-Down Signal |

| PAA | Plains All American Pipeline, L.P. | 15/6/2018 | Bearish | 24.21 | 4138 | MACD -ve Divergence |

| CRZO | Carrizo Oil & Gas, Inc. | 15/6/2018 | Bearish | 26.16 | 4014 | MACD Cross-Down Signal |

| MUR | Murphy Oil Corporation | 15/6/2018 | Bearish | 32.77 | 3960 | MACD Cross-Down Signal |

| SM | SM Energy Company | 15/6/2018 | Bearish | 23.24 | 3883 | MACD Cross-Down Signal |

| PSTG | Pure Storage, Inc. | 15/6/2018 | Bearish | 25.05 | 3720 | MACD -ve Divergence |

| MAS | Masco Corporation | 15/6/2018 | Bearish | 38.24 | 3672 | MACD Cross-Down Signal |

| SU | Suncor Energy Inc. | 15/6/2018 | Bearish | 39.17 | 3654 | MACD Cross-Down ZeroLine |

| TRGP | Targa Resources, Inc. | 15/6/2018 | Bearish | 46.54 | 3625 | MACD Cross-Down ZeroLine |

| CB | D/B/A Chubb Limited New | 15/6/2018 | Bearish | 130.88 | 3551 | MACD Cross-Down Signal |

| ETN | Eaton Corporation, PLC | 15/6/2018 | Bearish | 79.25 | 3475 | MACD Cross-Down Signal |

| LNC | Lincoln National Corporation | 15/6/2018 | Bearish | 67.19 | 3414 | MACD Cross-Down Signal |

| DKS | Dick’s Sporting Goods Inc | 15/6/2018 | Bearish | 37.94 | 3375 | MACD Cross-Down Signal |

| BAX | Baxter International Inc. | 15/6/2018 | Bearish | 75.22 | 3161 | MACD Cross-Down Signal |

| SPLK | Splunk Inc. | 15/6/2018 | Bearish | 115.86 | 3157 | MACD-H -ve Divergence |

| MNK | Mallinckrodt plc | 15/6/2018 | Bearish | 19.17 | 3142 | MACD Cross-Down Signal |

| DFS | Discover Financial Services | 15/6/2018 | Bearish | 74.57 | 3126 | MACD Cross-Down ZeroLine |

Moses US Stock Scan

AmiBroker Academy.com

Disclaimer:

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.