June 10, 2018

Thank you for visiting the site. Hope you like the content.

MSFT Microsoft Corporation and Moving Averages

Picture worth a thousand words, see chart moving averages.

Price Action and Moving Averages

Microsoft Corporation, MSFT has closed above 20 period moving average, 20 MA closed above 50 period moving average, and 50 moving average close above 100 period moving average.

All three 20, 50 and 100 MA are slopping up. The price action trend is bullish.

Manage your risk.

June 8, 2018 Microsoft Corporation and Moving Averages

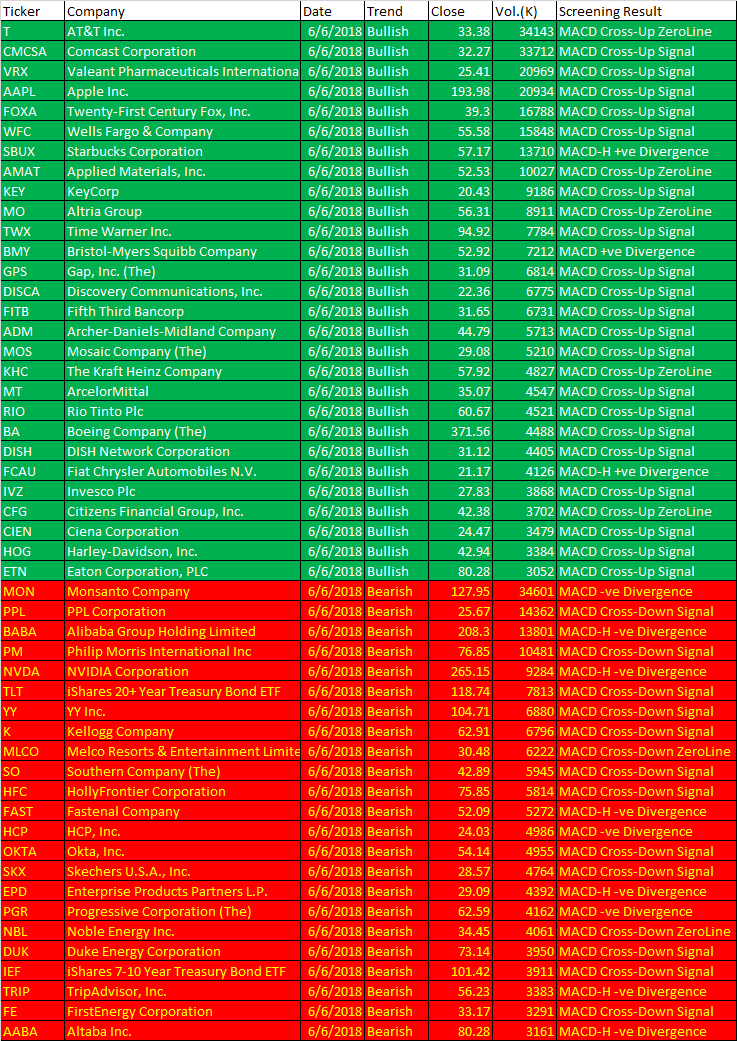

Updated Free MACD Scan One-day US Stock MACD Screening Results on June 6 2018

Remember all setup can fail. This is true for all indicators. It is also true for MACD signals setup.

But, even the setup can fail. Without the MACD scan results, how to find a stock might moves in the near eight thousand stocks market. The MACD signals at least reduce the among the stocks you need to study and make your trade plan.

Manage your risk.

June 6, 2018 Updated US Stock one-day MACD Signals

These are the six types of MACD Signals:

- MACD line crosses above MACD signal – Bullish trend

- MACD line crosses above zero line – Bullish trend

- MACD Histogram +ve Divergence – Bullish trend

- MACD line crosses below MACD signal – Bearish trend

- MACD line crosses below zero line – Bearish trend

- MACD Histogram -ve Divergence – Bearish trend

| Ticker | Company | Date | Trend | Close | Vol.(K) | Screening Result |

| T | AT&T Inc. | 6/6/2018 | Bullish | 33.38 | 34143 | MACD Cross-Up ZeroLine |

| CMCSA | Comcast Corporation | 6/6/2018 | Bullish | 32.27 | 33712 | MACD Cross-Up Signal |

| VRX | Valeant Pharmaceuticals International, Inc. | 6/6/2018 | Bullish | 25.41 | 20969 | MACD Cross-Up Signal |

| AAPL | Apple Inc. | 6/6/2018 | Bullish | 193.98 | 20934 | MACD Cross-Up Signal |

| FOXA | Twenty-First Century Fox, Inc. | 6/6/2018 | Bullish | 39.3 | 16788 | MACD Cross-Up Signal |

| WFC | Wells Fargo & Company | 6/6/2018 | Bullish | 55.58 | 15848 | MACD Cross-Up Signal |

| SBUX | Starbucks Corporation | 6/6/2018 | Bullish | 57.17 | 13710 | MACD-H +ve Divergence |

| AMAT | Applied Materials, Inc. | 6/6/2018 | Bullish | 52.53 | 10027 | MACD Cross-Up ZeroLine |

| KEY | KeyCorp | 6/6/2018 | Bullish | 20.43 | 9186 | MACD Cross-Up Signal |

| MO | Altria Group | 6/6/2018 | Bullish | 56.31 | 8911 | MACD Cross-Up ZeroLine |

| TWX | Time Warner Inc. | 6/6/2018 | Bullish | 94.92 | 7784 | MACD Cross-Up Signal |

| BMY | Bristol-Myers Squibb Company | 6/6/2018 | Bullish | 52.92 | 7212 | MACD +ve Divergence |

| GPS | Gap, Inc. (The) | 6/6/2018 | Bullish | 31.09 | 6814 | MACD Cross-Up Signal |

| DISCA | Discovery Communications, Inc. | 6/6/2018 | Bullish | 22.36 | 6775 | MACD Cross-Up Signal |

| FITB | Fifth Third Bancorp | 6/6/2018 | Bullish | 31.65 | 6731 | MACD Cross-Up Signal |

| ADM | Archer-Daniels-Midland Company | 6/6/2018 | Bullish | 44.79 | 5713 | MACD Cross-Up Signal |

| MOS | Mosaic Company (The) | 6/6/2018 | Bullish | 29.08 | 5210 | MACD Cross-Up Signal |

| KHC | The Kraft Heinz Company | 6/6/2018 | Bullish | 57.92 | 4827 | MACD Cross-Up ZeroLine |

| MT | ArcelorMittal | 6/6/2018 | Bullish | 35.07 | 4547 | MACD Cross-Up Signal |

| RIO | Rio Tinto Plc | 6/6/2018 | Bullish | 60.67 | 4521 | MACD Cross-Up Signal |

| BA | Boeing Company (The) | 6/6/2018 | Bullish | 371.56 | 4488 | MACD Cross-Up Signal |

| DISH | DISH Network Corporation | 6/6/2018 | Bullish | 31.12 | 4405 | MACD Cross-Up Signal |

| FCAU | Fiat Chrysler Automobiles N.V. | 6/6/2018 | Bullish | 21.17 | 4126 | MACD-H +ve Divergence |

| IVZ | Invesco Plc | 6/6/2018 | Bullish | 27.83 | 3868 | MACD Cross-Up Signal |

| CFG | Citizens Financial Group, Inc. | 6/6/2018 | Bullish | 42.38 | 3702 | MACD Cross-Up ZeroLine |

| CIEN | Ciena Corporation | 6/6/2018 | Bullish | 24.47 | 3479 | MACD Cross-Up Signal |

| HOG | Harley-Davidson, Inc. | 6/6/2018 | Bullish | 42.94 | 3384 | MACD Cross-Up Signal |

| ETN | Eaton Corporation, PLC | 6/6/2018 | Bullish | 80.28 | 3052 | MACD Cross-Up Signal |

| MON | Monsanto Company | 6/6/2018 | Bearish | 127.95 | 34601 | MACD -ve Divergence |

| PPL | PPL Corporation | 6/6/2018 | Bearish | 25.67 | 14362 | MACD Cross-Down Signal |

| BABA | Alibaba Group Holding Limited | 6/6/2018 | Bearish | 208.3 | 13801 | MACD-H -ve Divergence |

| PM | Philip Morris International Inc | 6/6/2018 | Bearish | 76.85 | 10481 | MACD Cross-Down Signal |

| NVDA | NVIDIA Corporation | 6/6/2018 | Bearish | 265.15 | 9284 | MACD-H -ve Divergence |

| TLT | iShares 20+ Year Treasury Bond ETF | 6/6/2018 | Bearish | 118.74 | 7813 | MACD Cross-Down Signal |

| YY | YY Inc. | 6/6/2018 | Bearish | 104.71 | 6880 | MACD Cross-Down Signal |

| K | Kellogg Company | 6/6/2018 | Bearish | 62.91 | 6796 | MACD Cross-Down Signal |

| MLCO | Melco Resorts & Entertainment Limited | 6/6/2018 | Bearish | 30.48 | 6222 | MACD Cross-Down ZeroLine |

| SO | Southern Company (The) | 6/6/2018 | Bearish | 42.89 | 5945 | MACD Cross-Down Signal |

| HFC | HollyFrontier Corporation | 6/6/2018 | Bearish | 75.85 | 5814 | MACD Cross-Down Signal |

| FAST | Fastenal Company | 6/6/2018 | Bearish | 52.09 | 5272 | MACD-H -ve Divergence |

| HCP | HCP, Inc. | 6/6/2018 | Bearish | 24.03 | 4986 | MACD -ve Divergence |

| OKTA | Okta, Inc. | 6/6/2018 | Bearish | 54.14 | 4955 | MACD Cross-Down Signal |

| SKX | Skechers U.S.A., Inc. | 6/6/2018 | Bearish | 28.57 | 4764 | MACD Cross-Down Signal |

| EPD | Enterprise Products Partners L.P. | 6/6/2018 | Bearish | 29.09 | 4392 | MACD-H -ve Divergence |

| PGR | Progressive Corporation (The) | 6/6/2018 | Bearish | 62.59 | 4162 | MACD -ve Divergence |

| NBL | Noble Energy Inc. | 6/6/2018 | Bearish | 34.45 | 4061 | MACD Cross-Down ZeroLine |

| DUK | Duke Energy Corporation | 6/6/2018 | Bearish | 73.14 | 3950 | MACD Cross-Down Signal |

| IEF | iShares 7-10 Year Treasury Bond ETF | 6/6/2018 | Bearish | 101.42 | 3911 | MACD Cross-Down Signal |

| TRIP | TripAdvisor, Inc. | 6/6/2018 | Bearish | 56.23 | 3383 | MACD-H -ve Divergence |

| FE | FirstEnergy Corporation | 6/6/2018 | Bearish | 33.17 | 3291 | MACD Cross-Down Signal |

| AABA | Altaba Inc. | 6/6/2018 | Bearish | 80.28 | 3161 | MACD-H -ve Divergence |

You must understand what MACD is all about before using the results.

Moses US Stock Scan

AmiBroker Academy.com

Disclaimer:

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.