January 27, 2017

Welcome to Moses’s Singapore Stock Analysis at AmiBrokerAcademy.com.

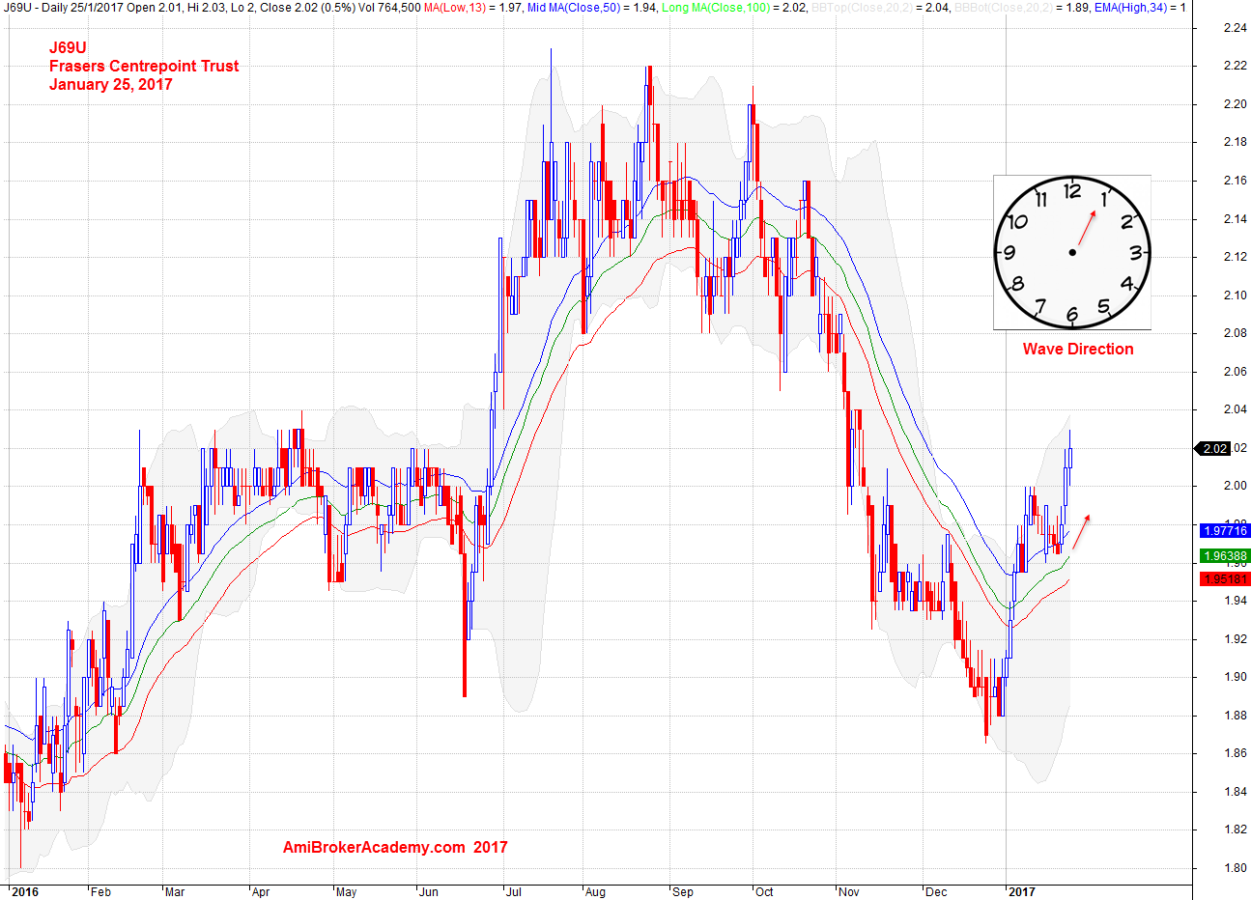

Frasers Centrepoint Trust Daily and 34 EMA Wave

Price action was flying above the 34 EMA Wave, and it started to close below 34 EMA Wave and resisted by the Wave. This was happened all the way till end of 2016.

Can 2017 be different? Will, the price action has closed above the 34 EMA Wave and the Wave is slopping up and pointing between twelve to two o’clock direction. The price action has supported by the wave too. If this momentum remains, the stock could travel further north.

January 25, 2017 Frasers Centrepoint Trust Daily and 34 EMA Wave

Frasers Centrepoint Trust Daily and MACD Indicator

With the MACD indicator, any new clue you can gather? We see the MACD cross down signal being rejected. Besides that the divergence has given away the previous trend ending soon. All these has resulted in the price action retrace up, and the new high higher than the last high has confirm the reversal. But the key level marked show the resistance may be strong.

Trade what you see. Be aware of the price action will fail first before it continue the north journey.

January 25, 2017 Frasers Centrepoint Trust and MACD Indicator

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.