August 20, 2014

Dad Teach Me to Be Realistic, Moses’ Stock Column

Welcome to Moses’ Stock Column at AmiBrokerAcademy.com. Thank you for visiting the site. One of the reasons you are here because you want to know who moves your stock.

Lesson

Dad Teach Me to Be Realistic

When I was young, my dad had told me that there isn’t any get-rich-quick scheme. What do we mean get-rich-quick-scheme? To acquire high return with small investment and do not need to work hard, little or no time, and no skill. My dad want me to be realistic, go to school and learn the basic, work hard to prepare for the opportunities.

See the number of success stories in the last few decades. The only different is the time to success is getting shorter. With the technologies, with the hard work and never give up attitude.

The Success Stories

Microsoft was founded in 1975, and went public in 1986, took the company 11 years to be successful.

Apple established in 1976 and only when till iMac hit the market in 1998 Apple was struggled to keep afloat.

Facebook started as early as 2003, formally founded in February 2004 and listed in February 2014.

Get-Rich-Quick

Get-rich-quick schemes typically promote “secret formulas”. Quite often there are promises on little skill, little investment, and time such as sleep while you earn. But you can make load and load of money.

Once I call a friend and congratulate her on her success in trading. She was testified on a newspaper about her recent training with a guru. However, she told me that she was lucky only on that few trades. She cannot repeat her success anymore. She has no idea how she did it.

Trading Is Not a Get-Rich-Quick Scheme

Learn the skill, the basic, practice (back test), and manage your risk. Do a small investment at a time. Take profit as it goes.

Stay focus

Stay focus, trade reasonable and manage your risk.Don’t play play. Do your necessary home work and trade responsibly. You are responsible for your own trade do not give excuses.

Moses’ Free MACD Scan

This site provides you the free MACD scan for Singapore stocks.

This is August 13, 2014, Wednesday Singapore stocks that have the following MACD signals, which have trading volume greater than 500,000 shares.

Total 70 stocks have MACD bullish and bearish signals, 45 stocks have bullish MACD signals, and 25 stocks have bearish MACD signals.

40 stocks are traded more than 500,000 shares. 31stocks have bullish MACD signals, and only 9 stocks have bearish MACD signals. Wow! The bulls have left the town.

- MACD line crosses above MACD signal – Bullish trend

- MACD line crosses above zero line – Bullish trend

- MACD Histogram +ve Divergence – Bullish trend

- MACD line crosses below MACD signal – Bearish trend

- MACD line crosses below zero line – Bearish trend

- MACD Histogram -ve Divergence – Bearish trend

- Volume traded greater 500,000 shares

| Ticker | Company | Signals | Close | Vol.(K) | Screening Result |

| 5GB | SIIC ENVIRONMENT HOLDINGS LTD. | Bullish | 0.167 | 36589 | MACD Cross-Up ZeroLine |

| E5H | GOLDEN AGRI-RESOURCES LTD | Bullish | 0.525 | 32467 | MACD +ve Divergence |

| J16 | GSH CORPORATION LIMITED | Bullish | 0.077 | 17935 | MACD Cross-Up Signal |

| 5GJ | AUSGROUP LIMITED. | Bullish | 0.415 | 11852 | MACD Cross-Up Signal |

| T35 | SUNNINGDALE TECH LTD | Bullish | 0.22 | 6242 | MACD Cross-Up ZeroLine |

| Z59 | YOMA STRATEGIC HOLDINGS LTD | Bullish | 0.7 | 5875 | MACD Cross-Up Signal |

| AK3 | SWIBER HOLDINGS LIMITED | Bullish | 0.525 | 5072 | MACD Cross-Up Signal |

| 5G2 | KIMHENG OFFSHORE&MARINE HLDLTD | Bullish | 0.255 | 4714 | MACD Cross-Up Signal |

| M15 | MATEX INTERNATIONAL LIMITED | Bullish | 0.072 | 4045 | MACD Cross-Up Signal |

| SK7 | OUE HOSPITALITY TRUST | Bullish | 0.9 | 3942 | MACD Cross-Up ZeroLine |

| C8R | JIUTIAN CHEMICAL GROUP LIMITED | Bullish | 0.066 | 3004 | MACD +ve Divergence |

| 5GC | CNA GROUP LTD. | Bullish | 0.073 | 1894 | MACD Cross-Up Signal |

| 5MM | SKY ONE HOLDINGS LIMITED | Bullish | 0.13 | 1813 | MACD Cross-Up ZeroLine |

| S68 | SINGAPORE EXCHANGE LIMITED | Bullish | 7.18 | 1787 | MACD Cross-Up Signal |

| S53 | SMRT CORPORATION LTD | Bullish | 1.6 | 1558 | MACD Cross-Up Signal |

| C29 | CHIP ENG SENG CORPORATION LTD | Bullish | 0.83 | 1447 | MACD Cross-Up Signal |

| U19 | UNITED ENVIROTECH LTD | Bullish | 1.385 | 1409 | MACD Cross-Up Signal |

| Q01 | QAF LTD | Bullish | 0.88 | 1240 | MACD Cross-Up Signal |

| S21 | GENTING HONG KONG LIMITED | Bullish | 0.395 | 1098 | MACD Cross-Up Signal |

| 5CN | SINWA LIMITED | Bullish | 0.27 | 960 | MACD Cross-Up Signal |

| 5FI | ORIENTAL GROUP LTD. | Bullish | 0.1 | 938 | MACD Cross-Up Signal |

| 5CQ | TECHNICS OIL & GAS LIMITED | Bullish | 0.83 | 893 | MACD Cross-Up Signal |

| 526 | HG METAL MANUFACTURING LTD | Bullish | 0.079 | 843 | MACD Cross-Up Signal |

| P29 | POPULAR HOLDINGS LIMITED | Bullish | 0.255 | 839 | MACD Cross-Up Signal |

| SK3 | KRISENERGY LTD. | Bullish | 0.74 | 677 | MACD Cross-Up Signal |

| 5VS | HAFARY HOLDINGS LIMITED | Bullish | 0.19 | 667 | MACD Cross-Up Signal |

| B0Z | CHINA FISHERY GROUP LIMITED | Bullish | 0.37 | 638 | MACD Cross-Up Signal |

| A26 | SINARMAS LAND LIMITED | Bullish | 0.655 | 616 | MACD Cross-Up ZeroLine |

| B1N | DELONG HOLDINGS LIMITED | Bullish | 0.255 | 587 | MACD Cross-Up Signal |

| 5HT | COMMUNICATION DESIGN INTL LTD | Bullish | 0.137 | 585 | MACD Cross-Up Signal |

| M35 | WHEELOCK PROPERTIES (S) LTD | Bullish | 1.905 | 541 | MACD Cross-Up ZeroLine |

| 5RA | ASIA-PACIFIC STRATEGIC INV LTD | Bearish | 0.055 | 211730 | MACD Cross-Down Signal |

| Y92 | THAI BEVERAGE PUBLIC CO LTD | Bearish | 0.625 | 21698 | MACD Cross-Down Signal |

| 5FR | ETIKA INTERNATIONAL HLDGS LTD | Bearish | 0.142 | 4843 | MACD -ve Divergence |

| N4E | NAM CHEONG LIMITED | Bearish | 0.48 | 4619 | MACD-H -ve Divergence |

| D5IU | LIPPO MALLS INDO RETAIL TRUST | Bearish | 0.41 | 4394 | MACD Cross-Down Signal |

| 5ME | EZION HOLDINGS LIMITED | Bearish | 2.09 | 2365 | MACD Cross-Down ZeroLine |

| S63 | SINGAPORE TECH ENGINEERING LTD | Bearish | 3.78 | 1548 | MACD Cross-Down ZeroLine |

| K17 | KEPPEL LAND LIMITED | Bearish | 3.49 | 1365 | MACD Cross-Down ZeroLine |

| Z01 | ZAGRO ASIA LIMITED | Bearish | 0.315 | 648 | MACD-H -ve Divergence |

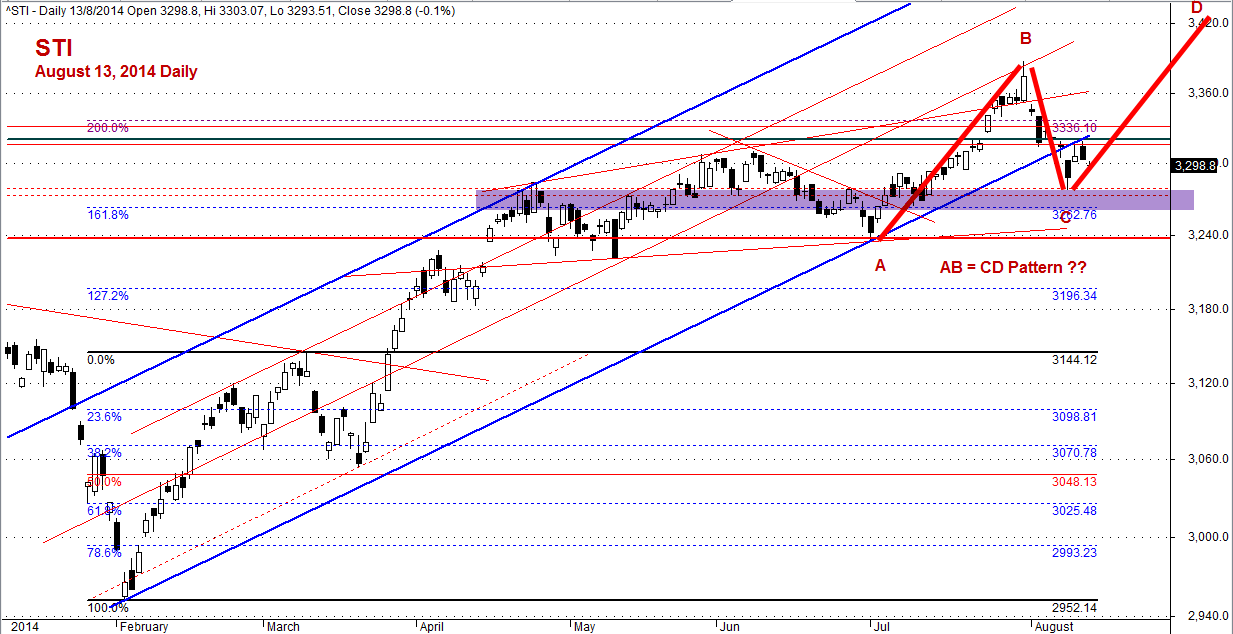

Straits Times Index

August 13, 2014, Wednesday

Straits Times Index, STI gaps down and closed at 3301.41 points. STI closed lower at1.98 points from the last closed at 3303.39 points.

AB = CD, Straits Times Index STI Daily Chart

Thanks for visiting the site, AmiBrokerAcademy.com.

Moses

DISCLAIMER

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should NOT be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids.

Trading is personal. You are responsible for your own trading decision.