November 16, 2017

We Said 3400 Not a Significant Level – ST Index

See our previous posting for full story and how we determine the weak or strong.

This was what we look at the chart again on November 10 chart. See the past summit, 2015 summit is quite a distance for STI to catch up. If the momentum remain, it is unlikely as everyone are in a holiday mode now. Sales are very busy, but the plan for the year is near end for most of the manufacturing. If you do not have the product to hit the market by November, you should call it the year. The game is near over. Of course, unless you redress your existing product like the latest to for the consumer.

To break the 3450 will also be a challenge, true or true? Will see.

November 10, 2017 ST Index and Next Challenge

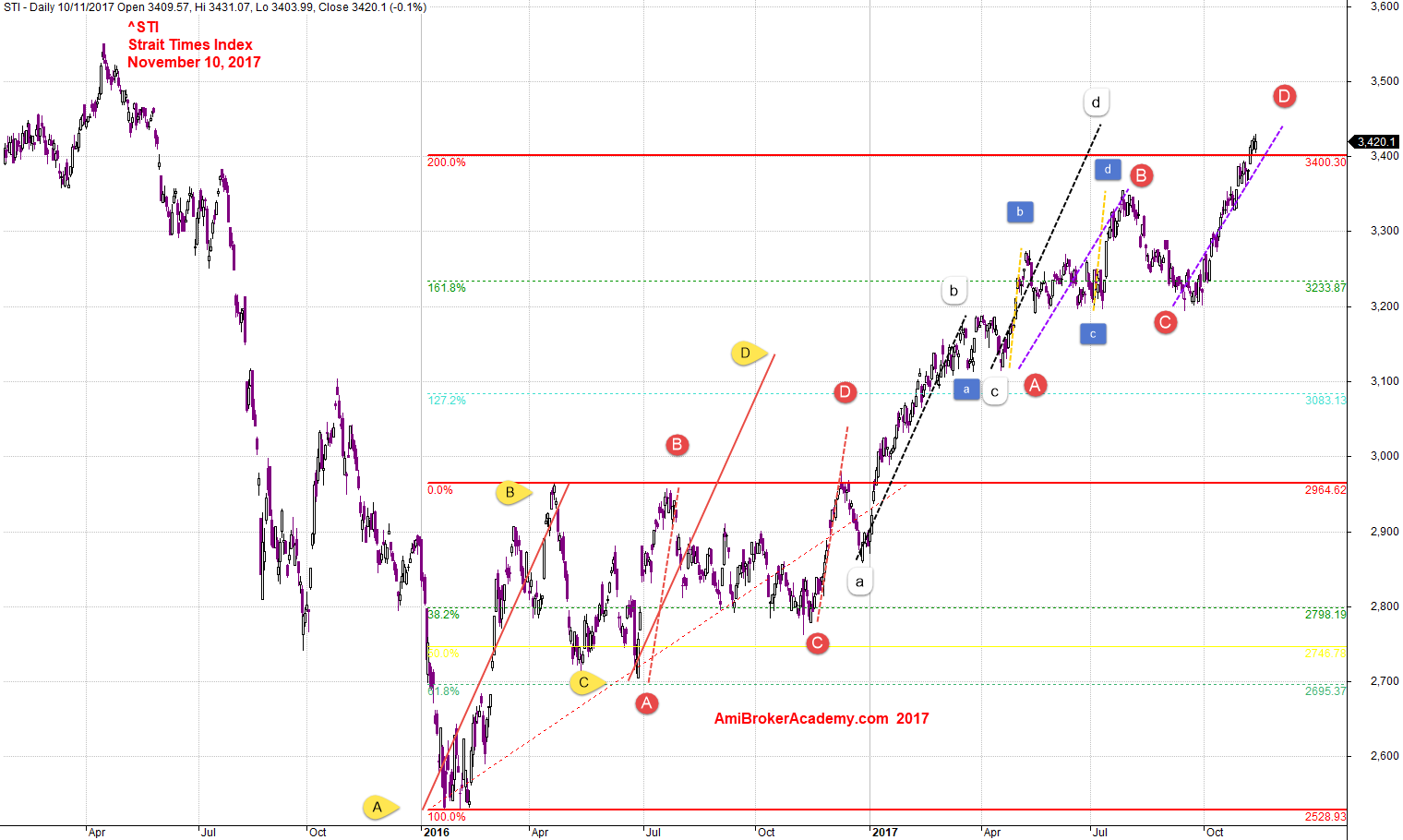

ST Index and Gartley ABCD Pattern

See chart for more, picture worth a thousand words. The extension break the 200 percent level.

November 10, 2017 Straits Times Index and ABCD Patterns

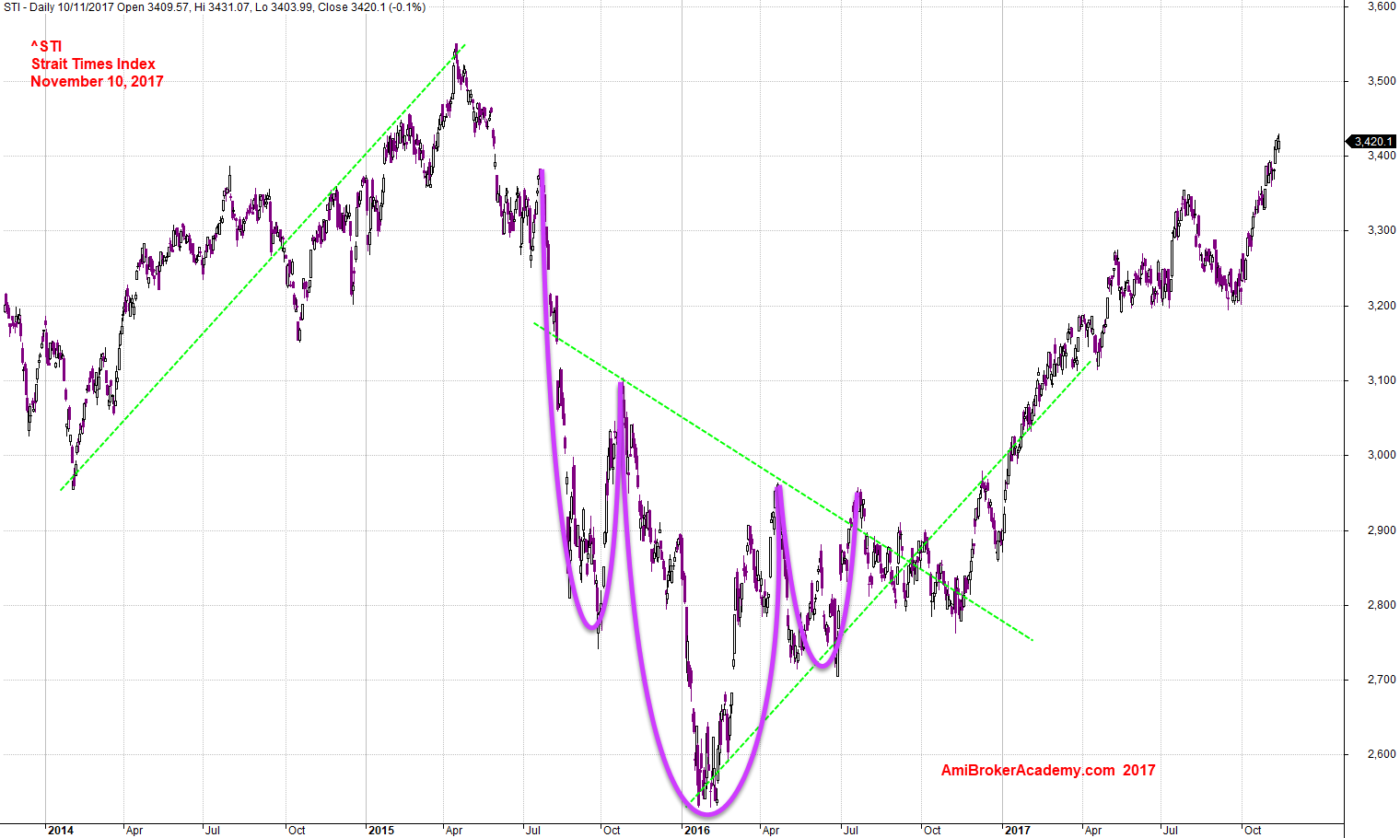

ST Index and Wave

See chart for more, picture worth a thousand words.

November 10, 2017 Straits Times Index and Big Wave

ST Index and Trend

See chart for more, picture worth a thousand words.

November 10, 2017 Straits Times Index and Trend

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.